Exceptional Generational Investment: 2.74M Gold Equivalent Ounce Project Revives Historic Mining Giant

Want to know how smart investors are positioning for a seismic economic shift?

While media creates noise, a select group is acquiring assets of a new financial era: gold, silver, and copper.

This is your opportunity to get in on a unique mining comeback story at the same level as lengendary investors like Rob McEwen, Dr. Quinton Hennigh, and Larry Lepard before Wall Street catches on.

If you could go back in time and acquire a world-class, past-producing gold and silver mine with over 2.5 million ounces of gold equivalent already outlined, would you take it?

Now imagine it also comes with existing infrastructure—before the rest of the market even knows it exists.

Fortunes are built when visionary investors recognize a paradigm shift long before the mainstream media, in moments of quiet conviction.

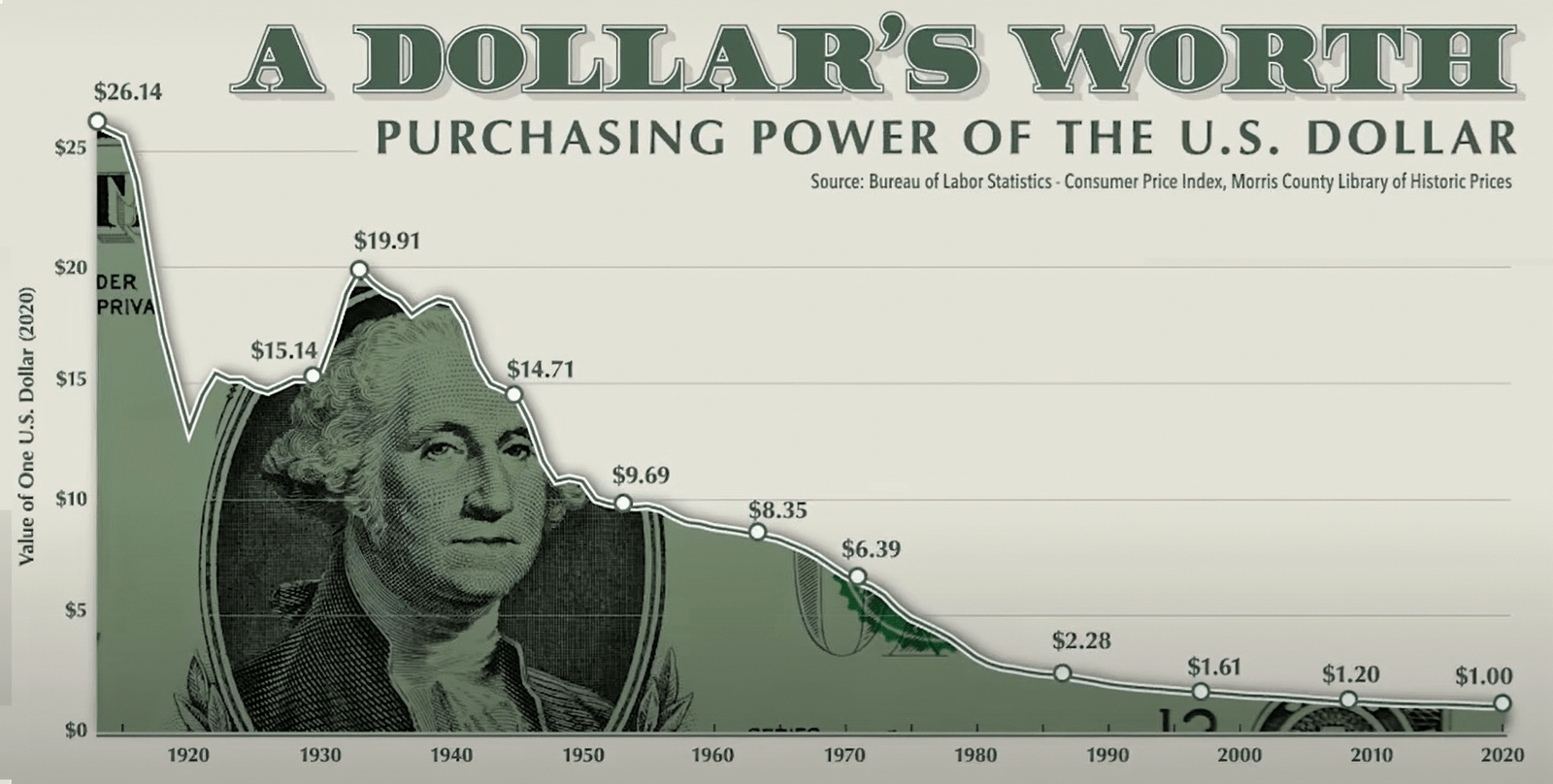

The financial world is at a breaking point due to soaring global debt, geopolitical tensions, and fiat currency printing.1

This has ignited an inflationary firestorm that threatens the savings of millions.

