THE U.S. MILITARY’S SUPPLY CHAIN IS UNDER THREAT – AND THIS STOCK COULD BE YOUR BEST DEFENSE

China has a stranglehold on a critical military metal—and the U.S. and NATO are scrambling for a solution.

This isn’t just another resource play. This is about national security.

One company is positioned to secure America’s future supply of critical military metals.

Military Supply Chain Crisis: The West's Antimony Problem

The United States and its allies face a critical vulnerability in their defense supply chains.

After decades of outsourcing, Western nations now confront a strategic materials shortage that threatens military readiness.1

Antimony, a little-known metalloid, exemplifies this crisis.

This element is essential for manufacturing armor-piercing ammunition, missile guidance systems, and crucial flame-retardant materials that protect military personnel and equipment.2

Despite being listed as a critical mineral by the U.S. government, America has no domestic antimony production.

The alarming reality: China and Russia control over 80% of global antimony supply.3

As geopolitical tensions rise, this concentration creates a dangerous dependency that military planners view with growing concern.

Defense manufacturers cannot produce key weapons systems without antimony, yet developing alternative suppliers requires years of investment.4

Military experts now recognize that sustainable security for fundamental defense materials requires immediate secure supply chains. Which brings us to Armory Mining Corp. (ARMY : CSE | RMRYF : OTC | J2S : FRA).

THE COMPANY THAT COULD SOLVE AMERICA’S MILITARY METALS SHORTAGE

- Armory Mining Corp. (RMRYF : OTC) is a resource company focused on securing a domestic supply of antimony.

With its flagship project in Nova Scotia, Canada, Armory Mining Corp.

(RMRYF: OTC) is strategically positioned to emerge as a vital supplier of this military-critical metal.

Just as the West approaches a potential breaking point!

