THE URANIUM SUPERCYCLE IS HERE: HOW AI AND THE NET-ZERO REVOLUTION ARE FUELING A ONCE-IN-A-GENERATION OPPORTUNITY

China and Russia control the nuclear fuel cycle. The West is seeking alternatives.

AI data centers demand massive power. Uranium provides the solution.

Uranium prices are approaching $100/lb. In our experience, Tier-1 explorers always outperform in bull markets!

Fortunes are built when visionary investors recognize a paradigm shift long before the mainstream media, in moments of quiet conviction.

The global energy landscape is at a breaking point. Soaring electricity demands from Artificial Intelligence, a desperate push for net-zero carbon emissions, and escalating geopolitical tensions have ignited a firestorm under the uranium market.1

In response, smart money and nations are fleeing from unreliable energy sources and moving into the timeless security of nuclear energy, arguably the only dense, reliable, and clean baseload power source that can save the grid.

Uranium is now the bedrock of a new energy era, the nuclear era!

While the mainstream media creates noise, the biggest players are strategically accumulating these physical assets, positioning themselves for a supercycle that could reshape the global energy landscape for decades.

They aren’t just hedging; they’re preparing for a new reality.

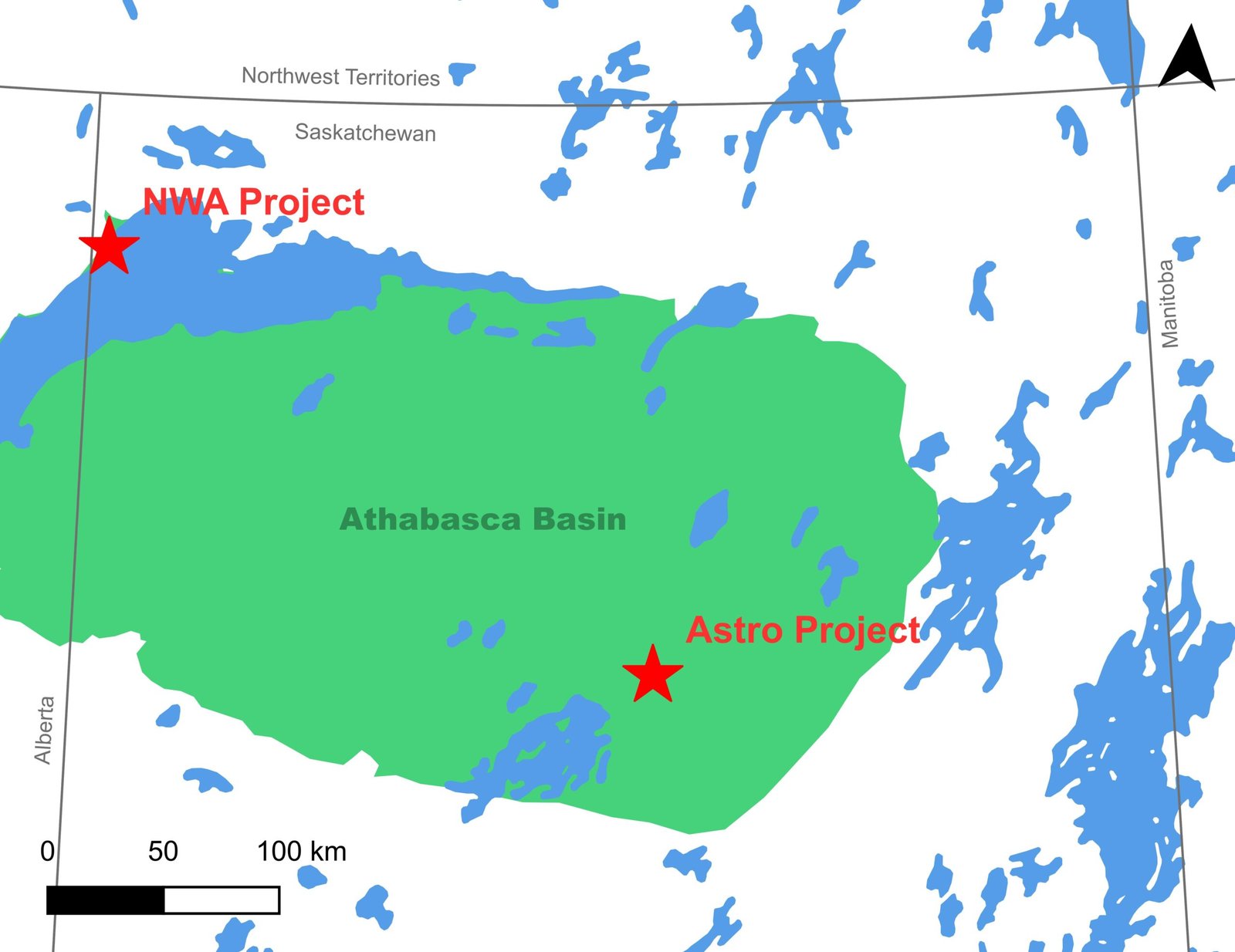

This is a seismic event, not just a market trend. At the epicenter lies a forgotten giant: the Athabasca Basin in Canada, which produces uranium at grades 10 to 100 times higher than the global average.2

This district is now being explored by a small, overlooked junior mining company with the vision of becoming a major domestic supplier.

This is the story of a company that holds a unique stake in what could be one of the most significant uranium opportunities in North America.

An opportunity so powerful, it attracted mining titans like Cameco Corp. (TSX: CCO), NexGen Energy Ltd. (TSX: NXE), and Orano Canada Inc. to form a strategic joint venture.

An asset that is now undergoing exploration work at a time when the world needs it most, driven by a confluence of demand so powerful it is unlike anything we have seen before.

Wall Street hasn’t caught on yet.

The mainstream analysts are looking elsewhere.

