A RARE OPPORTUNITY IN GOLD MINING IS HERE: A NEAR-TERM PRODUCER IN A WORLD-CLASS GOLD CAMP

The allure of gold is stronger than it has been in a generation!

The biggest gains don’t go to those who react to the headlines; they go to those who position themselves early in high-quality assets.

A rare opportunity in gold mining is here: a near-term producer in a world-class gold camp.

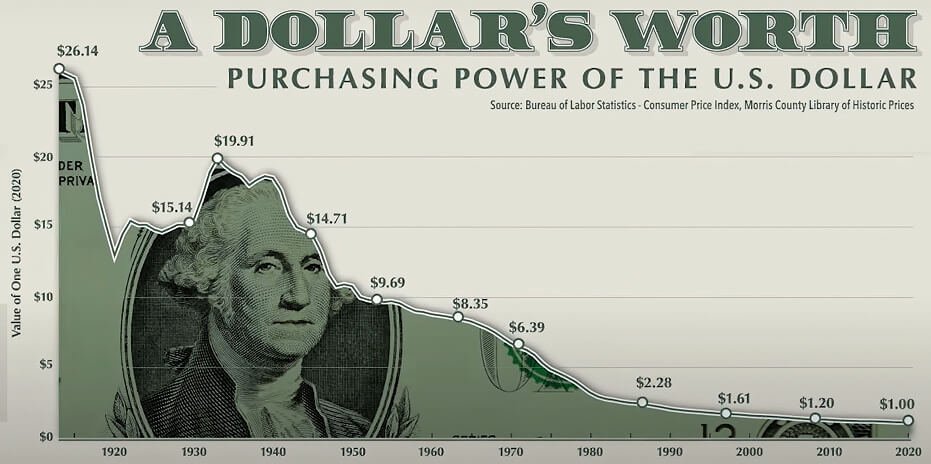

The global financial landscape is experiencing a fundamental shift that has propelled gold back into the spotlight as a critical component of investment portfolios and monetary policy strategies.

After years of relatively subdued interest in precious metals, multiple converging factors have created what many analysts describe as the beginning of a new gold supercycle.1 A multi-year period of sustained demand and price appreciation driven by structural changes in the global economy.

The current gold market environment represents a confluence of economic, political, and monetary factors that haven’t aligned simultaneously since the 1970s.2

Understanding this new supercycle requires examining the various forces that have transformed gold from a relatively stable store of value into what many consider an essential hedge against systemic risks plaguing the modern financial system.

Financial volatility has reached levels not seen since the 2008 financial crisis, with markets experiencing extreme swings driven by inflation concerns, interest rate uncertainty, and banking sector instability.2

In a world facing unprecedented financial volatility and rising geopolitical tensions, the allure of gold as the ultimate store of value is stronger than it has been in a generation.

With central banks buying gold at the fastest pace in over 50 years and analysts predicting prices to soar past previous all-time highs, the gold market is entering a new supercycle.4

Yet, the biggest gains don’t go to those who react to the headlines; they go to those who position themselves in high-quality assets with a clear path to production.

While many junior miners are engaged in speculative greenfield exploration with years or even decades until they might see an ounce of gold, one company is strategically positioned to become a near-term producer in one of North America’s most prolific gold districts.

Welcome to Lafleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF), a company on the path to production in the Abitibi Gold Belt, a region with over 300 million ounces of total gold content (including production, reserves, and measured and indicated resources).

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) has a dual-asset strategy that sets it apart from its peers: a flagship exploration project with a significant resource poised for growth, and a fully permitted and refurbished gold mill ready for restart.

This unique combination transforms LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) from a pure explorer to an integrated near-term gold producer with both mining and milling capabilities, pivoting the company years ahead of other players in the region.

Much more on LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) will be shared further below.

For now, please continue reading why now is the time to be fully vested in the gold sector!

Why Gold and Why Now

Perhaps the most significant recent development in the gold market has been the unprecedented pace of central bank purchases.5

According to data from the World Gold Council, central banks purchased more than 1,000 tonnes of gold in 2022, marking the highest level of annual purchases since 1967.

This trend accelerated in 2023, with central bank gold purchases reaching levels not seen in over five decades.6

The driving forces behind this central bank buying spree extend beyond simple portfolio diversification.

Many central banks, particularly those in emerging markets, are actively working to reduce their dependence on the U.S. dollar and other major currencies.

This process, known as de-dollarization, reflects concerns about the weaponization of currency systems through sanctions and the potential risks of holding large reserves in

any single currency.7

While predicting precise price levels for any commodity is inherently uncertain, many analysts have published increasingly bullish forecasts for gold, based on the factors discussed above.

Several major financial institutions have raised their long-term gold price targets, with some projecting prices could exceed $5,000 per ounce within the next 12 months.8

These projections are based on various models that consider supply and demand fundamentals, currency devaluation, inflation expectations, and geopolitical risk premiums.

With that in mind where does that leave us with the current state of the junior gold mining sector?

The unprecedented central bank accumulation creates a particularly compelling environment for junior gold mining companies, as these institutional purchases establish a fundamental demand floor that didn’t exist in previous gold cycles.9

Unlike retail or speculative investment flows that can reverse quickly during market volatility, central bank purchasing represents long-term strategic positioning that typically spans years or decades.