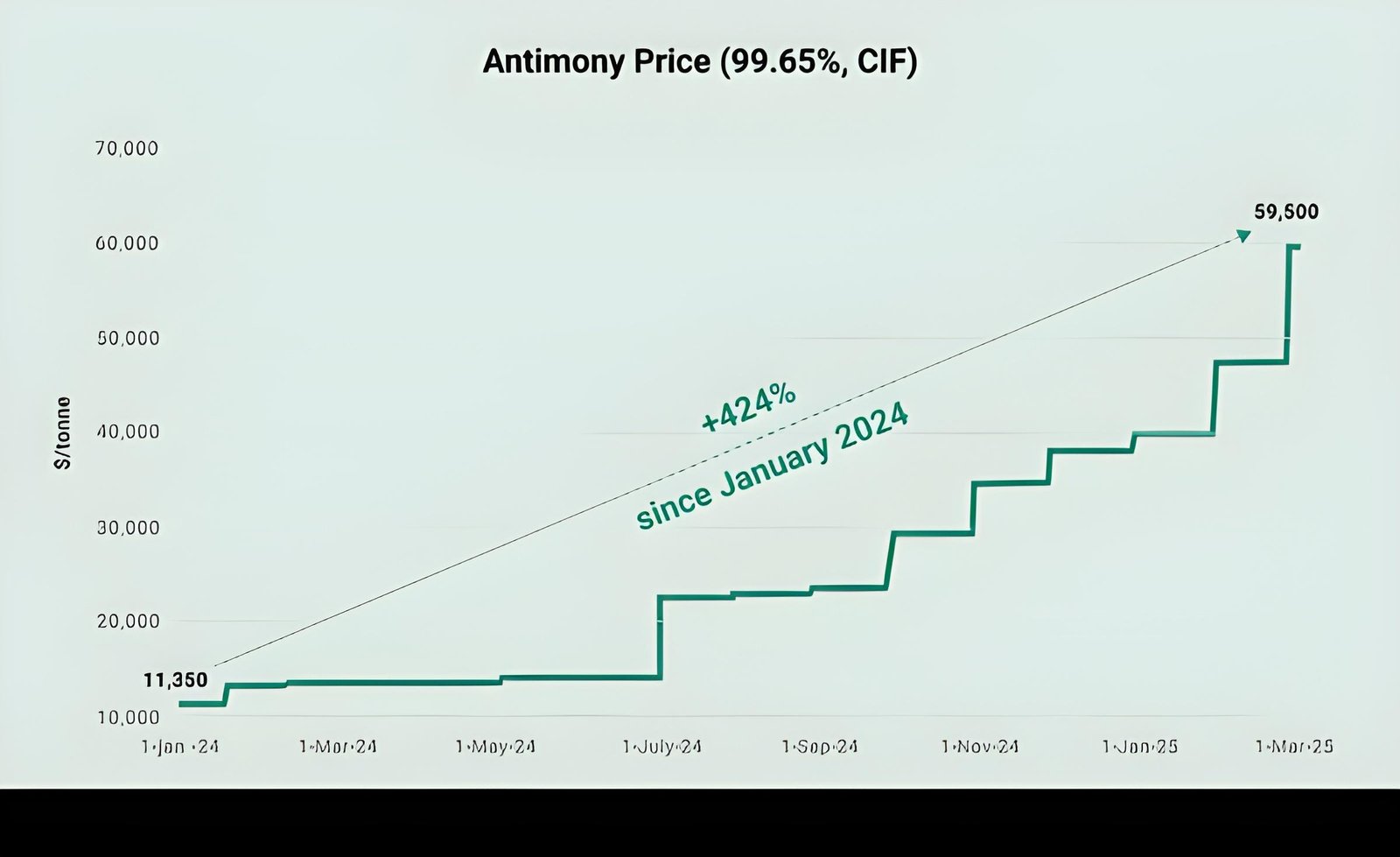

The antimony market is experiencing what industry experts describe as an “eye-popping” price surge.

When commodities enter a bull cycle of such magnitude, resource stocks can go from penny stocks to billion-dollar companies almost overnight.5

To that effect, this isn’t merely a typical commodity cycle, it represents a fundamental restructuring of global supply dynamics that has sent antimony prices skyrocketing to levels rarely seen in modern markets.

- Multiple powerful catalysts are converging simultaneously:

- Critical Supply Shortages: China has systematically reduced antimony exports through increasingly restrictive quotas.

- Geopolitical Blockades: International tensions have disrupted traditional supply routes.

- Strategic Stockpiling: Western militaries have begun aggressively securing supplies, further straining availability.

- Manufacturing Demand: Advanced technology applications continue to increase consumption.

- Domestic Production Vacuum: North America currently has zero domestic antimony mining production.

This unprecedented constellation of factors has created what market observers are calling a once in a lifetime antimony price “Moon Shot”.6

A rapid, vertical price trajectory that shows no signs of slowing as supply constraints intensify.

With that in mind, savvy early investors have a prime opportunity here, to capitalize on this and potentially build substantial wealth!

WHY NOW? THE PERFECT STORM FOR A MILITARY METALS BOOM

A seismic shift is underway in global defense priorities, creating unprecedented demand for strategic metals.

The international landscape has transformed as nations worldwide engage in an accelerating arms race, with the United States leading the charge through defense budgets that have reached historic highs.

Adding fuel to this already intensifying situation, NATO recently unveiled an ambitious $100 billion rearmament initiative, signaling a major commitment to military preparedness across the alliance.7

This massive investment represents just one facet of the growing global emphasis on defense capabilities and the materials required to support them.

Behind the scenes, the Pentagon has been quietly implementing a strategic stockpiling program for critical minerals.8

This urgent accumulation comes as a direct response to China’s increasingly restrictive export policies, which have threatened supply chains for essential defense components.9

Military planners recognize that secure access to these resources is no longer merely advantageous—it’s become a matter of national security.

Particularly significant is the U.S. Defense Department’s recent classification of antimony as a material of strategic importance.

This official designation highlights the critical role specific metals play in maintaining military readiness and technological superiority.

The consequences of these converging forces are already visible in the marketplace.