But for investors who understand the gravity of this moment, for those who can see the chess board, this is your chance to get in on the ground floor.

This is your chance to be early again by taking a position in Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN:A4098M).

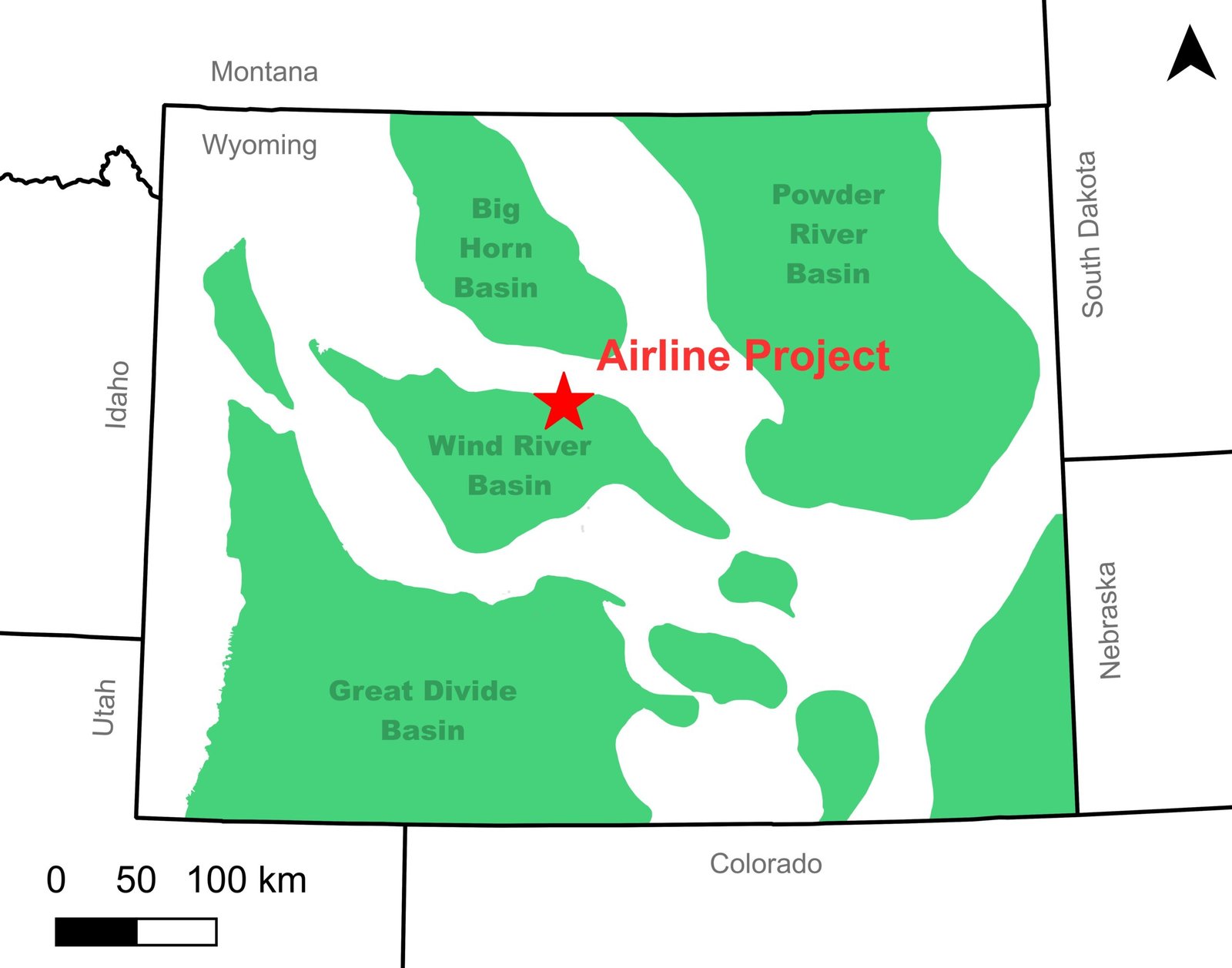

This unique company holds a portfolio of uranium projects in the world’s best mining jurisdictions: the Athabasca Basin, in Saskatchewan, Canada, and the Wind River Basin, in Wyoming, U.S.

Astute investors recognize that great opportunities emerge in uranium companies holding premier assets in politically stable, tier-1 mining districts during commodity bull market cycles.

Global Uranium Corp.’s (CSE: GURN | OTC: GURFF | WKN:A4098M) portfolio of uranium projects and ensuing field and drilling activities, provide “leveraged exposure” to the convergence of rising uranium prices, supply constraints, and surging demand.

In fact, Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) is already in a joint venture with the industry’s absolute leaders, a powerful validation of it’s current projects, that speaks louder than any press release.

This is a team that has done it before and is backing this company’s Athabasca project to do it again.

And they are just getting started!

Much more on Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) will be shared further below.

For now, please continue reading about the incoming uranium market perfect storm!

