THE INCOMING MONSTER COPPER SUPPLY SQUEEZE: WHY THIS TINY JUNIOR COPPER COMPANY CAN BE 2025'S MOST EXPLOSIVE OPPORTUNITY

While big miners scramble for copper, this junior explorer has “grades 10X the global average” In British Columbia’s prolific Omineca Mining District.

The copper deficit is approaching 4.5 million Tons as supply crisis looms, while this unique Company progresses toward undertaking the necessary work and permitting processes with the ultimate goal of constructing a mine.

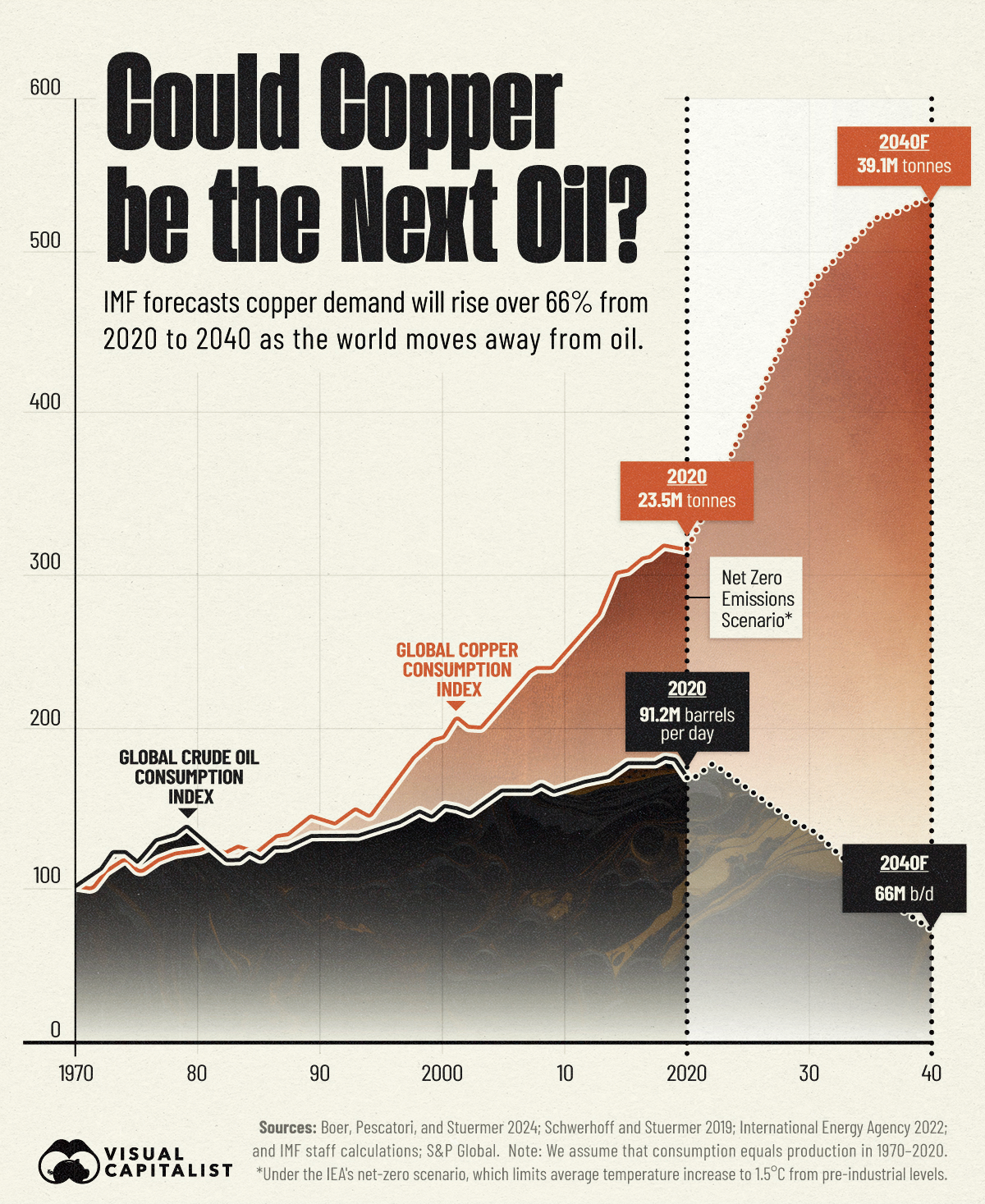

The global electrification transition is not just a vision for the future, it is happening now.

As governments, industries, and consumers push for a diversified energy grid, the demand for critical minerals like copper is expected to surge to unprecedented levels.

The rise of Artificial Intelligence (AI) is arguably the most immediate factor that could trigger and prolong an “unprecedented copper supply squeeze.”