This institutional commitment provides junior gold miners with greater confidence in the sustainability of higher gold prices.

Making it economically viable to advance previous optionality assets, emerging deposits, development-ready resources and, to pursue more aggressive exploration programs.

Additionally, the geopolitical motivations driving de-dollarization efforts suggest this demand will persist regardless of short-term economic fluctuations, creating a once in a lifetime stable foundation for junior mining investment decisions.

This stable foundation is precisely the context in which a company like LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) is strategically positioned to flourish!

The Heart of the Opportunity: A World-Class Project in a Premier Jurisdiction

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) is a well-located gold company strategically positioned to transition from an explorer to an emerging near-term gold producer.

The company’s business model is centered on a dual-asset approach in Québec’s Abitibi Gold Belt, one of the world’s most prolific gold-producing regions.

This strategy is designed to create value by advancing its district-scale exploration project which hosts over 36,000 metres of historical diamond drilling, while simultaneously preparing a key, nearby production asset for operation.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) has positioned itself as a unique entity within Quebec’s mining sector through the strategic combination of advanced exploration assets and operational processing capabilities.

The company’s dual-asset strategy, encompassing both the Swanson Gold Project and Beacon Gold Mill, creates an integrated mining operation that distinguishes LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) from conventional junior exploration companies while providing a clear and quick pathway to production and revenue generation.

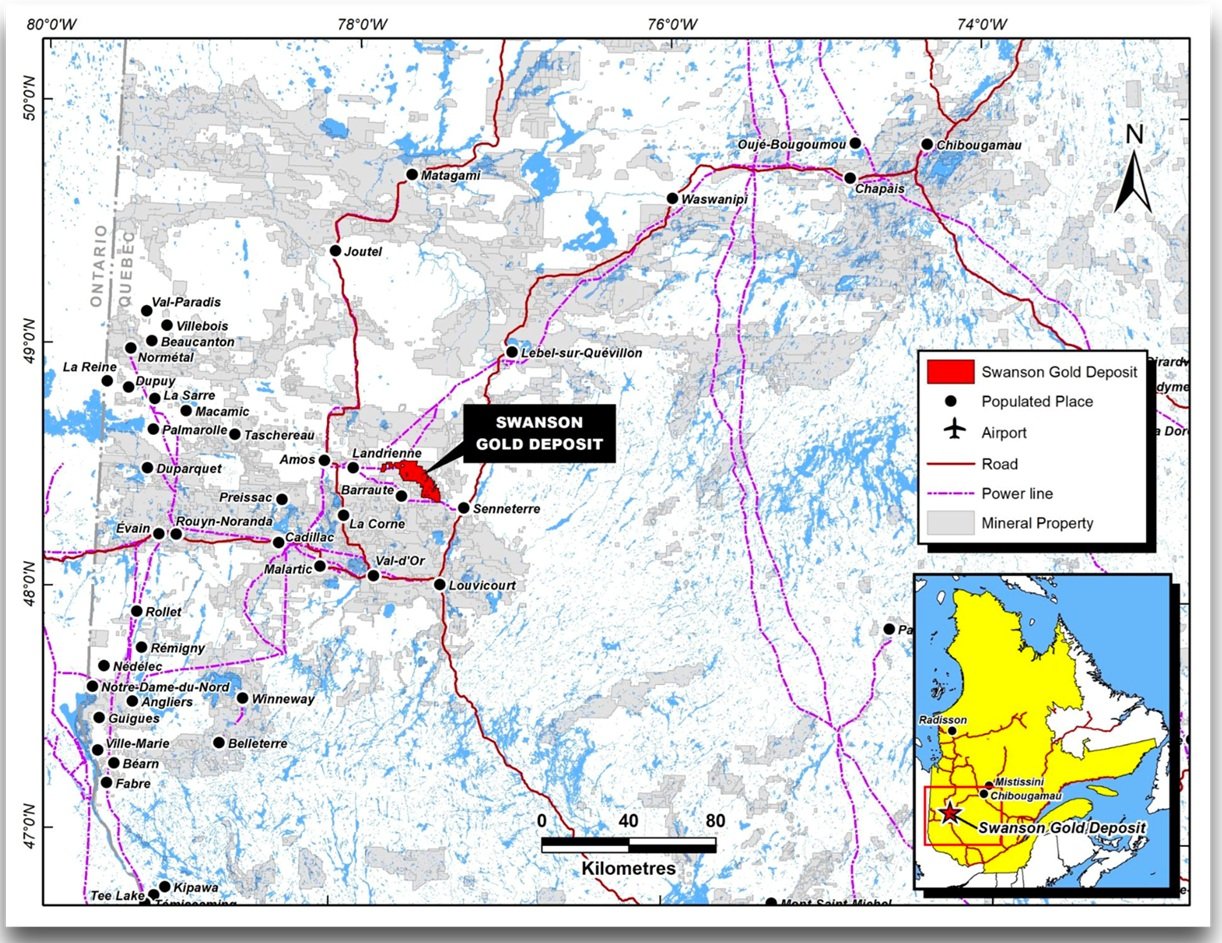

The Swanson Gold Project: Foundation Asset in the Abitibi Belt

The Swanson Gold Project serves as LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) primary exploration and resource development asset, strategically located approximately 60 kilometers north of Val-d’Or, Quebec, within the southeastern Abitibi Greenstone Belt.