THE PERFECT STORM: WHY URANIUM IS ON THE VERGE OF A HISTORIC BREAKOUT

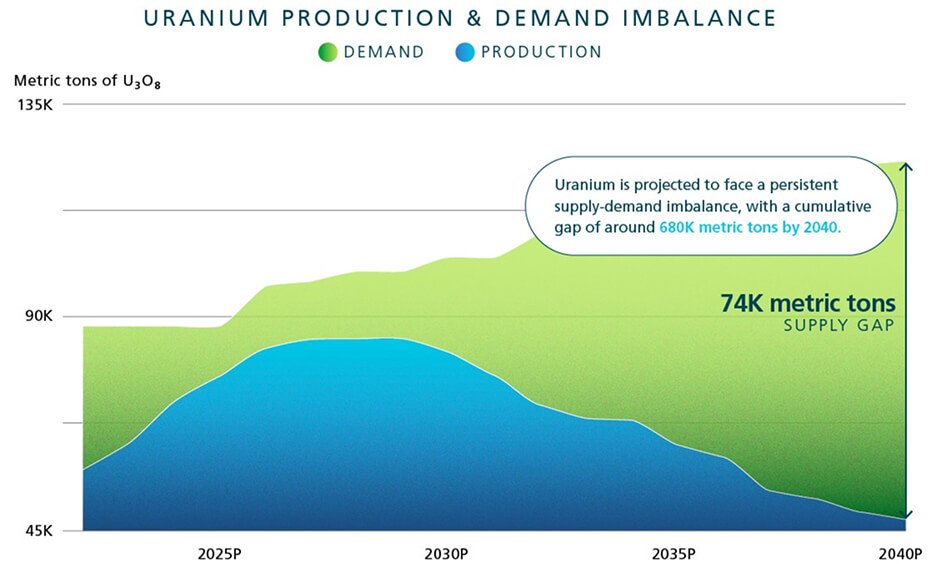

Source: Visual Capitalist-The Global Uranium Market

A convergence of powerful, synchronized macroeconomic forces is creating a once-in-a-generation opportunity in the uranium market.

This isn’t speculation, it’s a fundamental shift driven by three unavoidable realities: the AI energy crisis, the global net-zero mandate, and escalating geopolitical tensions.

Understanding this trifecta is essential to recognizing why uranium stands at the center of the coming decade’s most significant investment opportunity.

Uranium: The Only Answer to the AI Energy Crisis

The artificial intelligence revolution is not just transforming technology; it is fundamentally reshaping global energy infrastructure.

They say data is the new oil. That’s an understatement. The AI revolution is literally power-hungry, and the numbers are staggering.

Data centers powering AI technologies are projected to consume up to 12% of U.S. electricity by 2028.3

A single large AI data center can use as much energy as a small city, requiring constant, clean, and reliable baseload power that operates 24/7 without interruption.4

Traditional energy sources simply cannot meet this challenge. Intermittent renewables like solar and wind falter when the sun doesn’t shine and the wind doesn’t blow.5

Yet, AI infrastructure cannot afford even momentary power disruptions.

Fossil fuels bring the carbon emissions that no longer align with corporate and governmental net-zero commitments, plus they face mounting political and regulatory hurdles.

This reality explains why the U.S. Department of Energy has identified 16 federal sites, including major national laboratories, as potential locations for AI data centers specifically designed to leverage nuclear energy infrastructure.

It’s why the technology giants driving AI innovation are making unprecedented commitments to nuclear-powered facilities.7

The incoming Stargate Project, a monumental $500 billion joint venture between OpenAI, Oracle, and SoftBank, will deliver 10 gigawatts of AI computing capacity.8

Microsoft has committed $7 billion to its Fairwater AI Data Center, including an initial $3.3 billion investment.9

Amazon Web Services is deploying $100 billion through Project Rainier.10

Google and Meta are expanding their AI data center footprints to support next-generation services and applications.11

These aren’t speculative investments or optional expenditures.

These are strategic imperatives from companies that cannot afford to lose the AI race due to power constraints.

This isn’t optional demand; it’s mandated by technological necessity and national policy. Without uranium and the advanced reactors, it fuels, the AI revolution stops.

Rendering of GE Vernova Hitachi's SMR Source: GE Vernova

The Small Modular Reactor Revolution

Small Modular Reactors (SMRs) represent the next evolution in nuclear technology, purpose-built for the distributed energy demands of the AI era.

With reduced construction times, lower capital costs, enhanced safety features, and scalable deployment, SMRs can be integrated seamlessly with existing renewable energy grids while providing the baseload reliability that AI data centers require.12

The global race for SMR deployment is accelerating rapidly.

The United States Department of Energy has awarded contracts for producing High-Assay Low-Enriched Uranium (HALEU), the specialized fuel that these advanced reactors demand.13

Canada is positioning SMRs as solutions for remote communities and mining operations, with pilot projects advancing in Ontario and Saskatchewan.14

The United Kingdom has committed over £2.5 billion to develop the country’s first three SMRs.15

France, through the French Alternative Energies and Atomic Energy Commission and partners like EDF, is developing SMR technologies for domestic and export markets.16

Across Asia, China, South Korea, and Japan are investing heavily in SMR research and demonstration projects.17

These nations aren’t experimenting.

They’re preparing for a future where energy security determines economic competitiveness, and nuclear power provides the strategic advantage.

The Net-Zero Mandate: Tripling Nuclear Capacity

For decades, nuclear energy was controversial. Today, that perception is dangerously obsolete.

At the 2023 UN Climate Change Conference, over 20 countries launched a declaration to triple nuclear energy capacity by 2050.

This commitment was echoed in 2024 by corporate giants like Amazon, Google, and Meta.18

The math is compelling: one uranium pellet yields the energy equivalent of 120 gallons of oil, one ton of coal, or 17,000 cubic feet of natural gas.19

Nuclear power boasts the smallest carbon footprint of any reliable power source.

The green revolution is, in reality, a nuclear revolution and global policy is finally catching up to this fact.

Geopolitical Chaos: The West vs. Russia & China

Beyond AI and climate commitments, a third catalyst is driving uranium demand: geopolitical necessity.

The West faces a severe uranium supply crisis that threatens both energy security and national defense.

Russia and its allies control nearly 50% of the global nuclear fuel supply chain.20

For years, America and Europe have relied on these geopolitical rivals for the very fuel that powers their electrical grids and national security infrastructure.

This chronic dependency on an adversarial nation for an indispensable strategic metal is not sustainable.

The Uranium Supply Crisis

Years of underinvestment, mine closures, and geopolitical disruptions have created a supply deficit just as demand is exploding.