Many are unaware of the immense energy demands required to support the development of advanced technologies like AI.

Even fewer recognize the critical role copper plays in powering the growing number of AI data centers.

Think of the incoming Stargate Project!

The Stargate Project is a monumental joint venture announced by the U.S. government on January 21, 2025, involving OpenAI, SoftBank, Oracle, and MGX.

This initiative aims to “invest up to $500 billion” over the next four years to develop cutting-edge AI infrastructure across the United States.

For instance, did you know that a 100,000 square foot AI data center may contain 50 to 100 metric tons of copper just for power distribution only?

Copper is used extensively in such facilities due to its superior conductivity and thermal properties, making it critical for power distribution, cooling systems, and network connectivity.

These initiatives and factors could present a significant opportunity for this overlooked copper exploration company called NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF, FSE: 34S0).

A uniquely positioned junior copper company, poised to capitalize on this wave. If you could turn back time and invest in Freeport-McMoran before it became a billion-dollar copper mining powerhouse, would you jump at the opportunity? Of course, you would.

Now, a rare second chance is here—an opportunity to invest in a company with world-class copper assets before the rest of the market takes notice.

Why now? Because the worldwide copper supply is struggling to keep pace with the rapidly growing copper demand.

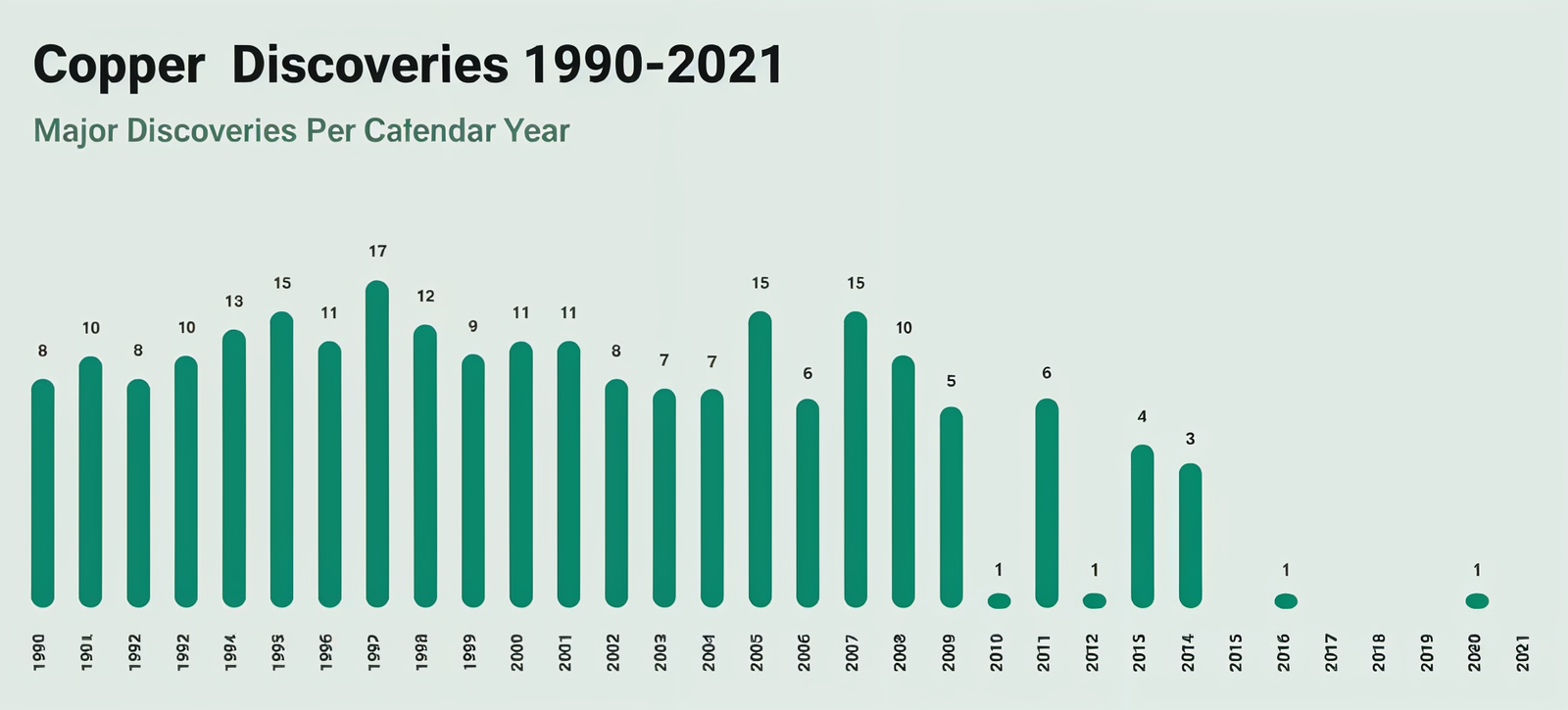

New copper discoveries are becoming increasingly rare. Even when a new deposit is found, it can take up to 18 years for a mine to become operational, adding significant delays to meeting global needs².

