TSX.V: SAGA

Driving for Discovery in the Multi-Trillion Dollar Mining Industry: SAGA Metals Corp. Leads the Way

As a new Commodity Supercycle begins, SAGA Metals Corp. (TSX.V: SAGA) is poised to benefit from the current multi-trillion-dollar mining industry sector by focusing on critical minerals essential for the global energy transition. Sprott Asset Management, managing US$29.4 billion, asserts that:

“the post-pandemic era heralds a new Commodities Supercycle, particularly for critical minerals”

And forward-thinking companies like SAGA Metals Corp. (TSX.V: SAGA) stand to benefit accordingly.

Critical minerals are vital for green energy generation, battery storage, and energy transmission, making them indispensable for the energy transition. The emerging Commodity Supercycle, driven by supply and demand shocks, is intensifying global competition for these essential commodities. SAGA Metals Corp. (TSX.V: SAGA) stands out as a leading mining exploration company dedicated exclusively to these critical minerals.

The U.S. Inflation Reduction Act of 2022, the largest climate legislation in U.S. history, allocates $392.5 billion to support energy transition initiatives1. This monumental act presents a significant opportunity for companies like SAGA Metals Corp. (TSX.V: SAGA) to capitalize on the booming market for critical minerals.

Demand for commodities is surging due to the clean energy transition and geopolitical tensions prompting global powers to reshore their supply chains. This demand shock, combined with a decade of underinvestment in the mining sector, creates a ripe environment for investors. The sanctions on Russia, a major commodity producer, further exacerbate supply constraints and fuel resource nationalism.

Historically, commodity Supercycle’s have emerged from varying conditions, such as the OPEC embargoes in the 1970s and China’s aggressive growth in the early 2000s. Today, SAGA Metals Corp. (TSX.V: SAGA) is well-positioned for growth in this new Supercycle.

The transition to low-carbon energy sources is expected to expand the mining sector’s share of GDP. Mining exploration equities like SAGA Metals Corp. (TSX.V: SAGA) tend to correlate with commodity prices over the long term, a trend that has gained momentum post-pandemic.

With the top 40 global mining companies generating a record $943 billion in revenue in 2022, the potential for investors is clear. The energy transition has sparked a new arms race for critical minerals, with SAGA Metals Corp. (TSX.V: SAGA) leading in exploration and charging forward into a green future. Nations are racing to secure these vital resources for clean energy and electric vehicles, aiming to build resilient supply chains and enhance economic competitiveness and national security.

Join SAGA Metals Corp. (TSX.V: SAGA) as we seize the current critical minerals revolution and stand to benefit from the opportunities of the new Commodity Supercycle!

LATEST NEWS

NEWSLETTER

“Saga Metals Corp. (TSX.V: SAGA) is just completing its IPO and already has a major partnership with Rio Tinto, the second largest mining company in the world!”

Critical Minerals for the Green Energy Revolution!

There is a forgotten mineral province in North America that could explode thanks to the global energy transition occurring right now. This area of North America simply never got the attention it deserved. It’s larger than California and it’s loaded with high-value minerals. And there is one small exploration company primed to capitalize on this global green energy shift.

Imagine a world powered by green energy, where the air is clean, and the environment is protected. This vision is within reach, but it requires a reliable supply of critical minerals! To that effect, the global shift towards green energy is creating unprecedented demand for critical minerals like uranium, lithium, titanium, and vanadium. These minerals are essential components in a variety of technologies, including renewable energy systems, electric vehicles, and advanced manufacturing. However, finding reliable and promising sources of these minerals can be challenging, and many investors miss out on early opportunities that offer the highest potential returns.

Enter Saga Metals Corp. (TSX.V: SAGA), dedicated to making this vision a reality. This one company could ride the critical minerals wave to massive success through its cutting-edge and hyper focused exploration activities in two of the “top 10 mining jurisdictions” in the world, according to the Fraser Institute.

Positioning for Leadership in the North American Critical Minerals Exploration Sector

In this rapidly evolving market, securing a foothold in the critical minerals sector is more important than ever. Traditional energy sources are being phased out, and the race to develop sustainable alternatives is intensifying. This shift has created a sense of urgency among investors to find companies like Saga Metals Corp. (TSX.V: SAGA) that can work towards reliably supplying the necessary raw materials. Unfortunately, many investment opportunities are either too risky, too late, or lack the necessary scale to make a significant impact.

Thanks to the massive global energy transition underway, it’s time for this area of North America to take center stage. As with any trend, getting in early means potentially making the largest gains. And that’s what we see here today. This overlooked region could become North America’s hub for energy metals. These metals are so valuable that the Canadian and US government offers massive tax breaks for their exploration and development. This area has all the hallmarks of a great place to build a mine: infrastructure, mining history, population, and political backing.

Saga Metals Corp (TSX.V: SAGA) has staked thousands of hectares in this vast area of potential mineral wealth. And they plan to build a company that can potentially become a cornerstone of North America’s Critical Mineral Strategy.