Supply channels for these essential materials are rapidly constricting while prices climb steadily upward.10

As military demand continues its dramatic surge, a select few companies, such as Armory Mining Corp. (RMRYF: OTC), positioned within this specialized supply chain, stand to benefit enormously.

What we’re witnessing isn’t simply a temporary market fluctuation, it’s a fundamental realignment of defense priorities and resource allocation that presents a once-in-a-lifetime opportunity for strategically positioned suppliers in this critical sector.

ARMORY MINING CORP: POSITIONED FOR RAPID GROWTH

In today’s volatile resource market, rare opportunities emerge where timing, assets, and expertise converge to create exceptional investment potential.

Armory Mining Corp. (RMRYF: OTC) stands at precisely such a crossroads – not merely another speculative junior miner, but a strategically positioned resource powerhouse whose undervalued status belies its extraordinary potential in the military-critical minerals sector.

STRATEGIC MILITARY-CRITICAL ASSETS: A PORTFOLIO BUILT FOR TOMORROW'S CONFLICTS

The foundation of Armory Mining Corp. (RMRYF: OTC) compelling investment thesis rests upon its meticulously assembled portfolio of resource-rich properties, each selected for its strategic significance in an increasingly unstable world.

The company’s flagship Ammo Property in Nova Scotia represents far more than its historical significance as a past-producing mining district.11

This antimony-gold asset sits at the intersection of precious metals value and critical defense applications.

With the company’s comprehensive 2025 exploration program now taking shape, investors stand at the ground floor of what could become a pivotal North American source of antimony.

A metal the Pentagon has explicitly classified as strategically essential for military readiness.12

The property’s dual-metal profile offers a compelling blend of defensive positioning through gold exposure alongside the extraordinary growth potential of antimony as supply chains reconfigure around geopolitical realities.

Complementing this cornerstone asset, Riley Creek in British Columbia encompasses an impressive 3,550 hectares of highly prospective terrain.

This expansive property hosts multiple gold-antimony targets situated within one of Canada’s most richly mineralized geological regions.

The project’s significant scale provides Armory Mining Corp. (RMRYF: OTC) with the exploration runway needed to potentially establish substantial resource findings, while its location in a mining-friendly jurisdiction offers clear pathways to development.

A MILITARY-GRADE METALS PORTFOLIO: POSITIONED AT THE NEXUS OF NATIONAL SECURITY

While countless junior miners chase fleeting market trends and the latest commodity headlines, Armory Mining Corp. (RMRYF: OTC) has methodically constructed a resource portfolio aligned with permanent, non-discretionary demand drivers.

Their strategic focus on antimony places them squarely in the critical path of Western governments’ urgent scramble to secure mineral supply chains essential for military readiness. This isn’t speculative positioning – it’s a response to explicit policy.

The U.S. Department of Defense has formally designated antimony as a material of strategic importance,13 recognizing its irreplaceable role in military applications ranging from ammunition to armored vehicles, night vision technology, and nuclear deterrence systems.

As China’s grip on global antimony supplies tightens and export restrictions intensify, Armory Mining Corp. (RMRYF: OTC) North American assets represent potentially vital domestic supply alternatives.

The company’s dual focus on antimony alongside precious metals creates a uniquely balanced investment profile.

While antimony provides extraordinary growth potential tied to geopolitical realignment, the gold component offers traditional precious metals exposure.

Creating natural hedges against both inflation and economic uncertainty in a single investment vehicle.

EXPERIENCED MANAGEMENT WITH PROVEN SUCCESS: MILITARY PRECISION MEETS MINING EXPERTISE

Behind every successful resource company stands a leadership team capable of navigating the complex challenges of exploration, development, and market positioning.

Armory Mining Corp. (RMRYF: OTC) has assembled an exceptional management group that blends specialized expertise across the critical domains of mining operations, defense sector understanding, and capital markets navigation.