Critical minerals are vital for energy generation, battery storage, and energy transmission, making them indispensable for the new global electrification race.

The possibility for an emerging copper supercycle, driven by current supply and demand shocks, is intensifying global competition for new high-grade sources of this unique commodity!

Copper is the backbone of modern infrastructure, such as AI data centres, advanced technologies, and the electrification of our world.

This transition along with higher-than-expected AI adoption, is expected to expand the mining sector’s share of GDP.

Mining exploration equities like NorthWest Copper (TSXV: NWST, OTC: NWCCF) tend to correlate with commodity prices over the long term, a trend that has gained momentum post-pandemic.

NorthWest Copper (TSXV: NWST, OTC: NWCCF) offers investors a unique opportunity to be part of an organization with resource growth potential while it progresses toward undertaking the necessary work and permitting processes with the ultimate goal of constructing a mine.

“Copper to be key driver of price gains among industrial metals in 2025” – UBS

With the top 40 global mining companies generating a record $943 billion in revenue in 2022³ , the potential for investors is clear.

The electrification transition has sparked a new race for critical minerals, with NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF)leading in exploration and charging forward into a bold new future.

Nations are racing to secure these vital resources for no less than national security purposes, aiming to build resilient supply chains and enhance economic competitiveness.

Why NorthWest Copper Corp. and Why Now?

At NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF), the mission is clear: to create long-term value for shareholders while contributing to a sustainable future.

This unique enterprise presents a compelling investment opportunity in the critical minerals space, with a portfolio of high-grade copper-gold assets strategically positioned in British Columbia’s prolific Omineca Mining District.

The company’s flagship Kwanika-Stardust project, combined with the Lorraine-Top Cat property and East Niv discovery property, establishes NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) as one of the premier copper exploration plays in a jurisdiction with an established history of mining.