This isn’t about choosing one catalyst over the other.21

The smartest investors understand that the ultimate opportunity lies in uranium companies with assets in safe, Tier-1 jurisdictions in a “bull market setting”.

Assets that “offer leveraged exposure” to every facet of this perfect storm of incoming higher uranium prices.22

This is where the Athabasca Basin, with its global leading highest-grade uranium deposits, becomes the most important uranium district on Earth, and it is precisely this kind of strategic asset base that is now being advanced by Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M).

GLOBAL URANIUM CORP.: UNLOCKING TIER-1 ASSETS IN THE WORLD’S BEST URANIUM DISTRICTS

Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) controls a strategic portfolio of projects in the Athabasca Basin, Saskatchewan (responsible for 15.5% of global uranium production) and the Wind River Basin, Wyoming (the source of 69% of US uranium production).

The Athabasca Basin: The Saudi Arabia of Uranium

The Athabasca Basin isn’t just a mining district; it’s a legend.

It hosts the world’s largest high-grade uranium deposits, with grades ranging from 10 to 100 times higher than the global average.

It is home to the McArthur River mine, the largest high-grade uranium mine on earth.23

Saskatchewan ranks as the top jurisdiction in Canada and 7th globally for mining investment attractiveness.24

This is exactly where Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) has positioned itself for maximum impact.

Project 1: The Astro Project – The 25km Blue-Sky Corridor

The flagship Astro Project represents a district-scale exploration opportunity following a recent cutting-edge ZTEM survey that uncovered a continuous 25-kilometer east-west conductive corridor, representing a large and previously unknown geological structure.

This geophysical discovery provides the foundation for what could be a significant uranium exploration target within the renowned Athabasca Basin.25

The project benefits from its prime location within an established uranium mining district, situated just 28 kilometers west of the McArthur River Mine, which is the largest high-grade uranium mine on earth 26, and 13 kilometers north of the Millennium Deposit.

The Millennium Deposit is another Cameco asset with estimated indicated resources of 53.0 million pounds of U₃O₈ averaging 2.39% grade, and inferred resources of 20.2 million pounds of U₃O₈ averaging 3.19% grade.27

This proximity to world-class deposits provides important context, particularly given that average uranium grades outside the Athabasca Basin are typically around 0.15% U₃O₈, highlighting the exceptional potential of the region!28

The geology and structure at Astro are directly comparable to the settings that host local and nearby tier-1 deposits, providing proven analogues for the exploration potential.

The massive 25-kilometer scale of untested, high-priority targets represents potential for a company-making discovery, supported by a systematic approach through a clear, phased exploration plan already underway to drill-test these targets.

This represents the beginning of a well-defined target identified through modern geophysical techniques in a proven uranium district.

Project 2: The Northwest Athabasca (NWA) Joint Venture – validation “By The Giants”

This is perhaps the most powerful validation of Global Uranium Corp.’s (CSE: GURN | OTC: GURFF | WKN: A4098M) strategy.

The company is party to a joint venture with a consortium of uranium royalty: Cameco, NexGen, Orano, and Forum Energy Metals.

The NWA Project is located in the northwest corner of the Athabasca Basin and covers 13,845 hectares.

The joint venture is actively advancing this project, with recent drilling intersecting fractures with elevated radioactivity beneath surface.29

Wyoming: America's Uranium Heartland

While the Athabasca offers grade, Wyoming offers near-term production potential.

The state leads the nation in uranium output, with roughly 69% of US uranium production coming from Wyoming.

The Airline Project

This project demonstrates Global Uranium Corp.’s (CSE: GURN | OTC: GURFF | WKN: A4098M) strategic diversity.

It consists of eight mineral claims and a State lease, totaling 166 acres, within the Wind River Basin.

The area has a history of uranium production, with 500,000 lbs of U3O8 reportedly mined between 1955 and 1970.31

Accessible by paved highway, the project has seen recent reconnaissance work which has identified elevated radiometric anomalies.

The project’s geology suggests potential for both near-surface and deeper, high-value targets.

LEADERSHIP: A PROVEN TEAM TO EXECUTE A WORLD-CLASS VISION

The most promising geological discoveries and advanced exploration projects remain meaningless without the right leadership team positioned to unlock their potential and navigate the complex path from discovery to development.

Even the most exceptional uranium deposits require experienced professionals who understand both the technical challenges of resource extraction and the intricate regulatory and financial frameworks that govern modern mining operations.

Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M ) has strategically assembled a management team and board of directors comprised of seasoned industry veterans, accomplished capital markets professionals, and experienced strategic advisors who collectively possess the precise combination of technical geological expertise, capital markets acumen, regulatory knowledge, and stakeholder relations capabilities essential for advancing uranium projects in today’s competitive and highly regulated mining environment.

This carefully curated team brings decades of combined experience across all critical aspects of the mining value chain, from early-stage exploration and resource development through financing, permitting, and operational execution.

The leadership structure provides the company with the institutional knowledge and professional networks necessary to maximize the value of its uranium assets while effectively managing the inherent risks and challenges associated with resource development in the current market landscape.

The Airline Project

This project demonstrates Global Uranium Corp.’s (CSE: GURN | OTC: GURFF | WKN: A4098M) strategic diversity. It consists of eight mineral claims and a State lease, totaling 166 acres, within the Wind River Basin.

The area has a history of uranium production, with 500,000 lbs of U3O8 reportedly mined between 1955 and 1970.31

Accessible by paved highway, the project has seen recent reconnaissance work which has identified elevated radiometric anomalies.

The project’s geology suggests potential for both near-surface and deeper, high-value targets.