This geological formation represents one of North America’s most productive gold-hosting terranes, with a mining history spanning over a century and continuing to attract significant investment from major mining companies worldwide.

The project’s location within Quebec provides substantial regulatory and operational advantages.

The province maintains its position among the world’s leading mining jurisdictions, offering political stability, established regulatory frameworks, and favorable policies including flow-through share financing mechanisms that reduce capital costs for qualifying exploration expenditures.

This regulatory environment provides LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) with predictable operating conditions and access to capital market tools that enhance financing flexibility.

Infrastructure connectivity represents a critical advantage for the Swanson Gold Project, with established all-season road and rail access linking the property to regional processing facilities and markets.

The transportation network gains particular significance through the project’s proximity to LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) Beacon Gold Mill, located within an economical trucking distance of ~60 kilometers from the Swanson Gold Project.

This direct haulage corridor eliminates typical toll milling arrangements and concentrate transportation costs that often burden junior mining companies.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) has assembled a substantial consolidated land package encompassing approximately 18,304 hectares across 183 square kilometers through strategic acquisitions completed during 2024, which now includes 445 mineral claims and 1 mining lease.

These consolidation activities involved acquiring properties previously held by established mining companies including Monarch Mining, Abcourt Mines, and Globex Mining Enterprises, demonstrating industry recognition of the area’s geological potential.

The geological setting features classic orogenic gold characteristics, with mineralization occurring along regional structural break zones where deformation has created the fracture systems and fluid pathways necessary for gold concentration.

The geological package includes ultramafic rocks containing fuchsite, altered mafic volcanic rocks, and syenite intrusions, representing the diverse rock assemblages commonly associated with significant gold systems throughout the Abitibi Belt.

Resource Base and Technical Characteristics

The Swanson Gold Project’s current NI 43-101 compliant mineral resource estimate, prepared by InnovExplo with an effective date of September 17, 2024, demonstrates substantial scale and development potential, and the recently updated NI 43-101 Technical Report discloses the results of recent exploration programs.

The resource calculation incorporates both open-pit and underground mining scenarios, reflecting the deposit’s geometry and grade distribution patterns.

The Swanson Gold Project Mineral Resource Estimate (MRE) defines an Indicated mineral resource of 2,113,000 tonnes with an average grade of 1.8 grams per tonne gold, containing 123,400 ounces of gold, along with an Inferred mineral resource of 872,000 tonnes with an average grade of 2.3 grams per tonne gold, containing 64,500 ounces of gold. (MRE source: NI 43-101 technical report, effective September 17, 2024, filed on the Company’s SEDAR+ profile).

The current MRE was optimized with a price of gold at $1,850 resulting in a cut-off grade of 0.80 g/t gold for the open-pit constrained resource and a cut-off grade of 2.30 g/t Au for the underground constrained resource, with a minimum width of 2.0 m, which is appropriate for this style of deposit and typical of similar gold mines in the Abitibi Gold Belt.

The combined resource totals approach 187,900 ounces of gold across both resource categories, with significant potential for expansion as mineralization remains open in all directions.

The current resource estimate incorporates a 626 percent increase in Inferred resources compared to previous estimates, demonstrating the effectiveness of recent exploration efforts and the potential for continued resource growth.

The property’s extensive exploration database includes more than 36,000 meters of historical drilling across 958 drill holes, providing substantial geological and structural information for future exploration planning.

Historical development work included underground access to approximately 80 meters depth for bulk sampling, offering insights into ground conditions and mineralization characteristics that inform current development strategies.

The Beacon Gold Mill: Strategic Processing Asset

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) acquisition of the Beacon Gold Mill in September 2024 represents a transformative strategic development that fundamentally alters the company’s operational profile.

Located in Val-d’Or, Quebec, approximately 60 kilometers south of the Swanson Gold Project, the Beacon Gold Mill provides fully operational processing capabilities that eliminate common toll milling challenges faced by junior mining companies.

The acquisition was completed through an arm’s-length asset purchase agreement with Monarch Mining Corporation during its CCAA proceedings, providing LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) with the opportunity to acquire a substantial industrial asset at a favorable valuation.

The transaction included comprehensive transfer of all operating permits, leases, and infrastructure, providing immediate access to fully authorized processing capabilities without typical multi-year permitting requirements.

The Beacon Gold Mill underwent approximately C$20 million in refurbishment and upgrades under previous ownership in 2022, eliminating much of the deferred maintenance and technological obsolescence that often affects acquired processing facilities.

The base processing capacity of 750 tonnes per day provides sufficient throughput for significant gold production, with expansion capabilities up to 1,800 tonnes per day through cyanidation enhancements.

The processing system centers around a Merrill-Crowe cyanidation circuit, representing proven technology specifically suited to gold ore characteristics typical of the Abitibi region.

This established metallurgical approach reduces technical risk while ensuring compatibility with regional ore types and processing requirements.

Supporting infrastructure includes substantial facilities that would require millions of dollars to replicate, including a mill building measuring approximately 27.5 meters wide, 69 meters long, and 15 meters high.

The tailings storage facility encompasses 37 hectares with an additional 28-hectare polishing pond, while water management systems include fresh water and process water basins with combined capacity exceeding one million gallons.