This unique company is committed to revolutionizing the way the world sources critical minerals. The company is dedicated to exploration, while focusing on key projects with immense potential. Saga Metals (TSX.V: SAGA) has positioned themselves as potential future leaders in this rapidly growing market.

In July of 2024, Saga Metals Corp. (TSX.V: SAGA) announced the execution of an Option to Joint Venture agreement at its Legacy Lithium Project with Rio Tinto Exploration Canada. The deal is a potential 9 year partnership that would see Rio Tinto incur a $34,182,500 total expenditure budget on just one of the Saga Metals (TSX.V: SAGA) projects: The Legacy Lithium Project in Quebec!

LATEST NEWS

NEWSLETTER

The team at Saga Metals Corp. (TSX.V: SAGA) has built its project portfolio with an eye to the future of metal demand. The company wants to be the premier suppliers to the North American green energy market. It’s the kind of business plan that can create massive gains for early investors.

To that effect, Saga Metals Corp. (TSX.V: SAGA)’s exploration projects are located in Labrador and Quebec, Canada with the following four fully owned properties:

Primary Project: Double Mer Uranium

Primary Project: Legacy Lithium

Secondary Project: Radar Titanium-Vanadium

Secondary Project: North Wind Iron Ore

Saga Metals Corp. (TSX.V: SAGA)’s team was able to go in and stake huge swaths of ground that held exciting prospects with an area the size of California. And the data was just sitting there, waiting to be found. It came down to a few really smart guys doing the hard work, digging through historical documents and geological maps.

Saga Metals Corp. (TSX.V: SAGA) is not just about the assets they hold, but also about the key people leading their efforts. This unique forward-looking company is managed by a team of seasoned professionals with extensive experience in the mining and resource sectors. Their expertise, strategic vision, and commitment to excellence drive Saga Metals Corp. (TSX.V: SAGA)’s projects forward, ensuring that they maximize the potential of their assets. This is verified in their ability to get Rio Tinto, the world’s second largest mining company, to partner with them on its Lithium Project in Quebec, Canada.

The Electrification Bull Market is Already Creating Wealth

Commodity bull markets do the same, sometimes even more. And the next bull market in commodities just began. The global energy transition began as a move away from greenhouse gas emissions. But it morphed into energy independence for many countries.

There are massive financial tidal forces driving a “new energy reality”. Government and industry leaders are behind a mass shift to electricity. That means replacing fossil fuels like coal and oil with energy sources like:

- Nuclear power

- Wind power

- Solar photovoltaic Power

- Hydroelectric power

- Geothermal power

However, these technologies rely on a specific group of minerals. And the current production volumes are too low across the board to supply the coming demand. They are so important to energy independence that many countries, including the U.S. and Canada, declared them to be “critical”.

Today, more than 193 countries have ratified the Paris Agreement, which limits global warming to 2 degrees Celsius by 2050. In order to do that, there must be a wholesale shift in the way the world produces and stores electricity.

This will drive massive demand for new supplies of these metals. Fortunately, we can see the future by looking at similar situations from the past. Before we dig into the details of these metals and the economics driving them, we need to understand how metals can respond to this kind of rapid demand scenario.

A Glimpse of What’s Coming for Battery Metals

The global shift towards green energy presents a unique opportunity for investors like you. Governments and corporations worldwide are investing heavily in renewable energy sources, electric vehicles, and advanced technologies, all of which require a steady supply of critical minerals. As the demand for these minerals grows, so does the potential for substantial returns on investments in companies like Saga Metals Corp (TSX.V: SAGA).

To understand what this new bull market could look like, we simply need to look at the history of demand for nuclear energy. Global electricity demand is expected to grow by 86% between 2022 and 2050, according to the IEA World Energy Outlook. Countries must increase their share of greener-energy sources to lower GHG emissions and meet growing demand. Nuclear energy, with the lowest GHG profile and highest capacity, should be prioritized. Unlike solar, wind, geothermal, and hydropower, nuclear plants provide steady baseload power.

Sentiment toward nuclear power has improved due to climate change and geopolitical concerns. Increased focus on decarbonization and energy security has led to supportive policies. At COP28, there was “unprecedented global support” for nuclear power. Seth Grae, CEO of Lightbridge Corporation, noted that 22 countries pledged to triple their global nuclear energy capacity by 2050.

Around the world there are currently sixty new nuclear reactors under construction. According to the International Energy Agency (IEA), global nuclear power generation will grow 3% per year, through 2026.

You can’t have true clean energy independence without nuclear energy. And, you can’t have nuclear energy without uranium. This will do two things for the uranium market. First, it will quickly use up any excess supply from formerly closed plants. And second, it will bring in new demand, as Japan continues with restarting its mothballed plants.

The uranium price has already more than doubled since its 2016 low.

But we believe that the price will go much higher. Because nuclear power is the best source of baseload, carbon-free electricity available today.