Key Technical Highlights

1. Grade is King:

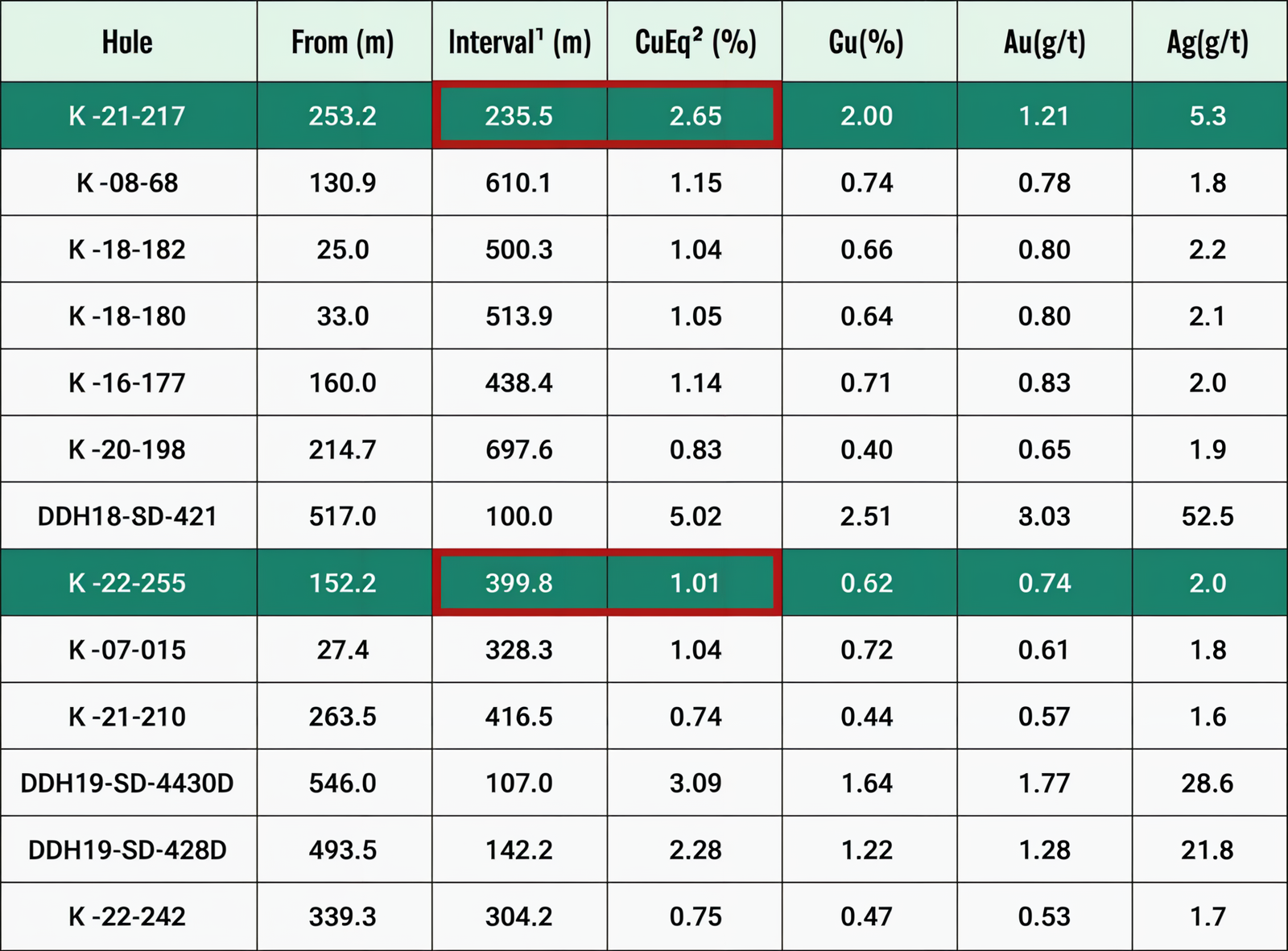

The Kwanika-Stardust project delivers impressive grades with M&I resources showing 0.59% CuEq across 105.0 Mt, including high-grade drill intercepts including:

– K-21-217: 235.5m @ 2.65% CuEq (2.00% Cu, 1.21 g/t Au, 5.3 g/t Ag)⁴

– 18-SD-421: 100.0m @ 5.02% CuEq (2.51% Cu, 3.03 g/t Au, 52.5 g/t Ag)⁵

2. Scale & Resource Growth Potential⁶ ⁷:

– Total M&I resource base: 1.0 billion lbs Cu, 1.4M oz Au, 5.4M oz Ag

– Inferred resources: 0.7 billion lbs Cu, 0.4M oz Au, 4.5M oz Ag

– Significant exploration upside with 175,000+ ha land package

3. Economics & Infrastructure:

– Kwanika-Stardust PEA demonstrates positive economics⁸:

. 12-year mine life

. 58 Mlbs Cu + 67 kozs Au annual production

. US$0.91/lb AISC (by-product basis)

. C$440M pre-tax NPV (7%)

– Access to critical infrastructure including roads, power, and rail

– Potential to incorporate additional copper resources at Lorraine into a revised PEA mine plan

4. Strategic Land Position:

The company’s properties are bookended by a current and past producing mine (Mt. Milligan and Kemess), demonstrating the district’s proven potential. The Omineca Copper District has attracted major players with recent M&A activity totaling $1.6 billion⁹.

Exploration Catalysts

1. Kwanika-Stardust Transfer Target:

A potential offset of the high-grade Central Zone mineralization, supported by:

– New geological modeling

– 2022 3D IP survey results

– Consistent alteration and metal zoning patterns

2. Lorraine Project Upside:

– Potential for shared infrastructure with Kwanika-Stardust

– Drill ready targets at Boundary, Cirque and Slide which are interpreted as a continuation of the trend of the Lorraine resource

– New Road IP discovery: 104.7m @ 0.13% Cu including 7.4m @ 1.10% Cu¹⁰, requires follow-up

– Multiple untested targets with similar geological signatures to the main deposit

3. East Niv Discovery:

– Discovery hole ENV-21-004: 81.60m @ 0.41% Cu, 0.20 g/t Au & 1.4g/t Ag from surface¹¹