ARMORY MINING CORP. EXECUTIVE TEAM: PROVEN LEADERSHIP IN RESOURCE DEVELOPMENT & STRATEGIC GROWTH

Arjun Grewal

- Former Canadian Armed Forces Special Operations leader with over two decades in military and defense technology

- Extensive experience in intelligence-led operations, national security strategy, and NATO collaborations

- Led military technology initiatives and IBM Cloud & Business Analytics divisions

Alex Klenman

- Seasoned mining executive with over 30 years of experience in capital markets and resource development

- Leadership roles across multiple publicly traded mining and energy companies

- Expert in business development, financing, and corporate growth strategy

Harry Nijjar

- Financial strategist with extensive experience in regulatory compliance and capital structuring

- Managing Director at Malaspina

- Consultants Inc., advising companies on financial and growth strategies

- Deep expertise in navigating financial environments across multiple industries

Independent Directors – Providing Strong Oversight

Ash Misquith

Arjun Grewal

Defense and technology expert, driving Armory Mining Corp. (RMRYF: OTC) security-focused mineral strategy

Most notably, the company’s chairman brings over two decades of experience in Canadian Special Operations and military intelligence.

Providing unparalleled insight into defense procurement priorities and supply chain vulnerabilities that few mining executives could hope to match.

This unique background translates into strategic advantages in identifying critical mineral opportunities, navigating government relationships, and understanding the true national security implications of resource development projects.

This leadership approach combines military precision with mining sector expertise, creating an execution-focused culture rarely seen in early-stage resource companies.

Each step in Armory Mining Corp. (RMRYF: OTC) development follows a disciplined, methodical process designed to maximize resource potential while minimizing operational risk.

A philosophy that extends from geological assessment through capital allocation and shareholder communications.

EXTREMELY TIGHT SHARE STRUCTURE: BUILT FOR SHAREHOLDER VALUE

In an industry often plagued by excessive dilution and misaligned incentives, Armory Mining Corp. (RMRYF: OTC) stands apart with a share structure specifically designed to protect and enhance shareholder value.

With only 38 million shares outstanding, the company maintains exceptional capital efficiency 14 – ensuring that exploration successes and strategic developments translate directly into meaningful share price appreciation without being undermined by bloated float.

This shareholder-friendly approach extends to insider ownership patterns, where significant management stakes create perfect alignment between leadership decisions and investor outcomes.

When executives hold substantial equity positions, their incentives naturally align with creating long-term value rather than short-term market movements or excessive compensation packages.

The company’s strategic positioning reflects this long-term orientation.

Rather than chasing quarterly headlines or temporary market enthusiasm, Armory Mining Corp. (RMRYF: OTC) development timeline aligns with the fundamental restructuring of critical mineral supply chains.

A generational shift that creates extraordinary potential for patient, positioned investors.

THE CONVERGENCE OF OPPORTUNITY: WHY ARMORY MINING DEMANDS ATTENTION NOW

As global tensions rise and supply chain vulnerabilities deepen, we are witnessing a rare moment where national security imperatives and investment opportunities align perfectly.

Armory Mining Corp. (RMRYF: OTC) stands at this critical intersection with a strategic portfolio of assets explicitly designed to address the West’s most urgent mineral security challenges.

This unique company has positioned itself as a potential cornerstone solution to this crisis through its meticulously assembled portfolio of strategic mineral assets in secure, mining-friendly jurisdictions.

While many junior miners chase speculative trends, Armory Mining Corp. (RMRYF: OTC) has methodically built a resource portfolio aligned with non-discretionary demand drivers backed by government policy and military necessity.

The company’s focus places it squarely in the critical path of Western governments’ urgent scramble to secure mineral supply chains that are mandatory for military readiness.

For investors, Armory Mining Corp. (RMRYF: OTC) offers a uniquely compelling proposition through its shareholder-friendly structure.

With only approximately 38 million shares outstanding, the company

maintains exceptional capital efficiency.

This tight share structure ensures that exploration successes and strategic developments translate directly into meaningful share price appreciation without being diluted by an excessive float.

For instance, consider the following extraordinary convergence of factors that make Armory Mining Corp. (RMRYF: OTC) a uniquely positioned opportunity in today’s market:

Strategic Asset Portfolio:

A group of distinct projects across secure jurisdictions, each targeting minerals essential to national security.