LEADERSHIP TEAM

Ungad Chadda

- Brings extensive capital markets and financial services leadership experience, including senior executive roles at TMX Group as President of the Toronto Stock Exchange and CFO of TSX Trust

- Qualified as a Chartered Accountant with specialized expertise in capital markets regulation, having served as a capital markets regulator prior to his corporate roles

- Provides strategic advisory services to clients on capital markets strategies, regulatory compliance, and corporate governance matters

Dr. Jared Suchan

- Professional geoscientist with over 10 years of specialized experience in Canadian mining project exploration and development, particularly in remote and challenging locations

- Possesses direct uranium exploration experience in Saskatchewan, complemented by expertise in North American rare earth element, base metal, and precious metal exploration programs

- Leads early-stage mineral exploration initiatives with proven capability in designing and executing exploration programs across multiple commodity types

Foster Wilson

Strategic Advisor and Director

- Veteran mining executive with over 40 years of comprehensive mineral resource experience spanning exploration, reserve estimation, feasibility studies, and mine development through permitting

- Former President of Mesa Uranium Corp. and director of Alpha Lithium Corporation, which was successfully acquired for approximately $313 million, demonstrating value creation track record

- Brings strategic expertise in advancing mining projects from early exploration through development and acquisition phases across multiple commodities and jurisdictions

Former Canadian Cabinet Minister Sergio Marchi

- Served in senior federal government positions providing deep understanding of Canadian political processes and policy development.

- Brings extensive network of government contacts and relationships built through years of high-level public service.

- Offers strategic guidance on navigating complex federal regulatory approval processes and stakeholder engagement.

Former Minister of Justice Martin Cauchon

- Professional geoscientist with over 10 years of specialized experience in Canadian mining project exploration and development, particularly in remote and challenging locations

- Possesses direct uranium exploration experience in Saskatchewan, complemented by expertise in North American rare earth element, base metal, and precious metal exploration programs

- Leads early-stage mineral exploration initiatives with proven capability in designing and executing exploration programs across multiple commodity types

Uranium Discovery Legend Ken Wheatley

- Participated in the discovery of 8 uranium deposits demonstrating exceptional geological expertise and exploration success.

- Brings decades of hands-on field experience in uranium exploration across various geological settings.

- Provides technical credibility and industry recognition that enhances the company’s reputation among investors and peers.

The Strategic Advantage of Proven Leadership

Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) brings together a unique combination of expertise through its leadership team and advisory board.

This unique team can navigate complex technical challenges in uranium exploration and possess established capital markets relationships for securing financing.

Each member brings proven track records in their respective areas.

The combination includes value creation experience, government relations expertise, and geological discovery success.

This provides the institutional credibility necessary for advancing Global Uranium Corp.’s (CSE: GURN | OTC: GURFF | WKN: A4098M) projects from exploration through potential development.

The team maintains stakeholder confidence essential for long-term success in the uranium industry.

The Investment Thesis: Why Global Uranium Corp. Stands at a Critical Inflection Point

The window of opportunity for ground-floor investments in truly exceptional companies is always fleeting.

Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) is standing at a critical inflection point, and for those paying attention, the investment case is overwhelmingly compelling.

The convergence of forces driving the uranium supercycle with AI’s insatiable energy demands, the global net-zero mandate requiring a tripling of nuclear capacity by 2050, and the West’s urgent need for supply chain independence from Russia and China, creates a backdrop unlike anything the uranium sector has witnessed in decades or maybe ever.

This isn’t a single catalyst story. This is a fundamental restructuring of global energy infrastructure, and Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) has strategically positioned itself at the intersection of all three mega-trends.

Consider the scale of what’s unfolding: The Stargate Project’s $500 billion commitment to AI infrastructure, Microsoft’s $7 billion Fairwater data center and Amazon’s $100 billion Project Rainier.

These aren’t speculative ventures, they are necessity-driven investments by companies that cannot afford energy disruptions.

When tech giants pivot toward nuclear power with this level of capital commitment, they’re not making bets, they’re responding to the inescapable reality that uranium can provide the 24/7 baseload power AI requires.32

The Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) dual-jurisdiction strategy offers investors something rare in the junior mining space: optionality across two of the world’s most prolific uranium districts.

The Athabasca Basin, producing 15.5% of global uranium at grades 10 to 100 times higher than the global average, represents the crown jewel destination for the uranium exploration.

Meanwhile, Wyoming’s Wind River Basin, source of 69% of US uranium production, provides provides exposure to a jurisdiction ranked 5th globally for mining investment attractiveness.

The Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) dual-jurisdiction strategy offers investors something rare in the junior mining space: optionality across two of the world’s most prolific uranium districts.

The Athabasca Basin, producing 15.5% of global uranium at grades 10 to 100 times higher than the global average, represents the crown jewel destination for the uranium exploration.

Meanwhile, Wyoming’s Wind River Basin, source of 69% of US uranium production, provides provides exposure to a jurisdiction ranked 5th globally for mining investment attractiveness.

Here’s why the time to act is now:

1. A Cascade of Near-Term Catalysts: Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) is entering a period of significant news flow that could rapidly re-rate the company’s valuation.

Upcoming catalysts include:

- Astro Project Drilling Activity: Upcoming geophysical surveys on the 25km corridor, followed by a drilling program.

- NWA JV Advancements: Continued results and advancement from the joint venture with Cameco, NexGen, and Orano provide constant validation and de-risking.

- Wyoming Expansion: Further land acquisition and target refinement in Wyoming enhance the near-term exploration outlook.

2. Uranium Price Correlation: Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) provides uranium sector exposure as prices trend toward forecast levels of $100/lb and potentially higher.33 Exploration companies with quality assets in tier-1 jurisdictions tend to benefit from rising commodity prices.

3. The Major Partner Advantage: The joint venture with industry leaders’ de-risks the project significantly. Their technical expertise and financial contributions reduce the capital burden on Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) and provide a stamp of approval no analyst report can match.

4. The American and Canadian Advantage: In an era of resource nationalism, having prime assets in the world’s safest and most mining-friendly jurisdictions is not an advantage—it is a necessity. This provides security and stability that projects in other parts of the world simply cannot offer.