In response, smart money and nations are fleeing from paper assets and moving into the timeless security of hard, finite assets.

Gold, silver, and copper are now the bedrock of a new economic era.2

While the mainstream media creates market noise, the biggest players are strategically accumulating these building blocks of the future, positioning themselves for a supercycle that could reshape the global resource landscape.

They aren’t just hedging; they’re strategically accumulating these assets.

This is a seismic event, not just a market trend.

At the epicenter lies a forgotten giant: a prolific, high-grade mining district in a tier-one jurisdiction that has already produced millions of ounces of gold and silver.

This district is now controlled by a small, overlooked junior mining company with the vision to resurrect it.

This is the story of a company that holds the keys to what could be one of the most significant brownfield opportunities in the Americas.

An asset so powerful, it attracted mining titans like Shell and Rio Tinto in the past.3

An asset that is now poised for a rebirth at a time when the world needs it most, driven by a confluence of demand so powerful it is unlike anything we have seen before.

Wall Street hasn’t caught on yet.

The mainstream analysts are looking elsewhere, focused on the crowded trades and yesterday’s news.

But for investors who understand the gravity of this moment, for those who can see the chess board and recognize the power of a strategic move, this is your chance to get in on the ground floor of a story that has all the makings of a legendary mining comeback.

This is your chance to be early again by taking a position in Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF).

This unique company controls the Choquelimpie project in northern Chile.

This past-producing gold, silver, and copper mine was once the country’s third-largest gold producer.

Historically, the project has produced 415,000 ounces of gold and 2 million ounces of silver.

But, this isn’t a hopeful story. It’s a proven blueprint.

In fact, the CEO of Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) sold the last company he founded, for approximately $520 million and has been part of multiple exits, generating over $1 billion for investors.

To do it again, him and his family have invested over $9 million of their own capital into Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF), demonstrating their commitment to this new exciting endeavour.

Additionally, he has attracted a team of equally successful investors, geologists and mining engineers in discovery, development and exit to make this a success.

To that effect, legendary mining investors like Rob McEwen, Dr. Quinton Hennigh, and Larry Lepard have also thrown their support behind Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) by investing in and leading the Company’s lastest round of financing.

Rob McEwen founded Goldcorp, growing it from $50 million to over $8 billion market cap with 31% annual share price growth, and later established McEwen Mining Inc.

Dr. Quinton Hennigh brings 33+ years as an internationally-renowned economic geologist with major firms like Homestake, Newcrest, and Newmont, discovering significant deposits including the 5 million oz. Springpole gold deposit and currently advising Crescat Capital.

Lawrence Lepard, Managing Partner at Equity Management Associates LLC, has focused on precious metals investing since 2008 after 25 years as a professional investor and venture capitalist, including partnerships at Geocapital and Summit Partners, with an MBA with Academic Distinction from Harvard Business School.

Much more on Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) will be shared further below.

For now, please continue reading about the incoming precious metals and copper price perfect storm!

THE PERFECT STORM: WHY GOLD, SILVER, AND COPPER ARE ON THE VERGE OF A HISTORIC BREAKOUT

Gold: The Ultimate Safe Haven in an Age of Monetary Chaos

A convergence of powerful, synchronized macroeconomic forces is creating a once-in-a-generation “perfect storm”.

This isn’t a bull market for a single metal, but unprecedented demand for gold, silver, and copper—the pillars of industry and wealth preservation.4

Each metal has its own explosive narrative, but together, they form an unstoppable force.

Understanding this trifecta is key to unlocking a monumental opportunity.

Silver: The Indispensable Metal of the Future

For years, central banks have injected trillions into the global economy through unprecedented monetary printing.5

This has debased currencies and ignited runaway inflation that erodes purchasing power.

The result is a mathematical certainty: your money is buying less today than it did yesterday.

In response to monetary chaos, global central banks are buying gold at the fastest pace in over 50 years to diversify away from the U.S. dollar.6

This strategic global pivot from fiat currency to gold is a clear signal that the smartest money managers are preparing for a new financial reality.

As geopolitical risk rises, gold’s role as a safe-haven asset is more critical than ever.