– Classic Cu-Au porphyry system with similarities to Red Chris

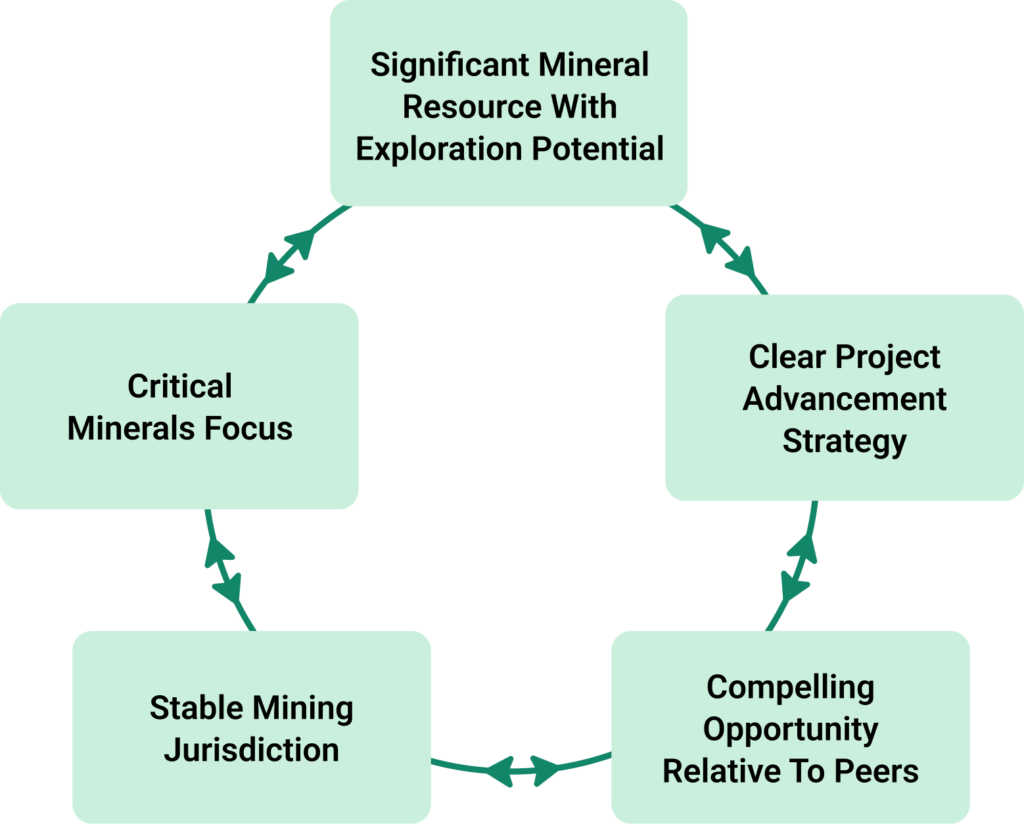

Investment Thesis:

1. Valuation Disconnect: Current market cap of C$57.8M¹² significantly undervalues:

– 1.5 billion lbs CuEq M&I resource base

– District-scale exploration potential

– Strategic location with a proven history of mining

2. Critical Minerals Exposure

– Copper demand projected to increase from 26Mt to 36Mt by 2035[Source]

– BC government support for critical metal exploration and development

– Essential metal for global electrification

3. Technical Excellence:

– Management team with proven track record

– Systematic exploration and development approach

– Multiple high-probability targets identified

4. Strategic Optionality:

– Potential to combine Kwanika-Stardust and Lorraine into single operation

– Attractive M&A target given district consolidation trend

– Multiple exploration and development pathways

Risk Mitigation:

1. Jurisdiction: BC is a proven location for mineral exploration and development

2. Infrastructure: Proximity to existing infrastructure can potentially reduce capital requirements

3. Technical: Multiple properties and deposits provide exploration and development flexibility

4. ESG: Strong Indigenous engagement with a focus on relationships and culturally responsible environmental practices

The confluence of high-grade resources, district-scale exploration and development potential, infrastructure access, and critical minerals exposure positions NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) as an undervalued opportunity in the copper space.

With multiple near-term catalysts and a proven team, the company offers significant leverage to copper price appreciation and exploration success in a proven location.

The time to invest in NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) is now.

The Company is entering a transformative phase, with advanced projects ready to progress rapidly and with additional early-stage projects available for new discoveries driving growth.

NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) stands out as a company that doesn’t just explore, it builds partnerships, fosters innovation, prioritizes environmental stewardship, and drives toward collaborative work with First Nations.

The Demand-Driven Advantage

As worldwide electrification accelerates, the need for critical minerals like copper has caught the attention of governments and industries worldwide. British Columbia, where NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) operates, is at the forefront of this shift.

Why British Columbia?

- Stable Mining Jurisdiction:

Low political risk and strong government support for critical minerals.

- Proven Location:

Active mines like Mount Milligan and Highland Valley demonstrate the region’s resource potential.

- Infrastructure Ready:

Road, rail, and hydroelectric power make operations efficient and scalable.

The Canadian government has committed to critical mineral strategies, including financial incentives for exploration and First Nations partnerships. NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) is well-positioned to capitalize on these trends.

Sustainability at the Core

NorthWest Copper Corp.’s (TSXV: NWST, OTC: NWCCF) commitment to sustainability sets it apart. The company understands that resource development must go hand in hand with environmental stewardship and social responsibility.

Key ESG Initiatives:

- Collaboration with Indigenous Communities:

Working closely with all Indigenous groups in areas in which we operate to ensure mutual benefit.

- Environmental Protection

Comprehensive wildlife management, water quality assessments, and archaeological evaluations are integrated into our planning.

- Transparency and Accountability

Regular ESG reporting and adherence to industry best practices.