The smart money understands that you buy before the catalysts, not after. Once the drill results are released or a new major discovery is announced, the opportunity for exponential returns will be gone.

The quiet accumulation phase is happening now.

The uranium rush of the 21st century is here.

The demand for clean, reliable baseload power is non-negotiable. And Global Uranium Corp. (CSE: GURN | OTC: GURFF | WKN: A4098M) holds one of the most compelling, strategic, and high-potential asset portfolios in the junior mining sector.

Secure your position in Global Uranium Corp. today!

Stock Information

Global Uranium Corp.

CSE: GURN

OTC : GURFF

Stay up to date and subscribe to our investor newsletter.

Disclaimers

QUALIFIED PERSON STATEMENT All scientific and technical information contained in this document has been reviewed and approved by Jared Suchan, Ph.D., P.Geo., Global Uranium’s Vice President of Exploration and Qualified Person under National Instrument 43-101.

PAID ADVERTISEMENT This communication is a paid advertisement and is not a recommendation to buy or sell securities. Danayi Capital Corp. (collectively with its owners, managers, employees, and assigns “Danayi Capital Corp.”) has been paid $100,000 United States dollars (US$) by Global Uranium Corp. (plus applicable taxes) for an ongoing marketing campaign including this article among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. Danayi Capital Corp. owns and operates the website www.wallstreetlogic.com and its associated landing pages.

SHARE OWNERSHIP The owner of Danayi Capital Corp. may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR Danayi Capital Corp. and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH Always consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

This communication contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include predicting future price appreciation and investor gains; suggesting future discoveries and potential stock appreciation; assuming continued rising demand for uranium, which could impact stock performance; implying that current projects will develop into major assets; assuming that Global Uranium Corp. dual-asset strategy, encompassing both the Athabasca and Wind River Basin projects, creates an integrated mining operation that distinguishes the company from conventional junior exploration companies while providing a clear and quick pathway to production and revenue generation; encouraging investors to act now based on future anticipated gains; that the location of the Company’s projects and potential proximity to existing mines will increase the chances of exploration success; that the Company will be able to obtain future financing to advance its prospects.

These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the use of and demand for uranium will not increase as expected; that uranium may be obtained from other sources than expected, and significantly reduce the demand for this commodity’s exploration and mining; that the Company’s projects may fail to have any commercial amounts of uranium whatsoever; that the Company may fail to take advantage of the demand and interest in uranium for various reasons; that the Company’s exploration programs may fail to be successful or to discover any significant uranium mineralization; that even if uranium and/or any other metals are discovered on the Company’s properties, there may be insufficient amounts to commercialize production; that advancements in technology may make exploration and development of uranium deposits obsolete or much less important; that the Company may fail to raise sufficient financing to fully implement its business exploration plans; that the Company’s management team may fail to effectively or successfully implement the Company’s exploration plans; that the Company may ultimately fail to successfully implement its business plans or generate any significant revenues whatsoever. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

Additional Disclaimer

Type of information: Marketing communication

Publisher: Danayi Capital Corp., a company incorporated in British Columbia, Canada.

Date of first creation: on or about September 25, 2025

Time of first creation: on or about 05:30AM PST

Creator of the marketing communication: Danayi Capital Corp.

Coordination with the issuer: Yes

Addressees: Danayi Capital Corp. makes the securities analysis available to all interested investment service providers and private investors at the same time.

Sources: Information sources of Danayi Capital Corp. are information of the issuer, domestic and foreign business press, information services, news agencies (e.g. Reuters, Bloomberg, Infront, etc.), analyses and publications on the Internet.

Scale of care: Valuations and investment judgments derived from them are prepared with the greatest possible care and taking into account all factors that are recognizably relevant at the respective time.

Disclosure of interests and conflicts of interest, as well as conflict of interest prevention policies

Danayi Capital Corp. receives a fixed fee from Global Uranium Corp. for the distribution of the marketing communication.

Because other research houses and stock market letters can also discuss the value, there may be a symmetrical generation of information and opinion in the current recommendation period. Of course, it is important to note that Global Uranium Corp. is listed in the highest conceivable risk class for stocks. The company may not yet have any sales and is at an early-stage level, which is both attractive and risky. The company’s financial situation is still loss-making, which significantly increases the risks. Capital increases that become necessary could also lead to dilution in the short term, which could be to the detriment of investors. If the company does not succeed in tapping into further sources of finance in the next few years, insolvency and delisting could even be threatened.

Declaration of release from liability and risk of total loss of invested capital

We would like to point out that equity investments are always associated with risk. Every transaction with warrants, leverage certificates or other financial products is even fraught with extremely high risks. Due to political, economic or other changes, there can be considerable price losses, in the worst case a total loss of the capital employed. With derivative products, the probability of extreme losses is at least as high as with small-cap shares, whereby the large domestic and foreign stocks can also suffer severe price losses up to a total loss. You should seek further advice before making any investment decision (e.g. from your bank or an advisor you trust).

Although the evaluations and statements contained in the analyses and market assessments of stock metrics have been prepared with reasonable care, we do not accept any responsibility or liability for errors, omissions or misstatements. This also applies to all representations, figures and assessments expressed by our interlocutors in the interviews. The entire risk arising from the use or performance of the Service and Materials remains with you, the reader. To the maximum extent permitted by applicable law, Danayi Capital Corp. shall not be liable for any special, incidental, indirect, or consequential damages (including, but not limited to, lost profits, business interruption, loss of business information, or any other pecuniary loss) arising out of the use of, or inability to use, the Service and Materials.

All statements in this report regarding Global Uranium Corp., other than statements of historical fact, should be construed as forward-looking statements that may not materially prove to be true due to significant uncertainties. The author’s statements are subject to uncertainties that should not be underestimated. There is no certainty or guarantee that the forecasts made will actually come true. Therefore, readers should not rely on the statements of stock metrics and should buy or sell securities only based on reading the report.