An evaluation report conducted by independent engineering firm Bumigeme Inc. revealed replacement costs of C$71.5 million, while rehabilitation costs are estimated at only C$4.1 million.

With the Beacon Gold Mill valued at over 17x its estimated rehabilitation and re-commissioning costs, LaFleur holds a unique, fully-permitted processing facility within a major gold mining jurisdiction, in a region flush with custom-milling opportunities and nearby gold deposits.

Permitting and Environmental Framework

The mill operates under comprehensive permitting that includes full authorization for processing operations and tailings storage facility management.

Tailings storage authorization permits processing of up to 1.8 million tonnes of tailings, representing approximately 9 years of operation at full capacity.

This long-term authorization eliminates near-term regulatory risk while providing operational certainty for mine planning and financing activities.

The acquisition included clean title transfer with no remaining royalties or encumbrances, as prior financial obligations were resolved during previous ownership’s CCAA proceedings.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) holds a C$2.4 million reclamation bond as financial assurance for environmental obligations, demonstrating commitment to responsible mining practices while providing regulatory authorities with appropriate financial guarantees.

Environmental compliance systems developed and tested through previous operations reduce implementation risk for LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) while ensuring ongoing compliance with Quebec’s environmental standards.

The established permitting framework provides operational flexibility and regulatory certainty that would be difficult to replicate through greenfield development.

Financial Structure and Restart Strategy

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) has estimated restart capital requirements at C$5 to 6 million, covering mill repairs, equipment upgrades, and tailings storage facility work over a projected six to eight-month timeline.

The budget breakdown includes approximately C$3.8 million for mill maintenance and upgrades, with an additional C$1.8 million designated for tailings storage facility preparations.

The restart timeline targets a mill restart by late 2025, with ramp-up to full production capacity expected by early 2026.

This aggressive schedule reflects the mill’s good overall condition following recent refurbishment while providing sufficient time for thorough equipment inspection and necessary repairs.

The financing strategy combines debt and equity components to optimize capital structure while minimizing shareholder dilution.

Debt financing involves FMI Securities and FM Global Markets arranging up to C$5 million in secured financing, while concurrent equity offerings including LIFE private placement units and charity flow-through units target over C$5.4 million in additional capital.

Integrated Operations and Strategic Value

The combination of the Swanson Gold Project and Beacon Gold Mill creates unique strategic advantages within Quebec’s mining sector.

The integrated operation eliminates toll milling fees while providing operational flexibility and risk diversification through potential custom milling contracts with third-party producers.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) has initiated a bulk sampling program targeting approximately 100,000 tonnes of material from The Swanson Gold Project for processing at the Beacon Mill.

This bulk sample serves multiple strategic purposes: generating early revenue, validating metallurgical assumptions, optimizing processing parameters, and demonstrating integrated operations capabilities to investors and financing partners.

The bulk sampling program encompasses material at an estimated grade of 1.89 grams per tonne gold, containing roughly 6,350 ounces of gold and representing approximately 3 percent of the current mineral resource estimate.

Illustrative production modeling suggests approximately 79,063 tonnes could be processed over six months, assuming conservative metallurgical recovery of 98.2 percent and yielding approximately 4,107 ounces of gold.

Regional Context and Growth Potential

Beyond the primary Swanson Gold Project deposit, the consolidated property package includes historically identified gold deposits providing additional development opportunities.

The Jolin deposit, based on historical pre-NI 43-101 estimates, was reported to contain 190,000 tonnes at 6.6 grams per tonne gold in the Indicated category and 250,000 tonnes at 8.2 grams per tonne gold in the Inferred category.

The Bartec deposit was historically estimated at 113,400 tonnes grading 7.9 grams per tonne gold, in the Inferred category.

These historical estimates have not been verified by a Qualified Person, under current standards and do not constitute current mineral resources for LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF).

However, they serve as indicators of the geological potential within the area and establish priority targets for future exploration and drilling campaigns.

The presence of 27 mineral showings across the property, including 22 gold occurrences and others containing silver, copper, zinc, lead, and molybdenum, suggests potential for discovering additional mineral systems.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) has outlined aggressive exploration strategies targeting resource growth toward the one-million-ounce threshold, a scale that typically attracts institutional investment while providing sufficient mine life for major capital expenditures.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) is currently completing a minimum of 5,000 metres of diamond drilling, focusing on step-out drilling along strike to evaluate open-pit mining potential. This is to expand mineral resources at the Swanson Gold Deposit, Bartec and Jolin targets. Results are expected in the coming weeks.

The exploration program recognizes that the current resource envelope represents only a portion of the broader mineralized system, with expansion potential through systematic drilling that could substantially increase economic potential while providing additional mine planning optionality.

Strategic Positioning and Market Opportunities

The mill’s location within Val-d’Or provides access to established mining infrastructure, including skilled labor, equipment suppliers, and technical services required for efficient operations.

Regional integration reduces operational costs while providing supply chain reliability and opportunities for technical collaboration with other mining companies.

Custom milling opportunities provide additional revenue potential from third-party ore sources within trucking distance.

The Val-d’Or region hosts numerous small-scale mining operations and exploration projects requiring processing services, creating potential markets for excess mill capacity while diversifying revenue sources.

The integrated asset base positions LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) uniquely within Quebec’s mining sector, providing exposure to both resource development potential and near-term production capabilities.