And that’s important because the supply/demand ratio is rough right now. The world needs more uranium supply.

According to the World Nuclear Association’s 2023 Nuclear Fuel Report, uranium demand will rise 28% by 2030 and 51% from 2031 to 20402.

And their analysts aren’t alone. In its high-demand scenario, the International Atomic Energy Agency projected demand could hit 283,000 metric tons by 2050. That’s a nearly 400% increase from the current 60,0003 metric ton per year demand.

The World Nuclear Association says there are 440 nuclear plants connected to the grid today. While countries will mothball some of these due to age, that number is shrinking. Countries like the US and France are extending the lives of their plants and building more.

But no one is building more than China. It’s building 18 plants. It’s planning or has proposed 202 more. Russia is building three and has another 48 in the works. (There is a total of 431 planned or proposed plants around the world. That’s as many as are operable today.)

The U.S., China, and France represent approximately 58% of global uranium demand. 3

The takeaway is simple – The nuclear power industry needs supply immediately to meet rising demand, but mines don’t move quickly. It takes years for them to come online. That’s why analysts believe demand will exceed supply for the next five to ten years. That means the price of uranium has to go up.

According to the World Nuclear Association, total global

uranium production in 2022 only satisfied 74 percent of global demand, a number

that is likely to shrink as nuclear reactors in Asian countries begin coming

online3.

Uranium is in a new bull market!

The previous one lasted 8 years. If the current market plays out the same way, there are still 6 years of growth ahead for investors. The companies that can find the next uranium discovery are going to be a great place for investors.

Saga Metals Double Mer Uranium Project: A Prime Opportunity in the Emerging Uranium Bull Market

And that puts Saga Metals Corp. (TSX.V: SAGA)’s Double Mer uranium project in the perfect spot. The Company’s Double Mer Uranium Project covers 25,600 hectares in Central Labrador. Double Mer is a highly prospective project, just 90 km northeast of the town of Happy Valley-Goose Bay. Previous companies held pieces of Double Mer and spent millions of dollars exploring each piece.

Saga Metals Corp. (TSX.V: SAGA)’s team has an outstanding opportunity to bring all that information together to make a potential massive uranium discovery. Other companies explored parts of the Double Mer project extensively from 1970 to 2008.

The last crew on site, built a winterized camp and loading dock on a small lake in the center of the property. There is an extensive library of scintillometer data. Counts per second (cps) measures elevated radioactivity related to the presence of uranium.

Out of the 182 historical samples, 51% had readings of more than 5,000 cps and 21% had a reading over 9,900 cps. That’s a great indication that this is a strongly mineralized trend. The radiometric data highlighted an 18 km long and 500 m wide linear trend of elevated radioactivity.

Historical work has over $4 million spent on the ground and is potentially drill-ready this field season, with a 14 km Uranium trend of PPM and CPS readings identified. Neighbors include Atha Energy Corp.(CMB Discovery) and Paladin Energy Limited (Michelin Project: among the largest Uranium deposits in North America).

Geologists collected and assessed 182 rock samples. The results were outstanding:

- 43% contained uranium concentrations above 500 parts per million.

- 23% contained uranium concentrations above 1,000 parts per million.

The results of the previous work outline an area of about 500 m in width and 18 km long, that are highly prospective for economic uranium mineralization.

Geologically, uranium mineralization occurs in two styles. Uranium occurs as a primary mineral in pegmatites, seen in rock samples and mapping. However, faulting in the region created a secondary, hydrothermal mineralization as well.

In 2022, the Canadian government identified uranium as a critical mineral. They introduced incentives like a 30% exploration tax credit to support new uranium projects[1]. That means Canadian investors can get a tax break for buying shares of companies exploring for uranium in Canada – like Saga Metals Corp. (TSX.V: SAGA).

And make no mistake, Canada is a wonderful place for uranium investing. It’s the second largest producing country in the world after Kazakhstan. It produces about 13% of the world’s supply annually. The mining and milling of uranium generate more than $800 million per year and employs over 2,000 Canadians[6].

Its two main mines: McArthur River, and Cigar Lake, are the largest and highest-grade uranium mines in the world. With grades up to 20% uranium, they are one hundred times higher than the world average.

Canada exports 85% of its uranium. The country boasts 514,000 metric tons of known uranium resources, 8% of the world’s total. And there is much more to find.

The current plan at Double Mer is a detailed lithological and structural mapping program. That will provide the detailed information needed to delineate the mineralized zones. The company will also collect scintillometer and rock samples over that area. This will improve the company’s accuracy when planning its drill program.

That’s why we believe Saga Metals Corp. (TSX.V: SAGA) is an excellent company for uranium exploration and there’s more here for investors to review. To that effect, the Company has positioned itself to take advantage of not one, not two, not three, but many metal bull markets that global analysts predict are coming by 2030.

Please continue reading…

The World’s Energy Sources are Changing Again.