Armory Mining Corp. (RMRYF: OTC) offers diversified exposure to critical minerals with strong demand and fundamentals.

Perfect Market Timing:

Dual-Metal Profile:

The antimony-gold nature of Armory Mining Corp. (RMRYF: OTC) flagship properties creates a natural hedge – offering exposure to precious metals alongside strategic mineral upside.

This balanced risk profile allows investors to participate in both traditional safe-haven assets and the extraordinary growth potential of critical defense metals.

Proven Leadership:

A management team that uniquely combines military intelligence expertise, mineral exploration experience, and capital markets knowledge.

Creating a strategic advantage in identifying, acquiring, and developing resources aligned with national security imperatives.

Capital Efficiency:

With approximately 38 million shares outstanding and a tight capital structure, Armory Mining Corp. (RMRYF: OTC) offers exceptional leverage to exploration success and mineral price appreciation without the dilution risk common in the junior mining sector.

IMMINENT CATALYSTS: POSITIONED FOR STRATEGIC DOMINANCE IN THE CRITICAL MINERALS LANDSCAPE

The upcoming 2025 exploration program at the company’s flagship Ammo Property could serve as a significant catalyst, potentially demonstrating the property’s viability as a North American source of antimony at precisely the moment Western governments are most desperate for secure supplies.

For investors seeking exposure to these powerful macro trends through a disciplined, well-structured vehicle, Armory Mining Corp. (RMRYF: OTC) represents a compelling opportunity that combines strategic significance with exceptional growth potential.

The company’s focus on military-critical minerals, experienced leadership team, and tight capital structure create an attractive risk-reward profile at current valuations.

As supply channels for critical defense materials continue to constrict and demand accelerates through increased military spending, Armory Mining Corp. (RMRYF: OTC) is ideally positioned to capitalize on this generational shift in mineral supply chains.

Every indicator suggests that we are entering a sustained period of premium valuations for companies controlling strategic minerals in secure jurisdictions,16 precisely the position Armory Mining Corp. (RMRYF: OTC) has established!

The time to gain exposure to this powerful trend is now, before broader market recognition drives the share price to reflect the company’s true strategic value.

With its unique positioning at the nexus of national security imperatives and resource scarcity, Armory Mining Corp. (RMRYF: OTC) offers investors a rare opportunity to align their portfolio with some of the most consequential geopolitical and mineral supply trends of our time.

This is not simply another resource stock – it’s a strategic position in the minerals that will determine the future of Western military readiness and industrial self-sufficiency.

The convergence of these powerful forces creates an extraordinary investment opportunity that demands immediate attention from forward-thinking investors.

As demand surges and supply chain vulnerabilities become increasingly evident, Armory Mining Corp. (RMRYF: OTC) stands as a first mover in a market poised for significant growth. Savvy investors are already making their move. Will you be ahead of the curve or left behind?

Stock Information

Armory Mining Corp.

CSE: ARMY

OTC : RMRYF

Stay up to date and subscribe to our investor newsletter.

Disclaimers

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Danayi Capital Corp. (collectively with its owners, managers, employees, and assigns “Danayi Capital Corp.”) has been paid $25,000 United States dollars (US$) by Armory Mining Corp. (plus applicable taxes) for an ongoing marketing campaign including this article among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. Danayi Capital Corp. owns and operates the website www.wallstreetlogic.com and its associated landing pages.

SHARE OWNERSHIP. The owner of Danayi Capital Corp. may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

This communication contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include predicting future price appreciation and investor gains; suggesting future discoveries and potential stock appreciation; assuming continued rising demand for antimony, which could impact stock performance; implying that current projects will develop into major assets; assuming that China and Russia will continue producing major antimony discoveries and that Armory Mining Corp. will benefit from it; encouraging investors to act now based on future anticipated gains; that the location of the Company’s projects and proximity to existing mines will increase the chances of exploration success; that the Company will be able to obtain future financing to advance its prospects.