This combination becomes increasingly valuable as gold prices rise and development pressure intensifies throughout the region.

Future development scenarios include potential processing capacity expansion, integration of additional ore sources, and possible conversion to specialized processing for high-grade or complex ores commanding premium pricing.

The facility’s design flexibility supports various expansion options as market conditions and ore sources evolve.

The strategic combination of advanced exploration assets with operational processing capabilities creates multiple pathways to value creation while reducing typical risks associated with junior mining companies.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) integrated approach provides operational flexibility, revenue diversification, and competitive advantages that position the company for sustained growth within one of the world’s premier gold mining districts.

Leadership & Financials: A Team and Plan Built for Success

A world-class asset is only as valuable as the team behind it.

At the core of LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) strategy to evolve from explorer to near-term producer is a seasoned management team and advisory board with a proven track record in mineral discovery, mine development, capital markets, and corporate governance.

Together, they bring decades of operational experience across gold, base metals, energy, and emerging technologies, combined with the financial expertise required to advance projects efficiently in a competitive market.

LEADERSHIP TEAM

Kal Malhi

- Founder & Chairman of Bullrun Capital Inc., backing early-stage companies on the path to public markets.

- Successfully raised over $300M in capital for numerous startup ventures over the past two decades.

- Specializes in commercializing academic research and emerging technologies through private and public companies.

- Brings broad sector expertise spanning mining, oil & gas, biomedical, agriculture, and technology.

Paul Ténière

- 25+ years of global mining experience as a seasoned C-Suite executive in exploration and development.

- Professional Geologist (P.Geo.) & Qualified Person (QP) with expertise across precious metals, base metals, critical minerals, and metallurgical coal.

- Recognized authority in NI 43-101 and SEC S-K 1300 disclosure standards.

- Held senior leadership roles including President & CEO, SVP – Exploration, Director, and served as a Technical Advisor to multiple public and private mining companies on the CSE and TSXV.

Jean Lafleur

- Professional Geologist (Québec) with 45 years of global experience, including Canada, USA, Mexico, Latin America, Ireland, Spain, and Africa.

- Early career with majors such as Newmont, Falconbridge, Dome Mines, and Placer Dome, later serving as a C-suite executive for junior exploration companies.

- Proven track record in the discovery of gold, base metals, nickel, PGEs, uranium, and iron deposits, and extensive expertise in project evaluation, audits, and exploration planning.

- Currently Senior Consultant, North America at Appian Capital Advisory LLP, leveraging his extensive network to identify and present mining investment opportunities.

This leadership team combines the essential elements required for successful project advancement: technical expertise, capital markets experience, and proven operational execution.

The combination of capital markets sophistication, technical competence, and operational experience positions LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) to execute its integrated mining strategy while maintaining the financial discipline required in today’s competitive resource sector.

With the leadership infrastructure in place to advance both the Swanson Gold Project and Beacon Mill restart, the company has assembled the human capital necessary to capitalize on the current gold market supercycle and transform from an exploration-stage entity to profitable gold producer.