Students of history know that humanity changed energy sources repeatedly. Each new energy source brought about massive changes. There are three major shifts in energy supply in human history:

- The change from wood to coal

- The change from coal to oil (and natural gas)

- The change from fossil fuels to low carbon electricity

Each change brought about huge disruptions to existing infrastructure. And each spurred massive innovations that created periods of massive wealth creation. This one will be no different.

In 1911, the British Royal Navy made a hard choice. Led by First Lord of the Admiralty Winston Churchill, England switched from using domestic coal to power their ships, to foreign oil. They did it to achieve several improvements: faster ships, faster fueling, and reduced crew. The higher energy density of oil and ease of fueling at sea, offered significant advantages.

The reason they switched came down to geopolitics. Germany was a serious threat to global stability according to the British Empire. The British wanted to maintain naval dominance and saw oil as the future.

There are parallels to that today. While many people associate this with climate change, there is a darker, underlying force driving that change. It comes from the 2022 Russian invasion of Ukraine. That incursion had a profound impact on global energy policy. It accelerated the transition from imported fuels to secure, domestic energy supplies.

Starting as far back as 2006, Russia weaponized its fuel exports like oil, coal, and natural gas.

That left Ukraine without reliable energy supplies. And it impacted Europe with soaring prices. According to the International Energy Association (IEA)8:

In 2022, Russia showed the world that fuel supplies can be manipulated for political gains. For decades, Russia used its natural gas supply as a political prod. In 2022, it tried to use natural gas supplies as cover for its invasion of Ukraine. It failed.

The European Union had to rapidly reduce its consumption of Russian natural gas. Prior to the invasion, Europe relied on that supply for 40% of its needs. By the end of 2022, that fell to just 10%[9].

As we said, geopolitical drivers spurred the last major change in energy. And as the change took hold, it shook up industries all over the world.

The Royal Navy led the way, spurring the universal shift from coal to oil. As you can imagine, this created a massive shift in the global energy industry. Regions with oil, like Iran and other Persian Gulf states suddenly became enormously wealthy.

LATEST NEWS

NEWSLETTER

Ten Reasons to Invest in Saga Metals Corp. (TSX.V: SAGA)

1 Focused on North America’s “Critical Minerals Strategy” in two highly favorable jurisdictions of North

America: Ǫuebec and Labrador, Canada.

- The combined properties sit at 65,591 Hectares (655 square km’s).

- Jody Dahrouge is responsible for the Patriot Battery Metals Corvette Lithium Discovery and the Winsome Adina Lithium Discovery.

- Neighbors include Atha Energy Corp.(CMB Discovery) and Paladin Energy Limited (Michelin Project: among the largest Uranium deposits in North America).

- Michael Garagan worked at B2Gold, and his father was a founding geologist.

- Harrison Pokrandt an experienced geologist at B2Gold.

- Neighboring projects include Tata Steel, Labmag GP, and Abaxx Technologies.

Today we are on the cusp of a brand-new era of energy. There is a massive migration away from oil and into diversified, low-carbon electric power generation. It will create new industries and breath life into old ones. And it will create massive wealth.

For example, when the oil industry rose to power, oil exploration companies exploded in value. Today, we see parallels. But one industry stands out among all the others – exploration. Like oil at the time, there were known quantities, but not nearly enough to meet the surging demand. That’s where Saga Metals Corp. (TSX.V: SAGA) comes in.

We know that exploration can be incredibly profitable. In oil, it created all the major names we know today. And this shift from fossil fuels to low-carbon power will do the same. These technologies are as dependent on mined materials as cars are on gasoline.

And, like the Royal Navy did in 1910, governments are leading the way today.

To date:

- The U.S. Inflation Reduction Act committed $370 billion, including money for electric vehicle manufacturing, sales, and infrastructure.

- Canada’s Critical Minerals Strategy includes $3.8 billion for mineral exploration, processing, manufacturing, and recycling.

- The U.S. Bipartisan Infrastructure Law provides $5 billion to build electric vehicle charging stations along highways.

- In 2022, China invested $177 billion in renewable energy projects.

- In 2023, the U.S. invested $36 billion in renewable energy in the first half of the year.

In the first half of 2023, global investment in renewable energy hit $358 billion, up 22% compared to 2022 10.

As you can see, there is a massive tailwind to this current trend. That has only spurred, incredible price spikes in materials like lithium, uranium, rare earth metals and more recently copper. The reason is that the increase in demand is moving much faster than supply can match.

Lithium was the first to move higher. That’s because globally in 2020, we used about 100,000 metric tons of the white metal. By 2030, we’ll need over 1.5 million metric tons per year. That’s a huge jump in demand and the price responded, as you can see[11].

That’s one reason Saga Metals Corp. (TSX.V: SAGA) is again so exciting right now. Its Legacy Lithium project can benefit immediately from these higher prices.