Analysts are now forecasting a sustained bull run for gold, with prices already shattering previous all-time highs.7

Under the renewed Trump administration, aggressive economic policies are set to further inflate America’s $35 trillion debt, already climbing at a record pace.

While aimed at stimulating growth, such measures risk amplifying inflation and undermining confidence in the U.S. dollar’s long-term stability.

Historically, political boldness and soaring deficits have fueled gold demand as investors seek safety from currency debasement and fiscal mismanagement.8

As debt grows unchecked and uncertainty intensifies, the case for gold as the ultimate store of value only strengthens.

For decades, silver was known as “poor man’s gold.”

Today, that moniker is dangerously obsolete.

Silver is now at the heart of two of the biggest industrial revolutions of our time: the green energy transition and the electrification of everything.9

It is a metal with a dual identity: a precious monetary asset and an irreplaceable industrial commodity.

Silver is a crucial component in modern technology due to its unparalleled conductivity, essential for solar panels, electric vehicles, and 5G towers.10

As governments invest trillions into clean energy, industrial demand for silver is skyrocketing.

This isn’t optional demand; it’s mandated by global policy, and without silver, the green revolution stops.

The world faces a severe silver supply crisis. Mining production has stagnated for years, and stockpiles are depleting at an alarming rate.

For several years, there has been a massive structural deficit where demand dramatically outpaces supply.

This chronic shortage of an indispensable metal is not a cyclical downturn.

As this supply squeeze intensifies, silver is positioned for a price explosion driven by its monetary value and industrial necessity.

Copper: The Backbone of the AI and Electrification Revolution

They say copper is the new oil. That’s an understatement!

Copper is the lifeblood of the 21st-century economy.11

The global push to electrify transportation, upgrade power grids, and build out renewable energy infrastructure is creating a tsunami of copper demand that miners are simply unable to meet.

A more powerful catalyst has emerged: the AI revolution.

Massive AI data centers built by companies like OpenAI, Microsoft, and Google require staggering amounts of copper for power, cooling, and connectivity—a single center can use hundreds of tons.12

As the global race for AI supremacy accelerates, copper demand is set to enter a historic supercycle.

New copper discoveries are rare and difficult to develop.

The world’s biggest miners are struggling to replace reserves, and the project pipeline is thin.

It can take over 15 years to bring a new mine online. This impending supply cliff and explosive demand create the most compelling investment case for copper in a century.

This isn’t about choosing one metal over the other.

The smartest investors understand that the ultimate opportunity lies in polymetallic deposits—projects that contain gold, silver, and copper.

These are the assets that offer leveraged exposure to every facet of this perfect storm.

And it is precisely this kind of world-class, polymetallic giant that is now being reawakened by Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF).

NORSEMONT MINING: UNLOCKING A FORGOTTEN WORLD-CLASS ASSET IN A TIER-ONE JURISDICTION

In the high-stakes world of mineral exploration, most junior companies are selling a dream—a patch of barren land with the faint hope of a future discovery.

They spend millions of dollars and years of shareholder patience just to see if there’s anything there, a high-risk gamble that rarely pays off.

Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) is not one of those companies. Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) is reawakening a proven giant!

The company controls the Choquelimpie Gold-Silver-Copper Project, a legendary past-producing mine located in the mining-friendly jurisdiction of northern Chile.

This isn’t just another exploration project; it’s a world-class, high-grade epithermal system with immense potential of underlying porphyry-style mineralization at depth.

This past producing mine has already produced over 400,000 ounces of gold and over 2 million ounces of silver from shallow, open-pit operations.

This is not speculation; it is historical fact.

Previous operators, including Royal Dutch Shell among others, invested tens of millions into the project, developing significant infrastructure and outlining a massive mineralized footprint before shelving the project due to shifting corporate priorities and lower metal prices at the time.

Their loss is Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF), and potentially your extraordinary gain.

Now, with gold, silver, and copper prices going into a robust bull market, Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) has stepped in to consolidate this district and unlock its true, multi-million-ounce potential.

The company has done what others could not: it has assembled the data, re-interpreted the geology with modern techniques, and launched the first systematic exploration program in decades to prove that the historical, high-grade production was just the tip of the iceberg.

This is a brownfield project of immense scale. The groundwork has been laid. The discovery has already been made.

The question is no longer if there is a world-class deposit at Choquelimpie—the question is how many more millions of ounces Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) is about to prove.

THE CHOQUELIMPIE ADVANTAGE: A DEEP DIVE INTO A BILLION-DOLLAR OPPORTUNITY

What makes an exploration project truly world-class?