Sustainability isn’t just a commitment for NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF), it’s a core value driving every decision.

Summary: Strong Fundamentals

High-Grade Resource

– 1.5 billion lbs CuEq M&I resources at 0.59% CuEq

– 0.89 billion lbs CuEq Inferred resources at 0.51% CuEq

Kwanika-Stardust PEA

– Low capex, low AISC

– 90+ Million lbs CuEq per year over 12 years

– Potential to improve economics through exploration and mine life extensions

Stable Mining Location

– Omineca Copper District of British Columbia

– Flagship projects : Kwanika-Stardust, Lorraine-Top Cat & East Niv

– Near existing infrastructure

Sustainable, Responsible

– Collaborating with Indigenous leaders and communities to ensure an understanding of the environment where we operate and inclusion of Indigenous values and knowledge.

NorthWest Copper Corp.’s (TSXV: NWST, OTC: NWCCF) Experienced Management Team has what it takes to move these unique projects forward.

Maryantonett Flumian

Chair

Maryantonett has been a senior federal official. Amongst other positions, she helped create Service Canada and served as its first Deputy Minister. Maryantonett was also the most senior official responsible for the establishment on Nunavut’s administrative structure. She served as the President of the Institute on Governance for ten years where she founded an Indigenous Advisory Circle to foster dialogue on economic reconciliation and moving beyond the Indian Act. In the last five years, Maryantonett has worked almost exclusively with First Nations groups in British Columbia.

Paul Olmsted

Chief Executive Officer & Director

Mr. Olmsted brings 35 years of experience in the mining industry holding executive positions for close to 25 years. Most recently he was the CFO of Superior Gold Inc., where he led the company from its IPO in 2017 to its eventual sale in 2023. Prior to Superior, he was the SVP Corporate Development of IAMGOLD Corporation, overseeing acquisitions and strategic growth.

Enrico De Pasquale

Enrico is a lawyer and executive with an established record of advising, leading and transforming companies across multiple industries. He has extensive experience in strategic planning, business development, financing and mergers / acquisitions, while achieving organizational success.

Adam Manna

Adam practices litigation in Toronto. Part of his practice includes representing high net worth individuals and he is often asked to sit on a board of directors to represent his clients’ interests as is the case with NWST. Prior to opening his own practice Adam was part of a small executive team for a company that had worldwide sales of approximately $200 million per annum and where he was responsible for environmental and corporate compliance.

Jim Steel

Jim, a tri-lingual professional geoscientist with a management finance graduate degree, has 35+ years of experience in exploration, production geology, and portfolio management. In 1992, he discovered the Ujima copper deposit in Chile. Based in Brampton, Ontario, Jim founded and directs companies in silver exploration, hyperspectral imaging, and Chilean gold mining.

Lauren McDougall

Ms. McDougall is a Chartered Professional Accountant with over 15 years of experience in corporate accounting and finance. Ms. McDougall served as the CFO and Corporate Secretary of Sun Metals Corp. since its inception in 2018 through the successful merger with Serengeti Resources and launch of NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) in 2021. She also served as the Controller of PureGold Mining Inc. from 2015 to 2019.

Vesta Filipchuk, ESc., BSc., MA

Ms. Filipchuk is a leader in ESG management with over 30 years of experience in community engagement, Indigenous relations, environmental assessment, and sustainability. She has held senior roles, including with Teck and the Galore Creek Copper Project, and has advised government bodies. Ms. Filipchuk holds advanced degrees in geography and environmental science and serves on AME BC’s Board.

James Lang, B.Sc, M.Sc, Ph.D, P.Geo

Dr. Lang has 38 years of global experience in exploration, project development, and research on base and precious metal deposits. He contributed to major discoveries, including Pebble (Alaska) and Xietongmen (Tibet), developed exploration models widely used in B.C. and the Tintina Gold Belt, and led technical programs integrating geology, engineering, and environmental disciplines to enhance project outcomes.

Harry Burgess, P.Eng.

Mr. Burgess, P.Eng., has 44 years of mining industry experience. A co-founder of Micon International Limited, he now serves part-time as an Associate Consultant. Since 1980, he has been consulting, with prior senior roles in Zambia’s copper industry and South Africa’s gold mining. He also serves on boards, advisory committees, and audit committees for public companies.

Investment Highlights

Our Purpose

NorthWest Copper Corp.’s (TSXV: NWST, OTC: NWCCF) management team is uniquely positioned to drive the company’s success, combining decades of experience across key areas of mining, exploration, sustainability, and finance.

CEO Paul Olmsted’s 35-year track record in strategic growth, corporate development, and mining finance brings the leadership and expertise needed to navigate the complexities of project advancement. Having guided Superior Gold from IPO to a successful sale, he has demonstrated the ability to create shareholder value and deliver results.