And lithium isn’t alone. Vanadium demand, driven by energy storage, will grow substantially over the next few years. Vanadium Redox Flow Batteries (VRFBs) could account for 17% of consumption by 2033, up from just 3% in 2021[12].

The titanium market also looks to be critically undersupplied. Analysts forecast that the market will grow by 6.5% annually from 2024 to 2030 and hit $5.8 billion.

These metals: vanadium and titanium are commonly found in magmatic-mafic layered intrusions. That’s the geology that Saga Metals Corp. (TSX.V: SAGA) has at its Radar Property.

As we said before, Saga Metals Corp. (TSX.V: SAGA) has a plan. It isn’t a generic “exploration company”. This is a concern built around thoughtful market analysis and solid geological research. They understand what’s happening with the metals markets and set out to find deposits that can fill those needs.

They know that this trend is just the beginning. We need more mines. It takes a long time to go from exploration to production, much longer than oil. According to S&P Global Market Intelligence, it takes about 16 years for a deposit to become a mine[1]. That math doesn’t work. The world simply can’t produce enough metal to meet future demand. That imbalance will drive up the prices.

The vanadium market was around $30 billion in 2020. Analysts predict it will grow to $81.8 billion by 2030. The world bank estimates that by 2050, vanadium demand from batteries could be larger than global vanadium production in 2018 [1].

As you can see, this sets us up for huge changes in many industries. But the one industry poised to see the most change is “mining exploration”. We simply don’t have enough current supply to meet these demands.

For some metals, like vanadium, uranium, and lithium, it’s a matter of finding new sources. And that’s where Saga Metals Corp. (TSX.V: SAGA) and its secret mineral provinces again come in.

Saga Metals Corp. (TSX.V: SAGA) is prepared for the coming bull market!

Legacy Lithium Project

Saga Metals Corp. (TSXV: SAGA) staked the Legacy Lithium Project, which covers 34,243 hectares in Western Labrador. That’s a huge land package, nearly the size of the country of Liechtenstein. That’s an unbelievable achievement because this region is a hotbed for lithium right now.

The James Bay region of Labrador is a major new lithium camp. This is “hard rock” lithium deposits called pegmatites. Exploration didn’t begin in the region until around 2005. By 2021, there were 400 exploration projects. Over the past decade, companies found several major deposits [14] including:

- James Bay – 37.2 million metric tons at 1.3% lithium oxide

- Rose – 26.3 million metric tons at 0.87% lithium oxide

- Whabouchi – 36.6 million metric tons at 1.3% lithium oxide

- Moblan – 10.7 million metric tons at 1.4% lithium oxide

Saga Metals Corp. (TSX.V: SAGA) Legacy Lithium project is located east of this new camp. That’s because this team pondered the geologic question: why is there lithium in these rocks?

The answer, it turns out, is due to processes located deep in the earth. Millions of years ago, a huge chunk of the earth sank beneath the crust and began to melt. It created well over 1,000 kilometers of lithium pegmatites. The team used their expertise to identify prospective ground far away from the crowd. Sure enough, they came across a completely unknown lithium district.

The company identified three main zones on its ground:

- North Zone – outcropping pegmatite exposure with 5 km strike length of anomalouslithium values.

- Legacy Zone – 9 km of confirmed pegmatites with the potential to expand to 24 km.

- Mid Zone – 18 km trend of pegmatites with 7 km of anomalous lithium samples.

However, the company isn’t alone now. Giant mining company Rio Tinto has ground to their west, along with Loyal Lithium, Winsome Resources and Azimut Exploration. This is an outstanding area for lithium exploration and Saga Metals Corp. (TSX.V: SAGA) got in early.

Saga Metals Corp. (TSX.V: SAGA) and Rio Tinto Sign Option to Joint Venture Agreement for Lithium Asset in Eastern James Bay, Quebec

On July 3, 2024, Saga Metals Corp. (TSX.V: SAGA) announced the execution of an option to joint venture agreement on with Rio Tinto Exploration Canada Inc. (“RTEC”) for its Legacy Lithium Project in the renowned James Bay Lithium District. RTEC is a Canadian subsidiary of the Rio Tinto Group (LSE: RIO, ASX: RIO, NYSE: RIO).

Under the Option Agreement, RTEC has the option to acquire an initial 51% interest in the Legacy Lithium Project over a period of four (4) years, which it may exercise if it satisfies the following conditions:

- Cash payments totaling C$410,190.

- Exploration expenditures totaling C$9,571,100, including a firm commitment to spend not less than C$1,709,125 in the first 20 months of the effective date of the Option Agreement.

-

C$273,460 in cash payments to Saga Metals Corp. (TSX.V: SAGA) ($68,365 per year) and additional payments of C$225,000 in aggregate, being equal in amount to the underlying claim acquisition amounts owed by Saga Metals Corp. (TSX.V: SAGA) to the vendors from whom it acquired the Legacy Lithium Project.

RTEC will act as project operator under the Option Agreement during the First Option period and the Second Option period. Saga Metals Corp. (TSX.V: SAGA) and RTEC will form a technical committee to review and prepare the exploration programs.