Users who make investment decisions or carry out transactions on the basis of the information displayed or ordered for Danayi Capital Corp. act entirely at their own risk.

The reader hereby assures that he uses all materials and content at his own risk and that Danayi Capital Corp. assumes no liability.

Danayi Capital Corp. reserves the right to modify, improve, expand or remove the content and materials without notice. Danayi Capital Corp. excludes any warranty for service and materials. The Service and Materials and the related documentation are provided to you “as is” without warranty of any kind, either express or implied. Including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, or non-infringement.

The recommendations, interviews and company presentations published on this website fulfil advertising purposes without exception and are commissioned and paid for by third parties or the respective companies. For this reason, the analyses are not independent research studies.

There is no guarantee that the forecasts of the Company, the analyst or other experts and the management will actually come true. The performance of Global Uranium Corp. shares is therefore uncertain. As with any so-called microcap, there is also a risk of total loss.

The investor should follow the news closely and have the technical requirements for trading in penny stocks. The narrowness of the market, which is typical of the segment, ensures high volatility. Inexperienced investors and LOW-RISK investors are generally advised not to invest in shares of Global Uranium Corp. This analysis is aimed exclusively at experienced professional traders.

The author does not guarantee the completeness, timeliness or quality of the information provided. Liability claims against the author are excluded, as far as a negligent act is concerned. The author reserves the right to revise, supplement or delete parts of his statements.

Impressum (Required Information According to § 5 TMG)

Danayi Capital Corp.

Commercial Register:

550 – 800 West Pender Street, Vancouver, British Columbia, V6C 2V6, Canada

Represented by:

Mehran Bagherzadeh

Contact:

Phone: 6047672983

Email: Mehran@danayi.co

References

- [1]

Kotnala, R. K. (2024). Importance of nuclear energy to accomplish net zero carbon. Current Natural Sciences and Engineering. Retrieved from https://consensus.app/papers/importance-of-nuclear-energy-to-accomplish-net-zero-carbon-kotnala/7b27c49711295ce6bd40006128f104e1/

- [2]

Vance, R. (2006). Uranium production, exploration and mine development in Canada. Retrieved from https://consensus.app/papers/uranium-production-exploration-and-mine-development-in-vance/03d81625c9275195804077047268f7ea/

- [3]

Sunkara, K. C., & Narukulla, K. (2025). Power consumption and heat dissipation in AI data centers: A comparative analysis. International Journal of Innovative Research in Science, Engineering and Technology. Retrieved from https://www.energy.gov/articles/doe-releases-new-report-evaluating-increase-electricity-demand-data-centers

- [4]

Sunkara, K. C., & Narukulla, K. (2025). Power consumption and heat dissipation in AI data centers: A comparative analysis. International Journal of Innovative Research in Science, Engineering and Technology. Retrieved from https://consensus.app/papers/power-consumption-and-heat-dissipation-in-ai-data-centers-a-sunkara-narukulla/970e49691ef45998883ed3910b3938ea/

- [5]

Pacific Northwest National Laboratory (2023). “Energy Droughts in Wind and Solar Can Last Nearly a Week, Research Shows.” Retrieved from https://www.pnnl.gov/news-media/energy-droughts-wind-and-solar-can-last-nearly-week-research-shows

- [6]

Voinovich, G. V. (2008). Making the nuclear renaissance a reality. Retrieved from https://consensus.app/papers/making-the-nuclear-renaissance-a-reality-voinovich/64a53940ac0051c988f92aac4a95511d/

- [7]

Reuters (2024, October 14). Google to buy power from small modular nuclear reactor company for AI needs. Retrieved from https://www.reuters.com/technology/artificial-intelligence/google-buy-power-small-modular-nuclear-reactor-company-kairos-ai-needs-2024-10-14

- [8]

Reuters. (2025, September 23). OpenAI, Oracle, SoftBank plan $500 billion ‘Stargate’ AI data center project with 10GW capacity. Retrieved from https://www.reuters.com/business/media-telecom/openai-oracle-softbank-plan-five-new-ai-data-centers-500-billion-stargate-2025-09-23

- [9]

Microsoft. (2025, September 18). Made in Wisconsin: The world’s most powerful AI datacenter. Retrieved from https://blogs.microsoft.com/on-the-issues/2025/09/18/made-in-wisconsin-the-worlds-most-powerful-ai-datacenter

- [10]

David Chernicoff & Matt Vincent. (2025, July 8). Amazon’s Project Rainier Sets New Standard for AI Supercomputing at Scale. Retrieved from https://www.datacenterfrontier.com/machine-learning/article/55299331/amazons-project-rainier-sets-new-standard-for-ai-supercomputing-at-scale Data Center Frontier

- [11]

Reuters (2025). “Google pledges $9 billion to expand AI, cloud infrastructure in Oklahoma.” Retrieved from https://www.reuters.com/business/google-pledges-9-billion-expand-ai-cloud-infrastructure-oklahoma-2025-08-13/

- [12]

Sun, Y., & Kurosaki, K. (2025). Technical Overview of Recent Developments in Small Modular Reactors in the United States. Retrieved from https://arxiv.org/abs/2504.02599

- [13]

.S. Department of Energy. (2025, April 9). U.S. Department of Energy to Distribute First Amounts of HALEU to U.S. Advanced Reactor Developers. Retrieved from https://www.energy.gov/articles/us-department-energy-distribute-first-amounts-haleu-us-advanced-reactor-developers

- [14]

Natural Resources Canada (2025). “Small Modular Reactors for Mining.” Retrieved from https://naturalresources.canada.ca/energysources/nuclearenergyuranium/smallmodularreactorssmrsmining

- [15]