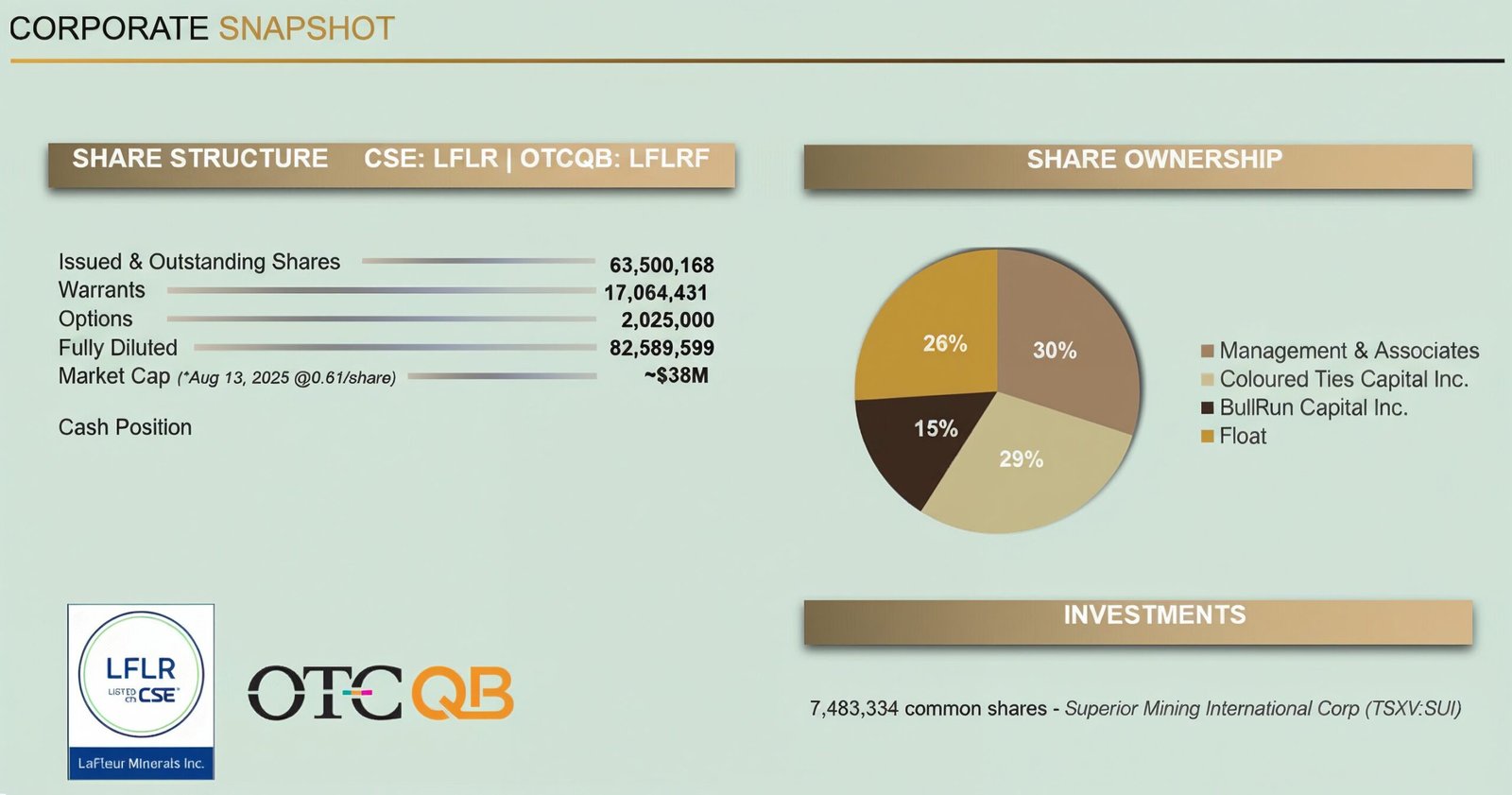

On the financial front, LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) has a tight capital structure with nearly 60% of shares outstanding held by management, directors and friendly hands, having raised over $4 million in late 2024 to advance its drill program, complete a PEA, and prepare for the mill restart.

This strong financial position and experienced team are crucial for moving the project forward and maximizing shareholder value.

The Investment Thesis

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) presents a compelling investment opportunity that converges three critical factors:

- Exceptional market timing

- Unique asset positioning

- Accelerated production pathway

The company’s investment thesis rests on its differentiated approach within the junior mining sector, where most companies offer either exploration upside or production capabilities, but rarely both simultaneously.

The timing advantage stems from LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) positioning within the current gold market supercycle, driven by central bank purchases exceeding 1,000 tonnes annually, the highest levels since 1967.10

This institutional demand creates a fundamental floor under gold prices that provides junior miners with unprecedented confidence in long-term price sustainability.

Unlike speculative retail flows that can reverse quickly, central bank purchasing driven by de-dollarization efforts represents strategic positioning that typically spans decades, creating stable market conditions for project development.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) strategic advantage lies in its integrated asset base that eliminates the typical development timeline faced by junior miners.

While most exploration companies require years to advance from resource definition through permitting, construction, and commissioning, LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) acquisition of the fully-permitted Beacon Gold Mill with 750 tonnes per day processing capacity enables near-term production from its Swanson project.

The mill’s recent C$20 million refurbishment and established permits provide immediate processing capabilities that would cost tens of millions of dollars and multiple years to replicate.

The financial structure supports rapid advancement with modest capital requirements.

The C$5-6 million mill restart cost represents a fraction of typical greenfield development expenses, while the company’s over C$4 million raised in late 2024 provides adequate funding for exploration expansion and mill preparation.

The combination of secured debt financing of up to C$5 million and additional equity raises exceeding C$5.4 million, creates sufficient capital runway for operational execution.

The resource expansion potential provides substantial upside beyond current operations.

The 626 percent increase in Inferred resources demonstrates exploration effectiveness, while mineralization remaining open in all directions, supports the company’s target of growing toward one million ounces.

The 27-kilometer mineralized corridor and 27 mineral showings across the property suggest significant discovery potential within an established gold district.

Why Now Is the Time to Act

Market conditions create a narrow window of opportunity before broader recognition drives valuation premiums.

The convergence of record central bank gold purchases, potential $5,000 per ounce price targets, and LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) unique near-term production profile suggests significant value appreciation potential before the market fully recognizes the company’s integrated advantages.

The restart timeline targeting late 2025 mill operations provides investors with a clear catalyst sequence over the next 12-18 months.

The planned 5,000-meter drilling program in H2 2025, combined with bulk sampling operations and mill commissioning, creates multiple value inflection points that could drive successive revaluations as milestones are achieved.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF) current market positioning offers exposure to both resource growth through exploration success and operational cash flow through mill restart, providing risk diversification unavailable in pure exploration plays.

The company’s location within Quebec’s top-tier mining jurisdiction, combined with established infrastructure and, experienced management team, reduces execution risk while maintaining substantial upside potential through resource expansion and production growth.

Secure your position in LaFleur Minerals today!

Stock Information

Lafleur Minerals Inc.

CSE: LFLR

OTCQB : LFLRF

Stay up to date and subscribe to our investor newsletter.

Disclaimers

QUALIFIED PERSON STATEMENT All scientific and technical information contained in this document has been reviewed and approved by Louis Martin, P.Geo., Technical Advisor for LaFleur Minerals Inc. who is a Qualified Person as defined by NI 43-101.