The Legacy Lithium Project contains 663 claims spanning 34,342 hectares hosting 100km of striking paragneiss.

“This marks a significant milestone in the Company’s development and creates a non-dilutive pathway for the necessary capital to properly explore our Legacy Lithium Project over the coming years,”

– States Mike Stier, CEO & Director of Saga Metals Corp. (TSX.V: SAGA) .

“We look forward to partnering with Rio Tinto and hope to have a long and fruitful relationship for many years to come.”

This is the kind of science that great companies do. Historically, this sort of thinking created huge amounts of wealth in mineral exploration. Geoscientists who can step back from the rush and ask simple questions are the ones who do it best. When they get the right answer, they can make enormously valuable discoveries. And that’s what Saga Metals Corp. (TSX.V: SAGA) has at its Legacy Lithium project, a partnership in place with the worlds second largest mining company, Rio Tinto.

Featured In

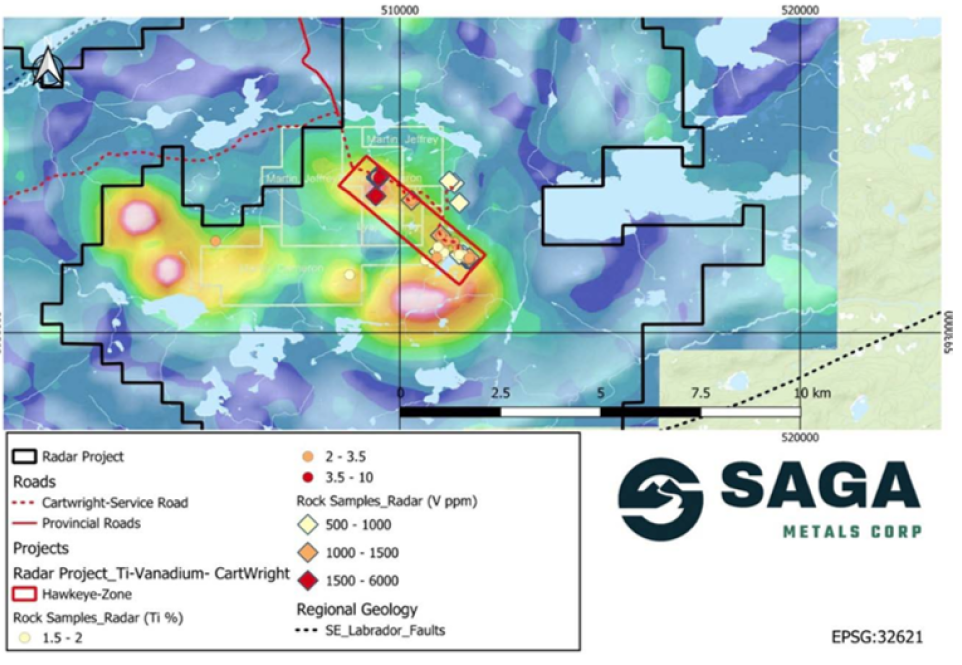

Radar Titanium-Vanadium Project

Saga Metals Corp. (TSX.V: SAGA) owns 100% of the 17,250-hectare Radar Project in eastern Labrador. This is an easily accessible area, just 10 km away by road from the coastal city of Cartwright, Labrador. The Company believes Radar holds a layered intrusive ore body. These deposits are the largest and most productive deposits for titanium, vanadium, nickel, chromium, and platinum group metals.

Geologically, these rocks are the same as those in Scandinavia. This geological province hosts the Lac Tio deposit, North America’s largest titanium-vanadium project, located roughly 500 km southwest of Radar.

Vanadium will be a critical component of large-scale battery development. VRFBs can be large, with high-cycle life. And they are much safer than many of the alternatives. According to the analysts at CRU Group, VRFBs will become a major part of the global energy storage market by 2040:

This demand will challenge vanadium producers. That’s why it is critical to find new supplies now. And that’s why Saga Metals Corp. (TSX.V: SAGA)’s Radar project is so exciting.

In 2023, the company’s field work outlined an area roughly 500 m wide by 3.5 km long with consistent anomalous titanium and vanadium values. That included 39 samples with over 2% titanium and over 500 parts per million vanadium. Four samples ran over 6% titanium, with correspondingly high vanadium as well.

As CGO Micheal Garrigan said,

“After weeks of data compilation and analysis I knew there was something special about the Radar property. Our team was able to vector into the mineralized zone after the first day on the property and confirm a 1.2km trend of highly anomalous Titanium and Vanadium values with open strike length still to be defined. We are quite pleased to be able to add a secondary asset of merit to the Saga Metals Corp. (TSX.V: SAGA) portfolio.”

As we discussed above, vanadium in particular is an extremely critical mineral. Demand from batteries alone will consume all the current global supply. A new discovery in North America will be incredibly valuable.