It’s a rare combination of grade, scale, jurisdiction, and infrastructure.

Choquelimpie, the flagship asset of Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF), ticks every single box with authority.

This isn’t just a project; it’s a district-scale opportunity with a foundation of de-risked assets that would take any other junior company a decade and tens of millions of dollars to replicate.

Part 1: Jurisdiction is Everything – The Power of Chile

In an era of rising resource nationalism, jurisdiction is paramount.

Chile is a true Tier-1 mining jurisdiction, home to the planet’s largest copper mines and known for respecting mining rights and foreign investment.13

The Chilean government offers a transparent permitting process, a skilled workforce, and established mining laws that provide investor security.

The Choquelimpie project is in a region with special tax incentives, which could enhance its economics.

While other companies face political risk, Norsemont operates with the security and stability that Chile provides.

Part 2: The Past-Producer Advantage – A Mine Already Built

Building a mine from scratch is a massive hurdle, taking over a decade and costing billions.

Norsemont bypasses this entirely because Choquelimpie is a past-producing mine with essential infrastructure already in place.

The existing infrastructure includes:

- Roads and Access: All-weather roads are already built, capable of handling a full-scale mining operation.

- Power and Water: The project is connected to the national power grid and has secured water rights, two difficult and expensive components of mine development in the arid Chilean highlands.

- Existing Mine Workings: The site has established open pits, fully-lined heap leach pads, and a 3,000 tons per day mill.

This infrastructure de-risks the project and slashes the timeline to production.

Norsemont can focus its capital on expanding the resource and fast-tracking redevelopment.

Part 3: The World-Class Resource – A Foundation of Gold, Silver, and Copper

Historical production at Choquelimpie was impressive, but it only scratched the surface.

Norsemont compiled decades of historical data from over 1,700 drill holes to create a modern, compliant mineral resource estimate.

In April 2025, a blockbuster NI 43-101 compliant Mineral Resource Estimate was announced:

- Indicated Resource: 2,184,000 ounces of gold equivalent (AuEq) at 0.83 g/t.

- Inferred Resource: 557,000 ounces of gold equivalent (AuEq) at 0.69 g/t.

A resource of nearly 2.8 million AuEq ounces places Norsemont in an elite class of developers.

The Indicated category provides a solid, bankable foundation for future economic studies.

This is a massive metal endowment, and it is just the beginning.

Part 4: The Untapped “Blue Sky” Potential – Hunting for the High-Grade Core

Norsemont has defined nearly 2.8 million AuEq ounces, with newly delineated sulfide mineralization offering long-term growth.14

Geological modeling suggests the near-surface mineralization is the upper halo of a potentially larger, higher-grade porphyry system at depth.

The company’s exploration strategy targets two “blue sky” targets:

- High-Grade Feeder Zones: These geological “plumbing systems” could contain bonanza-grade gold and silver, dramatically increasing the project’s grade and profitability if intersected.

- A Major Porphyry System: Evidence points to the potential for a massive gold-copper porphyry lurking beneath the known resource. A discovery of this nature would transform Choquelimpie into a world-class mining camp.

The current resource is the company’s floor; the upside potential is an entirely different order of magnitude.

Every drill hole has the potential to expand the resource and unlock the true, district-scale value of this asset.

LEADERSHIP: A PROVEN TEAM TO EXECUTE A WORLD-CLASS VISION

A world-class asset is worthless without a world-class team to advance it.

The greatest mineral deposits in the world have languished for decades under the wrong management, becoming nothing more than a footnote in a geology report.

Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) has assembled a team of seasoned industry veterans with the precise blend of technical expertise, capital markets savvy, and operational experience required to transform Choquelimpie’s potential into tangible shareholder value.

This is a team that knows how to explore, how to build, and how to create wealth in the mining sector.

Their collective resume is a testament to discovery, development, and delivering results.

LEADERSHIP TEAM

Marc Levy

CEO & Director

- Visionary Leader: Mr. Levy is a visionary leader with a profound grasp of both the geological and financial aspects of the mining industry.

- Talent for Identifying Value: He has a knack for identifying undervalued assets and creating deals that unleash their full potential.

- Passion for Unlocking Potential: He is passionate about transforming overlooked assets into successful, long-term ventures that benefit shareholders.

- Strategic Direction: Mr. Levy provides the corporate and strategic leadership necessary to guide projects from exploration to development, with a focus on maximizing shareholder returns.