His previous roles at IAMGOLD underline his experience in executing on acquisitions and strategic initiatives, setting a strong foundation for NorthWest Copper Corp.’s (TSXV: NWST, OTC: NWCCF) growth.

The technical expertise of the team is equally compelling. The CEO, Mr. Olmsted, brings a deep understanding of strategic growth initiatives, mergers and acquisitions and capital markets in the mining industry.

Dr. James Lang’s extensive contributions to global discoveries, including Pebble in Alaska, and his development of widely adopted exploration models, provide NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) with a significant competitive advantage. Mr. Burges, P.Eng., brings many years of experience in providing technical consulting services to international mining companies.

Why Invest Now?

By investing in NorthWest Copper Corp.(TSXV: NWST, OTC: NWCCF), you are securing your position to participate in the potential of the global electrification race.

The Company’s projects are strategically located in a region with favorable geological conditions and strong regulatory frameworks, increasing the likelihood of long-term success and stability of any future operations.

Consider the advantages of being an early investor in NorthWest Copper Corp.(TSXV: NWST, OTC: NWCCF). As they continue to explore and advance their projects toward the ultimate goal of building a mine, the value proposition can provide early investors with significant growth potential.

Additionally, their commitment to transparency and regular communication means that you will always be informed about the progress of their projects and the latest developments in the region in which they operate.

NorthWest Copper Corp.’s (TSXV: NWST, OTC: NWCCF) future success is not just about the assets they hold, but also about the people leading their efforts. Don’t miss out on this exceptional opportunity to invest in this unique enterprise and become a shareholder in a company dedicated to pioneering the future of global electrification

Invest now and be part of a unique global revolution!

By acting today, you are positioning yourself at the forefront of the critical minerals industry, poised to benefit from the “most imminent factor” that can drive towards and extend an “unprecedented copper supply squeeze”: the rise of AI.

Donald Trump’s incoming Stargate Project could potentially represent the highest and most significant growth factor for a global shift towards an upcoming “electrification revolution”.

Join the ranks of such forward-thinking investors as Bill Gates and Jeff Bezos who have recognized this unique paradigm shift towards a once-in-a-lifetime, incoming copper supply disruption!

This monumental event could have an immense “share price upside potential” for NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) and they are ready to seize this opportunity.

NorthWest Copper Corp.’s (TSXV: NWST, OTC: NWCCF) management team is dedicated to ensuring the success of its diverse projects while focusing on maximizing shareholder returns.

With a proven track record and a clear vision for the future, NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) is the ideal investment choice for those looking to capitalize on the global burgeoning demand for critical minerals and copper.

Invest in NorthWest Copper Corp. (TSXV: NWST, OTC: NWCCF) today and secure your place on the ground floor of the electrification future!

Stock Information

NorthWest Copper Corp.

TSXV: NWST

OTC: NWCCF

Stay up to date and subscribe to our investor newsletter.

Disclaimers

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Danayi Capital Corp. (collectively with its owners, managers, employees, and assigns “Danayi Capital Corp.”) has been paid $40,000 United States dollars (US$) by Northwest Copper Corp. (plus applicable taxes) for an ongoing marketing campaign including this article among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. Danayi Capital Corp. owns and operates the website www.wallstreetlogic.com and its associated landing pages.

SHARE OWNERSHIP. The owner of Danayi Capital Corp. may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Danayi Capital Corp. and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.i Capital Corp. and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

This communication contains certain forward-looking statements within the meaning of applicable securities laws. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements in this material include that copper could have a vital application in the artificial intelligence (“AI”) revolution including AI data centre applications and electric vehicle (EV) adoption; that AI technologies and data centres, along with EV adoption will change the way the world economy works; that copper is required for the change to the world economy and its ongoing electrification; that the AI and EV adoption megatrends will only accelerate the role and need of copper; that the Company may be well-positioned to explore for copper in its mining claims; that early stage companies have a better chance of potential upside than large established companies; that there will be an increasing demand for copper worldwide; that the Company will be able to capitalize on the growing demand for copper if it can successfully explore, discover and currently manage commercial amounts of copper on its properties; that there will be shortages of copper in the future and the Company may become an attractive opportunity for those interested in this commodity space; that the Company will benefit from the experience and expertise of its board members and management team; that the location of the Company’s projects and proximity to existing mines will increase the chances of exploration success; that the Company will be able to successfully explore its properties for commercial deposits of copper; that the Company will be able to obtain future financing to advance its prospects.