North Wind Iron Project

Saga Metals Corp. (TSX.V: SAGA)’s final project is a massive, 6,375-hectare iron project in a world-class iron producing region. The Labrador Trough area has hosted mines since 1954. Three mines currently produce about 35 million metric tons per year.

The North Wind Project is in west-central Labrador, just 16 km southwest of Schefferville, Quebec. It sits within the Labrador Trough. Historic drilling consisted of 8 holes and 590 meters total. The average grade was a whopping 20.7% iron.

The company needs to do more work to confirm those grades and resource estimates. This is the kind of underlying value few other exploration companies can claim.

For investors, the North Wind Iron Project anchors the value of Saga Metals Corp. (TSX.V: SAGA). This giant project has much less risk than many exploration projects. And while iron isn’t the most exciting metal today, there is always a market for it. With little more work, the Company could easily outline an attractive, large-scale iron deposit at North Wind.

Saga Metals Corp. (TSX.V: SAGA) Experienced Management Team has what it takes to move these 4 independent projects forward.

Michael Stier

CEO, Director

With a background in business management and finance, Mr. Stier has over 15 years of experience in capital markets. He has held senior roles in finance, business development, and wealth management, making him a crucial asset in steering Saga Metals Corp. (TSX.V: SAGA) towards growth and profitability.

Michael Garagan

Director & CGO

Mr. Garagan has 15 years of experience in the exploration industry with projects across the world including Africa, Asia, North and South America. With prior active roles with such high-profile companies like B2Gold, he is pivotal in guiding Saga Metals Corp. (TSX.V: SAGA) through strategic growth initiatives in the field.

Terence Lee

CFO

Mr. Lee is a CPA with over 9 years of experience in financial reporting under IFRS. His expertise spans various industries, including mining, technology, and healthcare. His financial acumen ensures that Saga Metals Corp. (TSX.V: SAGA) maintains a strong financial position as it advances its projects.

Michael Waldkirch

Independent Director

With a focus on strategic investments and governance, Mr. Waldkirch provides valuable insights that help shape the company’s strategic direction.

Harrison Pokrandt

Independent Director

His experience in project management and exploration makes him an invaluable advisor for the company’s mineral exploration initiatives.

Geologists Len Gal and James Macdonald

Both bring extensive field experience and technical expertise, ensuring that our exploration activities are thorough and effective.

Saga Metals (TSXV: SAGA) brings great leadership to the energy metals exploration sector, led by CEO Micheal Stier, who has fifteen years in the capital markets. Mr. Stier is a former consultant to companies in mining, oil & gas, life sciences, and biotech, among others.

Michael Garagan is the company’s Chief Geological Officer (CGO). Previously at B2Gold, Michael is the chief architect for the company’s strategy in Newfoundland and Labrador. He has a deep understanding of the geology of this region.

Stier brings the capital market strategy while Garagan brings the geological strategy. Together, they make Saga Metals a bright star in the energy metals exploration space, planning to supply materials to facilitate the energy transition.

Saga Metals Corp. (TSX.V: SAGA) – Building a Mineral Exploration Company to Supply the North American Critical Mineral Demand

As we discussed previously, Canada outlined 31 critical minerals and the U.S. listed 50 critical minerals. Both countries introduced tax benefits for using critical minerals supplied domestically or from free trade partners. That creates a tailwind for demand. However, neither country can physically supply the amount of material needed to meet that demand at the moment!

By investing in Saga Metals Corp. (TSX.V: SAGA), you are not only securing your financial future but also playing a vital role in the global effort to combat climate change and promote sustainability. This Company’s projects are strategically located in regions with favorable geological conditions and strong regulatory frameworks, ensuring the long-term success and stability of their operations.

Consider the advantages of being an early investor in Saga Metals Corp. (TSX.V: SAGA) . As they continue to explore and develop their assets, the value of their projects will increase, providing early investors with significant growth potential. Additionally, their commitment to transparency and regular communication means that you will always be informed about the progress of their projects and the latest developments in the industry.

Saga Metals Corp. (TSX.V: SAGA)’s success is not just about the diverse assets they hold, but also about the people leading their efforts. Don’t miss out on this exceptional opportunity to invest in this unique Enterprise and become a shareholder in a company dedicated to pioneering the future of energy. Visit their website to learn more about their projects, review their investor materials, and secure your stake in Saga Metals Corp. (TSX.V: SAGA) today.

Invest now and be part of the green energy revolution!

By acting today, you are positioning yourself at the forefront of the critical minerals industry, poised to benefit from the significant growth and demand driven by the global shift towards green energy. Join the ranks of forward-thinking investors who recognize the immense potential of Saga Metals Corp. (TSX.V: SAGA) and are ready to seize this opportunity.

Saga Metals Corp. (TSXV: SAGA)’s management team is dedicated to ensuring the success of its very unique and diverse projects, while maximizing the returns for the shareholders. With a proven track record and a clear vision for the future, Saga Metals Corp. (TSX.V: SAGA) is the ideal investment choice for those looking to capitalize on the burgeoning demand globally for critical minerals.