Mijael Thiele

Director

- Chile-Based Mining Engineer: Mr. Thiele is a mining engineer based in Chile with 30 years of experience in mineral exploration and project management in South America.

- Led Major Copper-Gold Project: He successfully led the $2.7 billion Esperanza copper-gold project from exploration to commercial operation in just six years, setting new benchmarks for safety, capital expenditure, and development time.

- Managed a Complex Mine: He managed Anglo American’s Los Bronces copper operation for three years, serving as VP of Operations and General Manager.

- Exceeded Production Goals: Under his leadership at Los Bronces, the mine continuously improved its safety performance and consistently exceeded production budgets while keeping costs under control.

Art Freeze

Geological Advisor

- Respected Geologist: Mr. Freeze is a highly regarded geologist with decades of experience in the discovery of significant mineral deposits.

- On-the-Ground Expert: He is a hands-on expert whose deep technical knowledge is crucial for guiding exploration strategies and turning projects into successes.

- Modern Exploration Strategy: Mr. Freeze uses modern science to interpret complex geological data and is instrumental in unlocking the potential of historic deposits.

- Proven Ability: He has a proven ability to identify high-priority drill targets and oversee the technical programs needed to grow resources.

David Laing

Senior Technical Advisor

- Respected Mining Engineer: Mr. Laing is a highly respected mining engineer with four decades of experience across the resource sector.

- Operational and Strategic Expertise: He has a reputation as a mine builder and a trusted advisor, with a blend of hands-on operational leadership and high-level corporate strategy.

- Proven Track Record: As a former COO for companies like Equinox Gold, he has successfully developed gold and base metal projects and guided over $25 billion in mergers and acquisitions.

- Strategic Advisor: Today, he serves as a director and advisor, using his insight and credibility to help transform high-potential projects into world-class operations and create long-term shareholder value.

This is a team built for success.

They have the experience, the vision, and the dedication to execute on the enormous opportunity presented by the Choquelimpie project.

This isn’t just another hopeful story, it’s a blueprint that Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) has followed before.

As described earlier, Mr. Levy (CEO and Director) was the founder of Norsemont 1.0, which was sold for approximately $520 Million.

That was his first big win. Since then, he has been part of multiple exits that have generated over $1 billion in returns for investors.

Now, his goal is to do it again. That’s why Mr. Levy and his family have invested over $9 million of their own capital into this company.

They are not just talking the talk; they are all-in and fully committed to seeing this company through.

For investors, this leadership group provides a critical layer of confidence that the company is in the most capable hands in the industry.

They have done it before and plan to do it again!

THE INVESTMENT THESIS: WHY NOW IS THE TIME TO ACT

The window of opportunity for ground-floor investments in truly exceptional companies is always fleeting.

The market is littered with the stories of investors who “almost” bought a stock before it delivered a 1000% return.

Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) is standing at a critical inflection point, and for those paying attention, the investment case is overwhelmingly compelling.

Here’s why the time to act is now, summarized for clarity but powerful in its implications:

- A Massively Undervalued, World-Class Resource: Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) controls nearly 2.8 million ounces of gold equivalent in a Tier-1 jurisdiction, yet its market valuation remains a fraction of its peers. The market has not yet priced in the true value of the existing, high-confidence Indicated and Inferred resource, let alone the massive “blue sky” potential of a deeper porphyry system.

- A De-Risked Project with Built-in Infrastructure: The past-producing nature of Choquelimpie, complete with roads, power, and water, represents hundreds of millions of dollars in upfront capital costs that Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) will not have to spend. This dramatically accelerates the timeline to production and enhances future profitability, a factor the market has completely overlooked.

- Exposure to the Trifecta of Metals: With a significant gold, silver, and copper footprint, Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) offers investors leveraged exposure to every key driver of the current commodity supercycle—from safe-haven demand for gold, to the industrial and monetary demand for silver, to the electrification-fueled boom in copper.

- A Cascade of Near-Term Catalysts: Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) is entering a period of significant news flow that could rapidly rerate the company’s valuation. Upcoming catalysts include:

- A Preliminary Economic Assessment (PEA): This will be the first study to put concrete economic numbers around the project, potentially revealing a multi-billion-dollar valuation based on the existing resource alone.

- Resource Expansion Drilling: The company will be actively drilling to grow the existing resource and test the high-grade feeder zones and porphyry targets. Every drill result has the potential to be a major share price catalyst.

- Ongoing Metallurgical Work: Further testing will continue to optimize the recovery processes for gold, silver, and copper, further de-risking the project and adding confidence for institutional investors.

The smart money understands that you buy before the catalysts, not after.