These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the use of and demand for copper will not increase as expected; that there will not be a deficiency of copper; that copper may be obtained from other sources than expected, and significantly reduce the demand for copper exploration and mining; that copper may not be necessary to produce AI technologies or EV adoption now or in the future, as anticipated; that the Company’s projects may fail to have any commercial amounts or copper whatsoever – that the Company may fail to take advantage of the demand and interest in copper for various reasons; that the Company’s exploration programs may fail to be successful or to discover any significant copper mineralization; that even if copper is discovered on the Company’s properties, there may be insufficient amounts to commercialize production; that advancements in technology may make exploration and development of copper deposits obsolete or much less important; that the Company may fail to raise sufficient financing to fully implement its business exploration plans; that the Company’s management team may fail to effectively or successfully implement the Company’s exploration plans; that the Company may ultimately fail to successfully implement its business plans or generate any significant revenues whatsoever – that the Company may not achieve the development, operational and economic results of the PEA; may not add Lorraine Resources to a Kwanika-Stardust project plan; the potential size of a mineralized zone or potential expansion of mineralization or any estimation of Mineral Resources may not be of sufficient quality or magnitude to justify development of an operating mine. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

Additional Disclaimer

Legal Notices

Type of information: Marketing communication

Publisher: Danayi Capital Corp., a company incorporated in British Columbia, Canada.

Date of first creation: on or about January 27, 2025

Time of first creation: on or about 05:30AM PST

Creator of the marketing communication: Danayi Capital Corp.

Coordination with the issuer: Yes

Addressees: Danayi Capital Corp. makes the securities analysis available to all interested investment service providers and private investors at the same time.

Sources: Information sources of Danayi Capital Corp. are information and information of the issuer, domestic and foreign business press, information services, news agencies (e.g. Reuters, Bloomberg, Infront, etc.), analyses and publications on the Internet.

Scale of care: Valuations and investment judgments derived from them are prepared with the greatest possible care and taking into account all factors that are recognizably relevant at the respective time.

Disclosure of interests and conflicts of interest, as well as conflict of interest prevention policies

Danayi Capital Corp. receives a fixed fee from Northwest Copper Corp. for the distribution of the marketing communication.

Because other research houses and stock market letters can also discuss the value, there may be a symmetrical generation of information and opinion in the current recommendation period. Of course, it is important to note that Northwest Copper Corp. is listed in the highest conceivable risk class for stocks. The company may not yet have any sales and is at an early stage level, which is both attractive and risky. The company’s financial situation is still loss-making, which significantly increases the risks. Capital increases that become necessary could also lead to dilution in the short term, which could be to the detriment of investors. If the company does not succeed in tapping into further sources of finance in the next few years, insolvency and delisting could even be threatened.

Declaration of release from liability and risk of total loss of invested capital

References

- [1]

Friedland, R. (2022). We simply cannot continue to exist as a species without a lot more copper, especially if we want to reduce hydrocarbon consumption or if we want to electrify the world’s transportation fleet. Wired. Retrieved from https://www.wired.com/story/power-metal-green-economy-is-hungry-for-copper.

- [2]

Coayla, E., & Romero, V. (2024). Copper and lithium industrialization by major producing countries for mining sustainability. International Journal of Energy Economics and Policy. https://consensus.app/papers/copper-and-lithium-industrialization-by-major-producing-coayla-romero/c9bba1728740541e9d8d817e85afb777/?utm_source=chatgpt.

- [3]

PwC. (2024). Mine 2024: Preparing for impact. PricewaterhouseCoopers. Retrieved from https://www.pwc.com

- [4]

NorthWest Copper Corp. press release dated October 21, 2021

- [5]

Sun Metals Corp. press release dated October 25, 2018

- [6]

NI 43-101 technical report titled “Kwanika-Stardust Project NI 43-101 Technical Report on Preliminary Economic Assessment” dated February 17, 2023, with an effective date of January 4, 2023.

- [7]

NI 43-101 technical report titled “Lorraine Copper-Gold Project NI 43-101 Report & Mineral Resource Estimate Omineca Mining Division, B.C”, dated September 12, 2022, with an effective date of June 30, 2022.

- [8] NorthWest Copper Corp. January 2025 Presentation

- [9] NorthWest Copper Corp. January 2025 Presentation

- [10]

NorthWest Copper Corp. press release dated October 10, 2024

- [11]

NorthWest Copper Corp. press release dated November 8, 2021

- [12]

As at January 30, 2025

Recent Posts

- The AI Revolution in Precious Metals Trading: Navigating Volatility with Machine Intelligence

- Superman’s Guide to Financial Success: Heroic Lessons for Building Wealth

- Navigating Alternative Investments: Understanding SEC Regulation D and Portfolio Diversification

- Trump’s Crypto Ventures Face Congressional Scrutiny as Digital Asset Legislation Advances

© 2024 Wallstreetlogic.com - All rights reserved.