These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the use of and demand for antimony will not increase as expected; that there will not be a deficiency of antimony; that antimony may be obtained from other sources than expected, and significantly reduce the demand for antimony exploration and mining; that the Company’s projects may fail to have any commercial amounts of antimony whatsoever; that the Company may fail to take advantage of the demand and interest in antimony for various reasons; that the Company’s exploration programs may fail to be successful or to discover any significant antimony mineralization; that even if antimony and/or any other metals are discovered on the Company’s properties, there may be insufficient amounts to commercialize production; that advancements in technology may make exploration and development of antimony deposits obsolete or much less important; that the Company may fail to raise sufficient financing to fully implement its business exploration plans; that the Company’s management team may fail to effectively or successfully implement the Company’s exploration plans; that the Company may ultimately fail to successfully implement its business plans or generate any significant revenues whatsoever. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

Type of information: Marketing communication

Publisher: Danayi Capital Corp., a company incorporated in British Columbia, Canada.

Date of first creation: on or about March 7, 2025

Time of first creation: on or about 05:30 AM PST

Creator of the marketing communication: Danayi Capital Corp.

Coordination with the issuer: Yes

Addressees: Danayi Capital Corp. makes the securities analysis available to all interested investment service providers and private investors at the same time.

Sources: Information sources of Danayi Capital Corp. are information and information of the issuer, domestic and foreign business press, information services, news agencies (e.g. Reuters, Bloomberg, Infront, etc.), analyses and publications on the Internet.

Scale of care: Valuations and investment judgments derived from them are prepared with the greatest possible care and taking into account all factors that are recognizably relevant at the respective time.

Disclosure of interests and conflicts of interest, as well as conflict of interest prevention policies

Danayi Capital Corp. receives a fixed fee from Armory Mining Corp. for the distribution of the marketing communication.

Because other research houses and stock market letters can also discuss the value, there may be a symmetrical generation of information and opinion in the current recommendation period. Of course, it is important to note that Armory Mining Corp. is listed in the highest conceivable risk class for stocks. The company may not yet have any sales and is at an early stage level, which is both attractive and risky. The company’s financial situation is still loss-making, which significantly increases the risks. Capital increases that become necessary could also lead to dilution in the short term, which could be to the detriment of investors. If the company does not succeed in tapping into further sources of finance in the next few years, insolvency and delisting could even be threatened.

We would like to point out that equity investments are always associated with risk. Every transaction with warrants, leverage certificates or other financial products is even fraught with extremely high risks. Due to political, economic or other changes, there can be considerable price losses, in the worst case a total loss of the capital employed. With derivative products, the probability of extreme losses is at least as high as with small-cap shares, whereby the large domestic and foreign stocks can also suffer severe price losses up to a total loss. You should seek further advice before making any investment decision (e.g. from your bank or an advisor you trust).

Although the evaluations and statements contained in the analyses and market assessments of stock metrics have been prepared with reasonable care, we do not accept any responsibility or liability for errors, omissions or misstatements. This also applies to all representations, figures and assessments expressed by our interlocutors in the interviews. The entire risk arising from the use or performance of the Service and Materials remains with you, the reader. To the maximum extent permitted by applicable law, Danayi Capital Corp. shall not be liable for any special, incidental, indirect, or consequential damages (including, but not limited to, lost profits, business interruption, loss of business information, or any other pecuniary loss) arising out of the use of, or inability to use, the Service and Materials.

All statements in this report regarding Armory Mining Corp., other than statements of historical fact, should be construed as forward-looking statements that may not materially prove to be true due to significant uncertainties. The author’s statements are subject to uncertainties that should not be underestimated. There is no certainty or guarantee that the forecasts made will actually come true. Therefore, readers should not rely on the statements of stock metrics and should buy or sell securities only based on reading the report.

Users who make investment decisions or carry out transactions on the basis of the information displayed or ordered for Danayi Capital Corp. act entirely at their own risk.

The reader hereby assures that he uses all materials and content at his own risk and that Danayi Capital Corp. assumes no liability.