Once the PEA is released or a bonanza-grade drill hole is announced, the opportunity for exponential returns will be gone.

The quiet accumulation phase is happening now. You have a choice.

You can wait for the mainstream headlines and chase the stock after it has already moved, or you can position yourself now, alongside the insiders and expert advisors who have already recognized the monumental opportunity at hand.

The gold rush of the 21st century is here. The demand for precious metals and copper is non-negotiable.

And Norsemont Mining Inc. (CSE: NOM | OTC: NRRSF) holds one of the most compelling, de-risked, and high-potential assets in the entire junior mining sector.

This isn’t just an investment in a mining company.

It’s a stake in a forgotten giant that is about to reawaken.

Don’t let this be the story you tell people you “almost” invested in. The time for hesitation is over.

Secure your position in Norsemont Mining today!

Stock Information

Norsemont Mining Corp.

CSE: NOM

OTC: NRRSF

Stay up to date and subscribe to our investor newsletter.

Disclaimers

PAID ADVERTISEMENT This communication is a paid advertisement and is not a recommendation to buy or sell securities. Danayi Capital Corp. (collectively with its owners, managers, employees, and assigns “Danayi Capital Corp.”) has been paid $50,000 United States dollars (US$) by Norsemont Mining Inc. (plus applicable taxes) for an ongoing marketing campaign including this article among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. Danayi Capital Corp. owns and operates the website www.wallstreetlogic.com and its associated landing pages.

SHARE OWNERSHIP. The owner of Danayi Capital Corp. may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Danayi Capital Corp. and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

This communication contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include predicting future price appreciation and investor gains; suggesting future discoveries and potential stock appreciation; assuming continued rising demand for gold and copper, which could impact stock performance; implying that current projects will develop into major assets; assuming that Choquelimpie project in northern Chile will continue producing major gold discoveries and that Norsemont Mining Inc. will be part of it; encouraging investors to act now based on future anticipated gains; that the location of the Company’s projects and potential proximity to existing mines will increase the chances of exploration success; that the Company will be able to obtain future financing to advance its prospects.

These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the use of and demand for gold, silver and copper will not increase as expected; that there will not be a deficiency of copper; that gold, silver and copper may be obtained from other sources than expected, and significantly reduce the demand for gold, silver and copper exploration and mining; that the Company’s projects may fail to have any commercial amounts of gold, silver and copper whatsoever; that the Company may fail to take advantage of the demand and interest in gold, silver and copper for various reasons; that the Company’s exploration programs may fail to be successful or to discover any significant gold, silver and/or copper mineralization; that even if gold, silver and copper and/or any ither metals are discovered on the Company’s properties, there may be insufficient amounts to commercialize production; that advancements in technology may make exploration and development of gold, silver and copper deposits obsolete or much less important; that the Company may fail to raise sufficient financing to fully implement its business exploration plans; that the Company’s management team may fail to effectively or successfully implement the Company’s exploration plans; that the Company may ultimately fail to successfully implement its business plans or generate any significant revenues whatsoever. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

Additional Disclaimer

This publication is part of an advertising campaign for the company under discussion and is aimed at experienced and speculatively oriented investors. This review of Norsemont Mining Inc. should not be construed as an independent financial analysis or even investment advice, as there are significant conflicts of interest that may affect the objectivity of the preparers (see the following section “Disclosure of Interests and Conflicts of Interest and Conflict of Interest Prevention Policies”).

Legal Notices

Type of information: Marketing communication

Publisher: Danayi Capital Corp., a company incorporated in British Columbia, Canada.

Date of first creation: on or about August 20, 2025

Time of first creation: on or about 05:30AM PST

Creator of the marketing communication: Danayi Capital Corp.

Coordination with the issuer: Yes

Addressees: Danayi Capital Corp. makes the securities analysis available to all interested investment service providers and private investors at the same time.

Sources: Information sources of Danayi Capital Corp. are information and information of the issuer, domestic and foreign business press, information services, news agencies (e.g. Reuters, Bloomberg, Infront, etc.), analyses and publications on the Internet.

Scale of care: Valuations and investment judgments derived from them are prepared with the greatest possible care and taking into account all factors that are recognizably relevant at the respective time.