PAID ADVERTISEMENT This communication is a paid advertisement and is not a recommendation to buy or sell securities. Danayi Capital Corp. (collectively with its owners, managers, employees, and assigns “Danayi Capital Corp.”) has been paid $25,000 United States dollars (US$) by LaFleur Minerals Inc. (plus applicable taxes) for an ongoing marketing campaign including this article among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. Danayi Capital Corp. owns and operates the website www.wallstreetlogic.com and its associated landing pages.

SHARE OWNERSHIP The owner of Danayi Capital Corp. may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR Danayi Capital Corp. and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH Always consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

This communication contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include predicting future price appreciation and investor gains; suggesting future discoveries and potential stock appreciation; assuming continued rising demand for gold and copper, which could impact stock performance; implying that current projects will develop into major assets; assuming that LaFleur Minerals Inc. dual-asset strategy, encompassing both the Swanson Gold Project and Beacon Gold Mill, creates an integrated mining operation that distinguishes the company from conventional junior exploration companies while providing a clear and quick pathway to production and revenue generation; encouraging investors to act now based on future anticipated gains; that the location of the Company’s projects and potential proximity to existing mines will increase the chances of exploration success; that the Company will be able to obtain future financing to advance its prospects.

These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the use of and demand for gold will not increase as expected; that gold may be obtained from other sources than expected, and significantly reduce the demand for this commodity’s exploration and mining; that the Company’s projects may fail to have any commercial amounts of gold whatsoever; that the Company may fail to take advantage of the demand and interest in gold for various reasons; that the Company’s exploration programs may fail to be successful or to discover any significant gold mineralization; that even if gold and/or any other metals are discovered on the Company’s properties, there may be insufficient amounts to commercialize production; that advancements in technology may make exploration and development of gold deposits obsolete or much less important; that the Company may fail to raise sufficient financing to fully implement its business exploration plans; that the Company’s management team may fail to effectively or successfully implement the Company’s exploration plans; that the Company may ultimately fail to successfully implement its business plans or generate any significant revenues whatsoever. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

Additional Disclaimer

This publication is part of an advertising campaign for the company under discussion and is aimed at experienced and speculatively oriented investors. This review of LaFleur Minerlas Inc. should not be construed as an independent financial analysis or even investment advice, as there are significant conflicts of interest that may affect the objectivity of the preparers (see the following section “Disclosure of Interests and Conflicts of Interest and Conflict of Interest Prevention Policies”).

Type of information: Marketing communication

Publisher: Danayi Capital Corp., a company incorporated in British Columbia, Canada.

Date of first creation: on or about September 2, 2025

Time of first creation: on or about 05:30AM PST

Creator of the marketing communication: Danayi Capital Corp.

Coordination with the issuer: Yes

Addressees: Danayi Capital Corp. makes the securities analysis available to all interested investment service providers and private investors at the same time.

Sources: Information sources of Danayi Capital Corp. are information of the issuer, domestic and foreign business press, information services, news agencies (e.g. Reuters, Bloomberg, Infront, etc.), analyses and publications on the Internet.

Scale of care: Valuations and investment judgments derived from them are prepared with the greatest possible care and taking into account all factors that are recognizably relevant at the respective time.

Disclosure of interests and conflicts of interest, as well as conflict of interest prevention policies

Danayi Capital Corp. receives a fixed fee from LaFleur Minerals Inc. for the distribution of the marketing communication.

Because other research houses and stock market letters can also discuss the value, there may be a symmetrical generation of information and opinion in the current recommendation period. Of course, it is important to note that LaFleur Minerals Inc. is listed in the highest conceivable risk class for stocks. The company may not yet have any sales and is at an early-stage level, which is both attractive and risky. The company’s financial situation is still loss-making, which significantly increases the risks. Capital increases that become necessary could also lead to dilution in the short term, which could be to the detriment of investors. If the company does not succeed in tapping into further sources of finance in the next few years, insolvency and delisting could even be threatened.

Declaration of release from liability and risk of total loss of invested capital

We would like to point out that equity investments are always associated with risk. Every transaction with warrants, leverage certificates or other financial products is even fraught with extremely high risks. Due to political, economic or other changes, there can be considerable price losses, in the worst case a total loss of the capital employed. With derivative products, the probability of extreme losses is at least as high as with small-cap shares, whereby the large domestic and foreign stocks can also suffer severe price losses up to a total loss. You should seek further advice before making any investment decision (e.g. from your bank or an advisor you trust).

Although the evaluations and statements contained in the analyses and market assessments of stock metrics have been prepared with reasonable care, we do not accept any responsibility or liability for errors, omissions or misstatements. This also applies to all representations, figures and assessments expressed by our interlocutors in the interviews. The entire risk arising from the use or performance of the Service and Materials remains with you, the reader. To the maximum extent permitted by applicable law, Danayi Capital Corp. shall not be liable for any special, incidental, indirect, or consequential damages (including, but not limited to, lost profits, business interruption, loss of business information, or any other pecuniary loss) arising out of the use of, or inability to use, the Service and Materials.

All statements in this report regarding LaFleur Minerals Inc., other than statements of historical fact, should be construed as forward-looking statements that may not materially prove to be true due to significant uncertainties. The author’s statements are subject to uncertainties that should not be underestimated. There is no certainty or guarantee that the forecasts made will actually come true. Therefore, readers should not rely on the statements of stock metrics and should buy or sell securities only based on reading the report.