Danayi Capital Corp. reserves the right to modify, improve, expand or remove the content and materials without notice. Danayi Capital Corp. excludes any warranty for service and materials. The Service and Materials and the related documentation are provided to you “as is” without warranty of any kind, either express or implied. Including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, or non-infringement.

The recommendations, interviews and company presentations published on this website fulfil advertising purposes without exception and are commissioned and paid for by third parties or the respective companies. For this reason, the analyses are not independent research studies.

There is no guarantee that the forecasts of the Company, the analyst or other experts and the management will actually come true. The performance of Armory Mining Corp. shares is therefore uncertain. As with any so-called micro cap, there is also a risk of total loss.

The investor should follow the news closely and have the technical requirements for trading in penny stocks. The narrowness of the market, which is typical of the segment, ensures high volatility. Inexperienced investors and LOW-RISK investors are generally advised not to invest in shares of Armory Mining Corp. This analysis is aimed exclusively at experienced professional traders.

The author does not guarantee the completeness, timeliness or quality of the information provided. Liability claims against the author are excluded, as far as a negligent act is concerned. The author reserves the right to revise, supplement or delete parts of his statements.

References

- [1]

European Commission. (2023). Critical Raw Materials Resilience: Charting a Path Forward. Retrieved from https://ec.europa.eu/growth/sectors/raw-materials

- [2]

RAND Corporation. (2023). The Role of Specialty Metals in Modern Warfare. Retrieved from https://www.rand.org/research

- [3]

U.S. Geological Survey. (2023). Mineral Commodity Summaries – Antimony. Retrieved from https://www.usgs.gov/centers/national-minerals-information-center/antimony

- [4]

World Bank. (2022). The Role of Critical Minerals in Energy Transition. Retrieved from https://www.worldbank.org/en/news

- [5]

Bloomberg Intelligence. (2024). Commodity bull markets: Where we are now and what’s next? Retrieved from https://www.bloomberg.com

- [6]

Sprott. (2023). The Bull Market in Critical Metals. Retrieved from https://sprott.com/insights

- [7]

NATO. (2023). Strengthening Collective Defense: NATO’s $100 Billion Initiative. Retrieved from https://www.nato.int/cps/en/natohq/news.htm

- [8]

U.S. Department of Defense. (2023). Strategic and Critical Materials Report. Retrieved from https://www.defense.gov/News/Publications/

- [9]

U.S.-China Economic and Security Review Commission. (2023). China’s Control Over Strategic Minerals. Retrieved from https://www.uscc.gov/research

- [10]

Center for Strategic & International Studies. (2023). China’s Grip on the Global Critical Minerals Market. Retrieved from https://www.csis.org

- [11]

Natural Resources Canada. (2023). Canada’s Critical Minerals Strategy. Retrieved from https://www.nrcan.gc.ca

- [12]

U.S. Department of Commerce. (2023). Critical Materials Assessment. Retrieved from https://www.commerce.gov/

- [13]

U.S. Department of Defense. (2022). National Defense Stockpile Requirements Report. Retrieved from https://www.defense.gov/

- [14]

Armory Mining Corp. (2023). Investor Presentation. Retrieved from https://armorymining.com/investors

- [15]

Government Accountability Office. (2023). Securing America’s Critical Minerals: A Stockpiling Strategy. Retrieved from https://www.gao.gov/reports

- [16]

The Times. (2024). China adds antimony to global trade war. Retrieved from https://www.thetimes.co.uk/article/china-adds-antimony-to-global-trade-war-h9jvwkxgg

Recent Posts

- Armory Mining Corp. (ARMY : CSE | RMRYF : OTC | J2S : FRA)

- Gold in 2025: How AI Predictions Compare to Human Expertise in a Turbulent Market

- Debt Literacy Month Highlights Financial Struggles Across Canadian Demographics

- The Alternative Investment Revolution: How Wealthy Investors Are Reshaping Private Banking

© 2024 Wallstreetlogic.com - All rights reserved.