Disclosure of interests and conflicts of interest, as well as conflict of interest prevention policies

Danayi Capital Corp. receives a fixed fee from Norsemont Mining Inc. for the distribution of the marketing communication. Because other research houses and stock market letters can also discuss the value, there may be a symmetrical generation of information and opinion in the current recommendation period. Of course, it is important to note that Norsemont Mining Inc. is listed in the highest conceivable risk class for stocks. The company may not yet have any sales and is at an early-stage level, which is both attractive and risky. The company’s financial situation is still loss-making, which significantly increases the risks. Capital increases that become necessary could also lead to dilution in the short term, which could be to the detriment of investors. If the company does not succeed in tapping into further sources of finance in the next few years, insolvency and delisting could even be threatened.

Declaration of release from liability and risk of total loss of invested capital

We would like to point out that equity investments are always associated with risk. Every transaction with warrants, leverage certificates or other financial products is even fraught with extremely high risks. Due to political, economic or other changes, there can be considerable price losses, in the worst case a total loss of the capital employed. With derivative products, the probability of extreme losses is at least as high as with small-cap shares, whereby the large domestic and foreign stocks can also suffer severe price losses up to a total loss. You should seek further advice before making any investment decision (e.g. from your bank or an advisor you trust).

Although the evaluations and statements contained in the analyses and market assessments of stock metrics have been prepared with reasonable care, we do not accept any responsibility or liability for errors, omissions or misstatements. This also applies to all representations, figures and assessments expressed by our interlocutors in the interviews. The entire risk arising from the use or performance of the Service and Materials remains with you, the reader. To the maximum extent permitted by applicable law, Danayi Capital Corp. shall not be liable for any special, incidental, indirect, or consequential damages (including, but not limited to, lost profits, business interruption, loss of business information, or any other pecuniary loss) arising out of the use of, or inability to use, the Service and Materials.

All statements in this report regarding Norsemont Mining Inc., other than statements of historical fact, should be construed as forward-looking statements that may not materially prove to be true due to significant uncertainties. The author’s statements are subject to uncertainties that should not be underestimated. There is no certainty or guarantee that the forecasts made will actually come true. Therefore, readers should not rely on the statements of stock metrics and should buy or sell securities only based on reading the report.

Users who make investment decisions or carry out transactions on the basis of the information displayed or ordered for Danayi Capital Corp. act entirely at their own risk. The reader hereby assures that he uses all materials and content at his own risk and that Danayi Capital Corp. assumes no liability.

Danayi Capital Corp. reserves the right to modify, improve, expand or remove the content and materials without notice. Danayi Capital Corp. excludes any warranty for service and materials. The Service and Materials and the related documentation are provided to you “as is” without warranty of any kind, either express or implied. Including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, or non-infringement.

The recommendations, interviews and company presentations published on this website fulfil advertising purposes without exception and are commissioned and paid for by third parties or the respective companies. For this reason, the analyses are not independent research studies.

There is no guarantee that the forecasts of the Company, the analyst or other experts and the management will actually come true. The performance of Norsemont Mining Inc. shares is therefore uncertain. As with any so-called micro cap, there is also a risk of total loss.

The investor should follow the news closely and have the technical requirements for trading in penny stocks. The narrowness of the market, which is typical of the segment, ensures high volatility. Inexperienced investors and LOW-RISK investors are generally advised not to invest in shares of Norsemont Mining Inc. This analysis is aimed exclusively at experienced professional traders.

The author does not guarantee the completeness, timeliness or quality of the information provided. Liability claims against the author are excluded, as far as a negligent act is concerned. The author reserves the right to revise, supplement or delete parts of his statements.

Impressum (Required Information According to § 5 TMG)

Danayi Capital Corp.

Commercial Register: 710 – 1030 West Georgia Street, Vancouver, British Columbia, V6E 2Y3, Canada

Represented by: Mehran Bagherzadeh

Contact:

Phone: 6047672983

Email: Mehran@danayi.co

References

- [1] Kyriazis, N., & Economou, E. M. L. (2025). Unveiling the impacts of geopolitical risk on the transition to the decentralized financial landscape. Peace Economics, Peace Science and Public Policy. https://consensus.app/papers/unveiling-the-impacts-of-geopolitical-risk-on-the-kyriazis-economou/2c9c3957b8d85d1e9bffbeaec39a7b5b/?utm_source=chatgpt

- [2] Kaymak, O. (2024). A Study on the Dependency Between Selected Global Stock Markets and Gold and Silver Futures. Cumhuriyet Üniversitesi İktisadi ve İdari Bilimler Dergisi.

https://consensus.app/papers/a-study-on-the-dependency-between-selected-global-stock-kaymak/41c60aa18b3d5424a597419584e71a41/?utm_source=chatgpt - [3] Norsemont Mining. (2025). Choquelimpie Gold-Silver-Copper Project. Retrieved from https://norsemont.com/choquelimpie/?utm_source=chatgpt.com