Users who make investment decisions or carry out transactions on the basis of the information displayed or ordered for Danayi Capital Corp. act entirely at their own risk.

The reader hereby assures that he uses all materials and content at his own risk and that Danayi Capital Corp. assumes no liability.

Danayi Capital Corp. reserves the right to modify, improve, expand or remove the content and materials without notice. Danayi Capital Corp. excludes any warranty for service and materials. The Service and Materials and the related documentation are provided to you “as is” without warranty of any kind, either express or implied. Including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, or non-infringement.

The recommendations, interviews and company presentations published on this website fulfil advertising purposes without exception and are commissioned and paid for by third parties or the respective companies. For this reason, the analyses are not independent research studies.

There is no guarantee that the forecasts of the Company, the analyst or other experts and the management will actually come true. The performance of LaFleur Minerals Inc. shares is therefore uncertain. As with any so-called microcap, there is also a risk of total loss.

The investor should follow the news closely and have the technical requirements for trading in penny stocks. The narrowness of the market, which is typical of the segment, ensures high volatility. Inexperienced investors and LOW-RISK investors are generally advised not to invest in shares of LaFleur Minerals Inc. This analysis is aimed exclusively at experienced professional traders.

The author does not guarantee the completeness, timeliness or quality of the information provided. Liability claims against the author are excluded, as far as a negligent act is concerned. The author reserves the right to revise, supplement or delete parts of his statements.

Impressum (Required Information According to § 5 TMG)

Danayi Capital Corp.

Commercial Register:

550 – 800 West Pender Street, Vancouver, British Columbia, V6C 2V6, Canada

Represented by:

Mehran Bagherzadeh

Contact:

Phone: 6047672983

Email: Mehran@danayi.co

References

- [1]

Rumyk, I., Kuzminsky, V., Pylypenko, O., & Yaroshenko, O. (2024). Precious metals market forecasting in the current environment. Economics, Finance and Management Review. Retrieved from https://consensus.app/papers/precious-metals-market-forecasting-in-the-current-rumyk-kuzminsky/f072e5bb25dd5ee283ddaedfc7fefd47/?utm_source=chatgpt

- [2]

Lai, J. (2025). An analysis of gold price trends based on the current economic environment. Advances in Economics, Management and Political Sciences. Retrieved from https://consensus.app/papers/an-analysis-of-gold-price-trends-based-on-the-current-lai/1cc24308b5d6579294c384216a5b0447/?utm_source=chatgpt

- [3]

Tomczak, K. (2017). The impact of the 2007–2008 financial crisis on the banking systems in advanced European countries. Applied Economics Quarterly, 63(2), 161–176. Retrieved from https://consensus.app/papers/the-impact-of-the-2007–2008-financial-crisis-on-the-banking-tomczak/ef04f938c89b5d3895b50e63f72b6ff8/?utm_source=chatgpt

- [4]

Kowalewski, P., & Skopiec, D. A. (2024). Price processes in the global gold market. Bank i Kredyt. Retrieved from https://consensus.app/papers/price-processes-in-the-global-gold-market-kowalewski-skopiec/c501a3aa45e457eda010f0eda3281bc5/?utm_source=chatgpt

- [5]

Kowalewski, P., & Skopiec, D. A. (2024). Price processes in the global gold market. Bank i Kredyt. Retrieved from https://consensus.app/papers/price-processes-in-the-global-gold-market-kowalewski-skopiec/c501a3aa45e457eda010f0eda3281bc5/?utm_source=chatgpt

- [6]

World Gold Council. (2023). Gold Demand Trends Q3 2023. Retrieved from https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2023

- [7]

Bharat, A., Gautam, R., & Rastogi, S. (2024). Trends of currencies in forex reserves: Whither de-dollarization? 2024 International Conference on Automation and Computation (AUTOCOM). Retrieved from https://consensus.app/papers/trends-of-currencies-in-forex-reserves-whither-bharat-gautam/509a4294d40b59db9f77767c71cf37bd/?utm_source=chatgpt

- [8]

Bloomberg. (2024). Gold could hit $5,000 an ounce, says Citi. Retrieved from https://www.bloomberg.com/news/articles/2024-04-12/gold-could-hit-5-000-an-ounce-says-citi

- [9]

Reuters. (2025). Central banks on track for 4th year of massive gold purchases, Metals Focus says. Retrieved from https://www.reuters.com/world/india/central-banks-track-4th-year-massive-gold-purchases-metals-focus-says-2025-06-05/?utm_source=chatgpt.com

- [10]

Reuters. (2025). Central banks on track for 4th year of massive gold purchases, Metals Focus says. Retrieved from https://www.reuters.com/world/india/central-banks-track-4th-year-massive-gold-purchases-metals-focus-says-2025-06-05/?utm_source=chatgpt.com

Recent Posts

- The Convergence of Cryptocurrency and AI: Building Infrastructure for the Agentic Economy

- Rethinking Pocket Money: Beyond Individual Merit to Social Responsibility

- The Rise of Alternative Investments: Transforming Portfolio Strategies in 2025

- Cryptocurrency Markets Surge Amid Geopolitical Tensions and U.S. Debt Concerns

© 2024 Wallstreetlogic.com - All rights reserved.