U.K. Government / Department for Energy Security & Net Zero. (2025, June 10). Rolls-Royce SMR selected to build small modular nuclear reactors; over £2.5 billion pledged for SMR programme. Retrieved from https://www.gov.uk/government/news/rolls-royce-smr-selected-to-build-small-modular-nuclear-reactors

- [16]

Lessons From France’s Nuclear Program. (2025, September 2). SMR development in France centers on the NUWARD project, a collaboration between EDF, the French Alternative Energies and Atomic Energy Commission (CEA), the Naval Group, and TechnicAtome. Retrieved from https://itif.org/publications/2025/09/02/lessons-from-frances-nuclear-program/

- [17]

International Trade & Investment Framework (2025). “Asia-Pacific Countries Deepen Investment in Small Modular Reactor Research and Demonstration Projects.” Retrieved from https://itif.org/publications/2025/04/14/smallmodularreactorsarealistapproachtothefutureofnuclearpower

- [18]

World Nuclear Association. (2025, March 28). Major Global Companies Pledge Historic Support to Triple Nuclear Energy by 2050. Retrieved from https://www.world-nuclear.org/news-and-media/press-statements/major-global-companies-pledge-historic-support-to-triple-nuclear-energy

- [19]

U.S. Department of Energy. (2019, October 15). Happy Nuclear Science Week: One uranium pellet produces as much energy as 120 gallons of oil, 1 ton of coal, or 17,000 cubic feet of natural gas. Retrieved from https://www.energy.gov/articles/happy-nuclear-science-week

- [20]

Russia possesses roughly 47 % of the world’s uranium enrichment capacity … most of the 32 countries that use nuclear power rely on Russia for some part of their nuclear fuel supply chain.” — Russia’s global grip on nuclear energy

- [21]

Mining.com (2023). “Reasons why a metals supply crunch is coming.” Retrieved from https://www.mining.com/web/reasons-why-a-metals-supply-crunch-is-coming

- [22]

Forbes. (2025, September 2). Uranium Marching Towards $100/lb As Supply Squeezed. Retrieved from https://www.forbes.com/sites/timtreadgold/2025/09/02/uranium-marching-towards-100lb-as-supply-squeezed/

- [23]

Vance, R. (2006). Uranium production, exploration and mine development in Canada. Retrieved from https://consensus.app/papers/uranium-production-exploration-and-mine-development-in-vance/03d81625c9275195804077047268f7ea/

- [24]

Fraser Institute. (2025). Annual Survey of Mining Companies 2024. Retrieved from https://www.fraserinstitute.org/studies/annual-survey-mining-companies-2024

- [25]

Global Uranium Corp. (2025). Global Uranium Corp Reports Results of Airborne ZTEM Survey at Astro Project, Athabasca Basin. Retrieved from https://www.globenewswire.com/news-release/2025/09/17/3151582/0/en/Global-Uranium-Corp-Reports-Results-of-Airborne-ZTEM-Survey-at-Astro-Project-Athabasca-Basin.html

- [26]

Jamieson, B. (2005). Mining the high grade McArthur River uranium. Retrieved from https://consensus.app/papers/mining-the-high-grade-mcarthur-river-uranium-jamieson/9be0791ac74455db9425bcdf8f245c67/

- [27]

Guffey, S., Piercey, S., Ansdell, K., Kyser, K., Kotzer, T., & Zaluski, G. (2015). Potential pathfinder elements: Footprint of 3D lithogeochemistry of the Millennium unconformity-type uranium deposit, Athabasca Basin, Saskatchewan. Retrieved from https://consensus.app/papers/potential-pathfinder-elements-footprint-of-3d-sguffey-spiercey/fceb5d1fb7f959df9f51f775a40f2162/

- [28]

Vance, R. (2006). Uranium Production, Exploration and Mine Development in Canada. Retrieved from https://consensus.app/papers/uranium-production-exploration-and-mine-development-in-vance/03d81625c9275195804077047268f7ea/

- [29]

Global Uranium Corp. (2025). Global Uranium Provides Update on the Northwest Athabasca Joint Venture Project Drilling Program. Retrieved from https://www.globenewswire.com/news-release/2025/02/24/3031087/0/en/Global-Uranium-Provides-Results-of-Airborne-ZTEM-Survey-at-Astro-Project-Athabasca-Basin.html

- [30]

Fraser Institute. (2025). Annual Survey of Mining Companies 2024. Retrieved from https://www.fraserinstitute.org/studies/annual-survey-mining-companies-

- [31]

Global Uranium Corp. (2024). Global Uranium Enters Into Agreement To Purchase 100% of Five Uranium Projects in Wyoming, USA. Retrieved from https://www.globenewswire.com/news-release/2024/06/17/2899610/0/en/Global-Uranium-Enters-Into-Agreement-To-Purchase-100-of-Five-Uranium-Projects-in-Wyoming-USA.html

- [32]

Google / press / News (2025). “Google to Commit Funding for Three Advanced Nuclear Power Projects.” Retrieved from https://www.nucnet.org/news/google-to-commit-funding-for-three-advanced-nuclear-power-projects-5-4-2025

- [33]

Forbes. (2025, September 2). Uranium Marching Towards $100/lb As Supply Squeezed. Retrieved from https://www.forbes.com/sites/timtreadgold/2025/09/02/uranium-marching-towards-100lb-as-supply-squeezed/

Recent Posts

- Brazil’s Renewable Energy Surplus Meets Cryptocurrency Mining: A Promising Partnership Taking Shape

- Global Uranium Corp. (CSE: GURN | OTC : GURFF)

- Gold Reaches Historic Heights: Understanding the Forces Behind the Precious Metals Surge

- Google’s Revolutionary AI Payment Protocol: How Alphabet Is Transforming Digital Commerce and Cryptocurrency

© 2024 Wallstreetlogic.com - All rights reserved.