- [4] Złoty, M., Tasarz, P., & Śniarowski, B. (2024). The Dichotomous Nature of Silver in the 21st Century. Annales Universitatis Mariae Curie-Skłodowska, Sectio H – Oeconomia.

https://consensus.app/papers/the-dichotomous-nature-of-silver-in-the-21st-century-złoty-tasarz/3604ecdd40a05ef298aa2ce9e40c52c5/?utm_source=chatgpt - [5] Galle, B., & Listokin, Y. (2021). Monetary Finance. LSN: Law & Economics: Public Law (Topic).

https://consensus.app/papers/monetary-finance-galle-listokin/f44bd8ac1105505887ca57814add47a6/?utm_source=chatgpt - [6] Kowalewski, P., & Skopiec, D. A. (2024). Price processes in the global gold market. Bank i Kredyt.

https://consensus.app/papers/price-processes-in-the-global-gold-market-kowalewski-skopiec/c501a3aa45e457eda010f0eda3281bc5/?utm_source=chatgpt - [7] Nguyen Viet Hung (2024). Forecasting gold price using technical analysis indicators. International Journal of Advanced Economics.

https://consensus.app/papers/forecasting-gold-price-using-technical-analysis-hung/540159494a2c5b97af4180b4fd79aaa8/?utm_source=chatgpt - [8] Ibrahim, Z. F., & Masih, M. (2021). Is gold a better choice as reserve currency for smaller market economies?

https://consensus.app/papers/is-gold-a-better-choice-as-reserve-currency-for-smaller-ibrahim-masih/3031a0100f3f5c28beea13f772a9c7cb/?utm_source=chatgpt - [9] Emerald Expert Briefings. (2021). Recent price squeeze masks silver’s firm fundamentals.

https://consensus.app/papers/recent-price-squeeze-masks-silvers-firm-fundamentals/bf6e9b2edce25872abcddd7fabc32d11/?utm_source=chatgpt - [10] Rout, S., Jana, P., Borra, C. R., & Önal, M. (2025). Unlocking silver from end-of-life photovoltaic panels: A concise review. Renewable and Sustainable Energy Reviews.

https://consensus.app/papers/unlocking-silver-from-endoflife-photovoltaic-panels-a-rout-jana/1cc4eac07f8c5e21b4812259b892f410/?utm_source=chatgpt - [11] Torrubia, J., Parvez, A. M., Sajjad, M., García Paz, F. A., & van den Boogaart, K. G. (2024). Recovery of copper from electronic waste: An energy transition approach to decarbonise the industry. Journal of Cleaner Production.

https://consensus.app/papers/recovery-of-copper-from-electronic-waste-an-energy-torrubia-parvez/a5af0b1d7e68563aa29feddd6c62ec94/?utm_source=chatgpt - [12] Gui, C., Wang, Y., Shen, C., Wang, S., Wang, R., Lv, Z., Lin, B., Tian, W., Li, Z., Zhang, X., Zhang, K., Wu, L., & Ahuja, N. (2023). Advanced Cold Plate Liquid Cooling Solution for Hyper-scale Data Center Application. Published in the 22nd IEEE Intersociety Conference on Thermal and Thermomechanical Phenomena in Electronic Systems (ITherm).

https://consensus.app/papers/advanced-cold-plate-liquid-cooling-solution-for-gui-wang/22647e7191325840b7b497aad16bd2cf/?utm_source=chatgpt - [13] Zamani, A. (2025). The Strategic Position of Chile in Latin America. Political Science and Security Studies Journal.

https://consensus.app/papers/the-strategic-position-of-chile-in-latin-america-zamani/07bd0c3522395d76839b807358baa7cd/?utm_source=chatgpt - [14] Norsemont Mining. (2025). Choquelimpie Gold-Silver-Copper Project. Retrieved from https://norsemont.com/choquelimpie/?utm_source=chatgpt.com

Recent Posts

- How Artificial Intelligence Transforms Raw Data Into Valuable Insights: A Modern Parallel to Ancient Alchemy

- Investment Experience and Knowledge Drive Cryptocurrency Adoption More Than Financial Literacy, New Research Finds

- Is the Art Market at a Crossroads?

- Winklevoss Twins Discuss Bitcoin’s Future, Zcash Privacy and Gemini’s Expansion Plans

© 2024 Wallstreetlogic.com - All rights reserved.