Invest in Saga Metals Corp. (TSX.V: SAGA) today and secure your place on the ground floor of the green energy revolution!

References

[1] https://www.congress.gov/bill/117th-congress/house-bill/5376

[2] https://world-nuclear.org/information-library/nuclear-fuel-cycle/uranium-resources/uranium-markets

[3] https://www.iaea.org/newscenter/news/iaea-symposium-examines-uranium-production-cycle-for-sustainable-nuclear-power

[4] https://www.visualcapitalist.com/sp/the-global-uranium-market-in-3-charts/

[5] https://investingnews.com/uranium-forecast/

[6] https://about.bnef.com/blog/renewable-energy-investment-hits-record-breaking-358-billion-in-1h-2023/

[7] https://world-nuclear.org/information-library/country-profiles/countries-a-f/canada-uranium

[8] https://world-nuclear.org/information-library/country-profiles/countries-a-f/canada-uranium

[9] https://www.statista.com/chart/28037/lithium-carbonate-price-timeline/

[10] https://www.iea.org/data-and-statistics/charts/share-of-european-union-gas-demand-met-by-russian-supply-2001-2023

[11] https://www.iea.org/topics/russias-war-on-ukraine

[12] https://www.crugroup.com/knowledge-and-insights/spotlights-blogs/blogs-2022/battery-demand-for-vanadium-from-vrfb-to-change-vanadium-market/

[13] https://impossiblemetals.com/blog/new-mine-average-lead-time-grows-41/

[14] https://www.geologyforinvestors.com/james-bay-an-up-and-coming-lithium-camp/

[15 ] https://www.crugroup.com/knowledge-and-insights/spotlights-blogs/blogs-2022/battery-demand-for-vanadium-from-vrfb-to-change-vanadium-market/

LATEST NEWS

NEWSLETTER

Disclaimers

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

The above promotional content contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include that there is a growing and significant investor interest in gold metal exploration and general market development, including investment interest efforts due to increased gold prices; that demand for gold will continue to rise; that Riverside Resources Inc. (the “Company”) will be able to successfully explore its properties for potential commercial deposits of gold, silver and copper; that the Company’s properties will have exploration and development potential due to their location to other deposits of mineralization on adjacent properties; that the Company’s proximity to railways, roads and processing infrastructure will provide an advantage for the Company in the event that it finds commercial deposits of precious metals and copper; that the Company’s management team can leverage previous exploration and development success in advancing the Company’s projects; that management’s previous investments, projects or properties may provide the Company with potential opportunities for cooperation, joint venture or other relationships which will benefit the Company; that the Company can advance its aim to become a critical player in the North American precious metals and copper exploration, development and supply chain; that the Company’s projects will be strategically located to shipping infrastructure and potential future refining facilities; that the Company’s management can duplicate its previous track record of identifying and investing in leading precious metals and copper exploration properties in Canada and Mexico; that the Company can generate revenues through implementation of its business models and/or obtain sufficient financing to continue its operations. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that investor interest in the precious metals and copper exploration and commercial development sectors, including investment interest and efforts may for various reasons decline; that the Company’s properties may fail to have any exploration and development potential; that the location of other properties with mineral resources may have no impact on the successful exploration or development of the Company’s properties; that the Company may be unable to take advantage of its proximity to railways, roads and proposed processing infrastructure for various reasons; that the Company’s management team may fail to duplicate previous exploration and development success; that management’s previous investments, projects or properties may fail to provide the Company with any anticipated opportunities or otherwise; that the Company’s business plans and operations may fail; that the Company may fail to generate revenues and/or may fail to raise sufficient financing to implement its business plan; that the Company may suffer negative and unforeseen consequences from the COVID-19 pandemic or future pandemics; that the Company may ultimately fail to successfully implement its business plans or generate any significant revenues. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

LEGAL DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Wallstreetlogic.com and its owners, managers, employees, and assigns (collectively “WSL”) is being paid for by Riverside Resources Inc. (the “Company”) six thousand Canadian dollars per month plus applicable taxes for an ongoing marketing campaign including this article among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of WSL may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. WSL and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.

About Us

Wall Street Logic serves as a "to-go" portal for a wide array of financial and investment information. We consistently provide the most recent and impactful news, sourced directly from the heart of the financial markets. Our team hopes to stand as your reliable companion in navigating the complex world of the capital markets and beyond.

Recent Posts

- Taking Control of Your Digital Footprint: A Comprehensive Guide to Managing Your Google Data Privacy

- The American Housing and Economic Mobility Act of 2024: A Comprehensive Overview

- Democrats Shift on Crypto: Schumer Promises Bipartisan Legislation if Harris Wins Presidency

- Gold Rises as Fed Rate Cut Signals Strengthen

© 2024 Wallstreetlogic.com - All rights reserved.